Maryland 502x Form 2019

What is the Maryland 502x Form

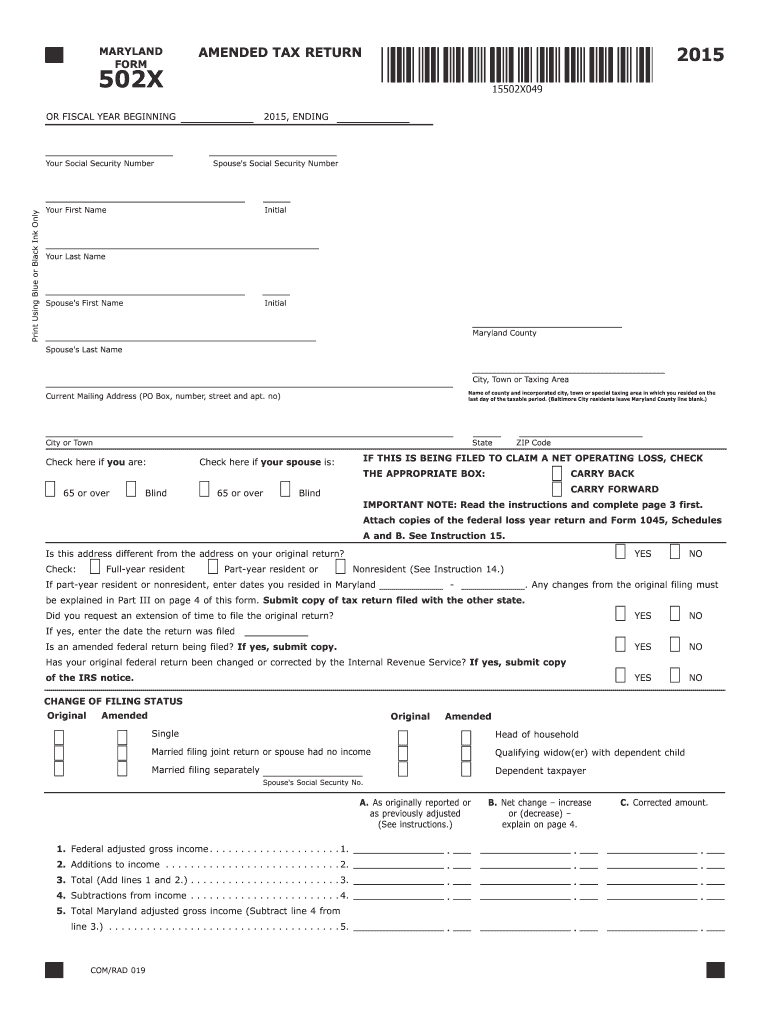

The Maryland 502x Form is a state tax form used by individuals to amend their Maryland income tax returns. This form allows taxpayers to correct any mistakes made on their original tax filings, such as errors in income reporting, deductions, or credits. By submitting the Maryland 502x Form, taxpayers can ensure that their tax obligations are accurately reflected and that they receive any potential refunds owed to them. This form is essential for maintaining compliance with state tax laws and ensuring accurate tax reporting.

How to use the Maryland 502x Form

Using the Maryland 502x Form involves several steps to ensure accurate completion. First, gather all relevant documents, including your original tax return and any supporting documentation for the changes you wish to make. Next, fill out the form with the corrected information, clearly indicating the changes from your original return. It is important to provide detailed explanations for each amendment. After completing the form, review it for accuracy before submitting it to the Maryland Comptroller's Office, either by mail or electronically, if applicable.

Steps to complete the Maryland 502x Form

Completing the Maryland 502x Form requires careful attention to detail. Follow these steps:

- Obtain the Maryland 502x Form from the official state website or your tax preparer.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are amending your return.

- Provide the original amounts from your initial return alongside the corrected amounts.

- Explain the reason for each amendment in the designated section.

- Sign and date the form to certify its accuracy.

Legal use of the Maryland 502x Form

The Maryland 502x Form is legally binding once submitted, provided it is completed accurately and in compliance with state tax laws. It is important to ensure that all information is truthful and correct, as falsifying information can lead to penalties. The form must be submitted within the statute of limitations for amending a tax return, which is generally three years from the original filing date. Adhering to these guidelines ensures that the amendments are legally recognized by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland 502x Form are crucial for compliance. Generally, taxpayers have three years from the original filing deadline to submit an amendment. For most individuals, this means that the deadline to file the Maryland 502x Form for a given tax year is April 15 of the third year following the tax year in question. It is advisable to keep track of these dates to avoid missing the opportunity to amend your tax return.

Form Submission Methods (Online / Mail / In-Person)

The Maryland 502x Form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file the form online, if the state offers an electronic filing option, or they can mail it to the appropriate address provided by the Maryland Comptroller's Office. In-person submissions may also be possible at designated state offices. It is important to check the latest guidelines for submission methods to ensure compliance.

Quick guide on how to complete 2015 maryland 502x form

Complete Maryland 502x Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Maryland 502x Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Maryland 502x Form effortlessly

- Find Maryland 502x Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Maryland 502x Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 maryland 502x form

Create this form in 5 minutes!

How to create an eSignature for the 2015 maryland 502x form

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Maryland 502x Form?

The Maryland 502x Form is a tax form used for filing amended individual income tax returns in Maryland. This form allows taxpayers to correct any previously filed returns, ensuring that all information is accurate. Utilizing this form correctly can help you receive any tax refunds owed or make necessary payments.

-

How can airSlate SignNow assist with the Maryland 502x Form?

airSlate SignNow provides a secure and user-friendly platform to electronically sign and send your Maryland 502x Form. With our service, you can quickly fill out and manage your forms online, reducing the risk of errors and ensuring timely submission. This streamlines the process and enhances your filing experience.

-

Is there a cost associated with using airSlate SignNow for the Maryland 502x Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs for managing documents like the Maryland 502x Form. Our cost-effective solutions ensure that you pay only for the features you require. Explore our pricing options to find the most suitable plan for your business.

-

What features does airSlate SignNow offer for eSigning the Maryland 502x Form?

With airSlate SignNow, you can enjoy features like customizable templates, document storage, and advanced security measures when eSigning the Maryland 502x Form. Our platform also allows you to collaborate with other signers in real-time, tracking changes and updates efficiently. Experience a seamless eSigning process with our intuitive interface.

-

Can I integrate airSlate SignNow with other software for handling the Maryland 502x Form?

Yes, airSlate SignNow supports integration with various third-party applications and software solutions. This allows you to streamline your workflow by connecting with your current systems for data management and document organization. Easily manage the Maryland 502x Form alongside your other essential business tools.

-

What are the benefits of using airSlate SignNow for filing the Maryland 502x Form?

Using airSlate SignNow to file the Maryland 502x Form provides numerous benefits, including enhanced efficiency, reduced paperwork, and increased accuracy. Our platform eliminates the hassle of manual signing and mailing, allowing for quicker submissions and updates. Overall, this leads to a smoother, stress-free tax filing experience.

-

Is it safe to use airSlate SignNow for my Maryland 502x Form?

Absolutely! airSlate SignNow employs advanced security protocols to protect your data while you prepare your Maryland 502x Form. Our platform ensures that your documents are encrypted during transmission and storage. You can trust us to keep your sensitive information secure throughout the eSigning process.

Get more for Maryland 502x Form

- Pub 393 form

- Amravati university degree certificate form

- Social housing application form tipperary

- Phq 9 gad 7 word document 255182552 form

- Sensible staffing timesheet form

- Printable form to balance check book

- Bellin health hipaa form fill and sign printable template online us

- Covid 19 child care information for providerswisconsin department of

Find out other Maryland 502x Form

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple