2350 2023

What is the 2350?

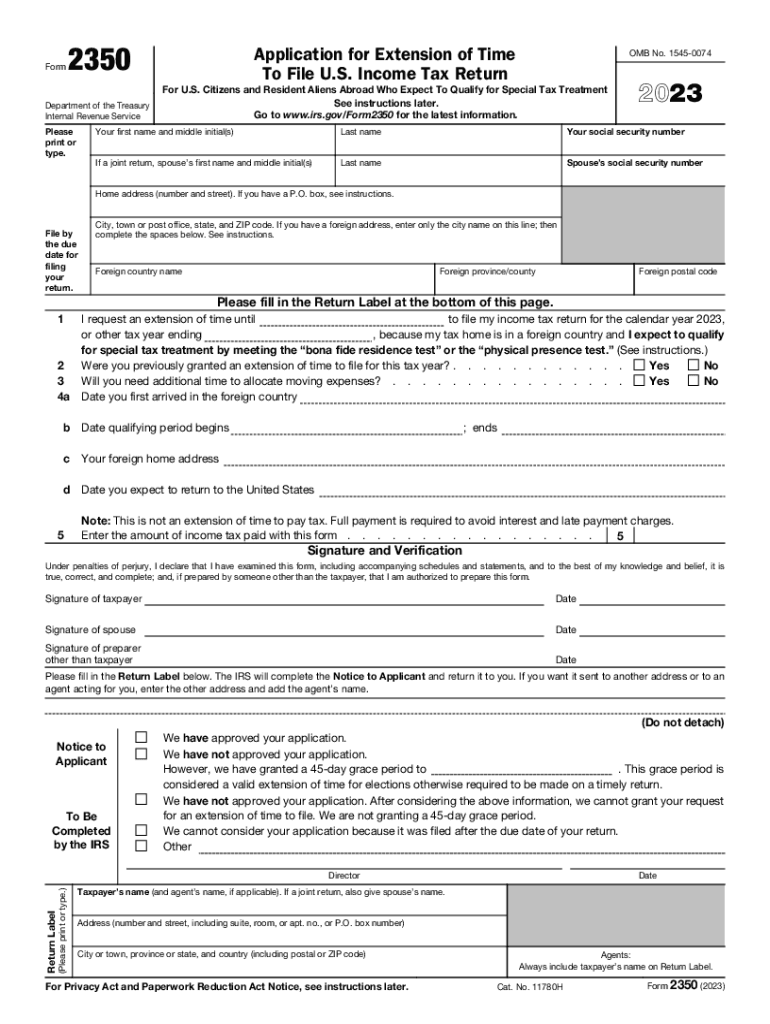

The 2350 form, officially known as Form 2350, is a federal tax extension application used by U.S. citizens and resident aliens who need additional time to file their federal income tax returns. This form is particularly relevant for taxpayers who are living abroad and require an extension beyond the standard filing deadline. By submitting Form 2350, individuals can obtain an automatic extension of time to file their tax return, ensuring compliance with IRS regulations while managing their unique circumstances.

How to use the 2350

Using Form 2350 involves a straightforward process. Taxpayers must first complete the form with accurate personal and financial information. This includes details such as your name, address, and Social Security number. After filling out the form, it should be submitted to the IRS by the due date of your tax return. It is crucial to ensure that the form is signed and dated. Once accepted, the IRS will grant an extension, allowing additional time to file your return without incurring penalties.

Steps to complete the 2350

Completing Form 2350 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including income statements and previous tax returns.

- Fill out the form with your personal information, ensuring all entries are accurate.

- Indicate the reason for the extension request, particularly if you are living outside the U.S.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Once completed, submit the form to the IRS by mail or electronically, depending on your preference and eligibility.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with Form 2350 is essential for compliance. Typically, the standard deadline for filing individual tax returns is April 15. However, if you are living abroad, you may qualify for an automatic two-month extension, moving the deadline to June 15. If additional time is needed, submitting Form 2350 can extend the deadline further, but it is important to file the form before the original due date to avoid penalties.

Required Documents

When preparing to file Form 2350, several documents are necessary to ensure accurate completion. These include:

- Previous year’s tax return for reference.

- W-2 forms or 1099 forms documenting income.

- Any additional documentation that supports your income claims and extension request.

Having these documents ready will streamline the process and help avoid delays in your extension request.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 2350. Taxpayers must ensure that they meet the eligibility criteria, which typically includes being a U.S. citizen or resident alien living abroad. Additionally, it is essential to understand that while Form 2350 allows for an extension to file, it does not extend the time to pay any taxes owed. Therefore, taxpayers should estimate their tax liability and pay any owed amounts by the original due date to avoid interest and penalties.

Quick guide on how to complete 2350

Effortlessly prepare 2350 on any device

Managing documents online has become increasingly popular for businesses and individuals alike. It offers an ideal eco-friendly option compared to traditional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle 2350 on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

The easiest method to modify and eSign 2350 effortlessly

- Obtain 2350 and click Get Form to begin.

- Make use of the tools available to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes just moments and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to finalize your alterations.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced paperwork, painstaking form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management requirements with just a few clicks from your chosen device. Edit and eSign 2350 to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2350

Create this form in 5 minutes!

How to create an eSignature for the 2350

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 2350 filing and how does it relate to eSigning documents?

The 2350 filing refers to a specific tax form used by certain entities to report income. Using airSlate SignNow, businesses can efficiently eSign documents related to the 2350 filing, making the process quicker and more streamlined.

-

How can airSlate SignNow help with the 2350 filing process?

airSlate SignNow provides an easy-to-use platform that simplifies the 2350 filing process by allowing users to send documents for eSignature efficiently. With its features, users can track the status of their documents in real time, ensuring compliance and timely submission.

-

What are the pricing options for using airSlate SignNow for 2350 filing?

airSlate SignNow offers several pricing plans to accommodate different business needs, starting with a free trial. The pricing for plans that support efficient 2350 filing is competitive, providing excellent value for the tools and integrations it offers.

-

Are there any integrations available to assist with 2350 filing?

Yes, airSlate SignNow integrates with numerous applications that can aid in the 2350 filing process. Popular choices include cloud storage services and productivity tools, streamlining your document management and eSigning workflow.

-

What features specifically benefit users handling 2350 filing?

Key features beneficial for 2350 filing include customizable templates, automated workflows, and secure storage. These ensure that users can manage their eSigning needs effectively while minimizing errors and enhancing compliance.

-

Can I use airSlate SignNow for teamwork in 2350 filing?

Absolutely! airSlate SignNow allows teams to collaborate on documents necessary for 2350 filing by providing shared access and comment features. This enhances communication and ensures that all team members are on the same page.

-

Is it secure to use airSlate SignNow for sensitive 2350 filing documents?

Yes, airSlate SignNow prioritizes security, ensuring that all documents, including those related to 2350 filing, are encrypted and stored safely. They adhere to industry standards to protect sensitive information during the eSigning process.

Get more for 2350

- Tenant qualification application form

- Community action pre application form

- City of bellevue ky occupational license form

- Arkansas electrician form

- Computershare transfer request form

- Solo provider record id information form fillable bcbs texas 2012

- Marriage registration form mrf 779592879

- Certificate of attendance wits university form

Find out other 2350

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement