706me Form 2020

What is the 706me Form

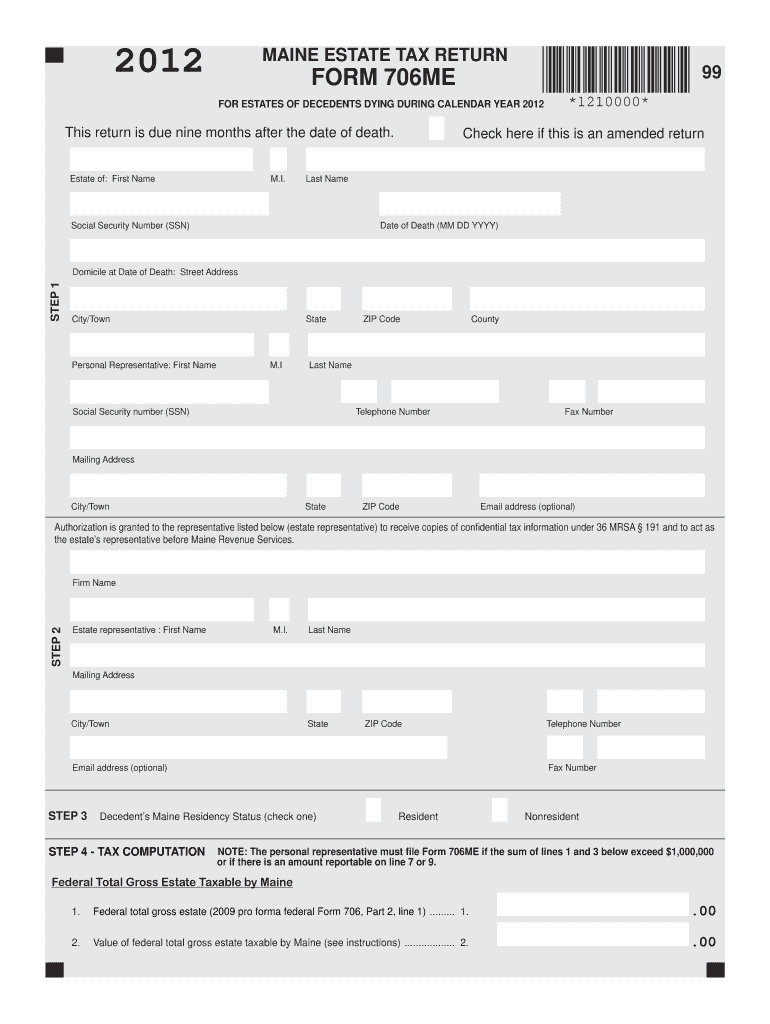

The 706me Form, also known as the Federal Estate Tax Return, is a crucial document used to report the estate of a deceased individual for tax purposes. This form is required when the gross estate exceeds a specific threshold set by the Internal Revenue Service (IRS). It includes details about the deceased's assets, liabilities, and any deductions that may apply. Understanding the 706me Form is essential for executors and beneficiaries to ensure compliance with federal tax laws and to facilitate the proper distribution of the estate.

How to use the 706me Form

Using the 706me Form involves several steps to ensure accurate and complete reporting. First, gather all necessary information about the deceased's estate, including bank statements, property deeds, and investment records. Next, carefully fill out the form, providing detailed information about the assets and liabilities. It is important to follow the IRS instructions closely to avoid errors that could lead to penalties. After completing the form, it must be filed with the IRS along with any required schedules and supporting documentation.

Steps to complete the 706me Form

Completing the 706me Form requires a systematic approach to ensure all necessary information is included. Here are the key steps:

- Gather all relevant financial documents related to the deceased's estate.

- Determine the gross estate value, including all assets and liabilities.

- Fill out the form accurately, ensuring all information is complete and correct.

- Include any applicable deductions, such as funeral expenses or debts.

- Review the completed form for accuracy before submission.

- File the form with the IRS by the specified deadline.

Legal use of the 706me Form

The 706me Form is legally binding and must be filled out in accordance with IRS regulations. Proper completion of the form ensures that the estate is accurately reported and that any taxes owed are calculated correctly. Failure to file the form or inaccuracies in reporting can result in penalties, interest, or legal complications. It is advisable to consult with a tax professional or attorney to ensure compliance with all legal requirements associated with the 706me Form.

Filing Deadlines / Important Dates

Filing the 706me Form must be done within specific timelines set by the IRS. Generally, the form is due nine months after the date of the deceased's death. However, an extension can be requested, but this does not extend the time for paying any taxes owed. It is crucial to be aware of these deadlines to avoid late fees and penalties. Keeping track of important dates related to the estate can help ensure timely compliance with tax obligations.

Required Documents

To complete the 706me Form, several documents are necessary. These typically include:

- Death certificate of the deceased.

- Financial statements detailing assets and liabilities.

- Appraisals for real estate and valuable personal property.

- Documentation of any debts or obligations of the estate.

- Records of any previous gifts made by the deceased that may affect the estate tax calculation.

Quick guide on how to complete 2012 706me form

Complete 706me Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-conscious substitute for traditional printed and signed paperwork, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage 706me Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to modify and eSign 706me Form with ease

- Locate 706me Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign 706me Form and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 706me form

Create this form in 5 minutes!

How to create an eSignature for the 2012 706me form

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the 706me Form and how is it used?

The 706me Form is a crucial legal document used in estate tax calculations. It helps to report the value of a deceased person's estate to the IRS. Using the airSlate SignNow platform, you can easily fill out and eSign the 706me Form, streamlining the estate settlement process.

-

How does airSlate SignNow simplify filling out the 706me Form?

airSlate SignNow offers an intuitive interface that makes completing the 706me Form straightforward. With features such as drag-and-drop document uploads and customizable templates, you can quickly fill in the necessary fields without complexity. This creates a more efficient workflow for both individuals and legal professionals.

-

Is there a cost associated with using airSlate SignNow for the 706me Form?

Yes, airSlate SignNow offers various pricing plans to meet different user needs, including features specifically for managing the 706me Form. It's designed to provide cost-effective solutions, allowing businesses to choose a plan that aligns with their budget and document signing requirements.

-

Can I integrate airSlate SignNow with other software for processing the 706me Form?

Absolutely! airSlate SignNow provides integrations with numerous platforms such as Google Drive, Dropbox, and Microsoft Office. These integrations allow you to enhance your workflow for managing the 706me Form, ensuring documents can be accessed and stored efficiently.

-

What are the security features of airSlate SignNow for the 706me Form?

airSlate SignNow prioritizes document security with features that include encryption and secure access controls. When you eSign the 706me Form, you can have peace of mind knowing that your sensitive information is protected. Compliance with industry standards further enhances the security of your documents.

-

Can multiple parties eSign the 706me Form using airSlate SignNow?

Yes, airSlate SignNow allows multiple parties to eSign the 706me Form easily and efficiently. This feature is especially useful for legal documents that require approval from several stakeholders. You can send out the form to all necessary signers and track its progress within the platform.

-

Are there any benefits of using airSlate SignNow for the 706me Form compared to traditional methods?

Using airSlate SignNow for the 706me Form offers numerous benefits over traditional paper methods, such as increased speed and lower costs. You can complete the eSigning process from anywhere, ensuring quick delivery and reduced turnaround times. This streamlines the overall estate management process.

Get more for 706me Form

Find out other 706me Form

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online