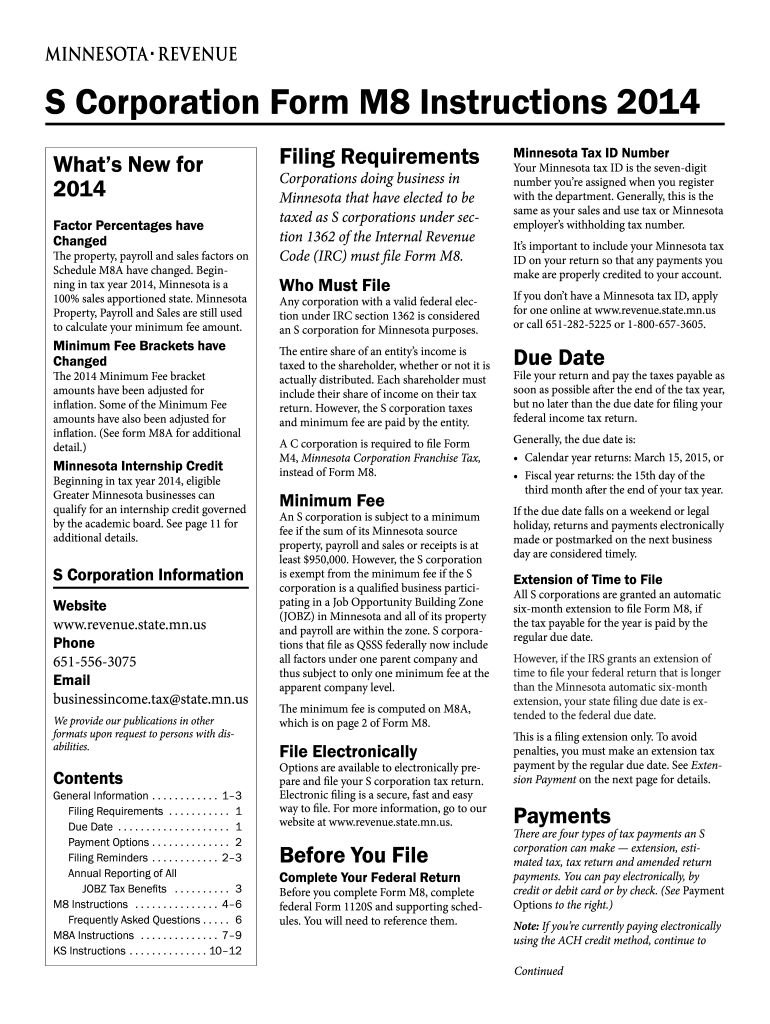

Minnesota M8 Form 2020

What is the Minnesota M8 Form

The Minnesota M8 Form is a specific document used for the purpose of reporting and calculating Minnesota state income tax for individuals. This form is particularly relevant for taxpayers who need to reconcile their income and tax obligations with the state. It is essential for ensuring compliance with Minnesota tax regulations and accurately reflecting any tax credits or deductions applicable to the filer.

How to use the Minnesota M8 Form

Using the Minnesota M8 Form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with accurate information regarding your income, deductions, and credits. It is crucial to double-check all entries for accuracy to avoid potential issues with the Minnesota Department of Revenue. Once completed, the form can be submitted either electronically or by mail, depending on your preference.

Steps to complete the Minnesota M8 Form

Completing the Minnesota M8 Form requires a systematic approach:

- Gather necessary documents such as income statements and previous tax returns.

- Begin filling out the form by entering personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and other sources.

- Calculate your deductions and credits based on the information provided in the form instructions.

- Review all entries for accuracy and completeness before submitting.

Legal use of the Minnesota M8 Form

The Minnesota M8 Form is legally binding when completed and submitted in accordance with state tax laws. It serves as an official document that the Minnesota Department of Revenue uses to assess tax liability. To ensure the legal validity of the form, it must be signed and dated by the taxpayer. Additionally, compliance with state regulations regarding eSignatures is necessary if the form is submitted electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota M8 Form typically align with the federal tax filing schedule. Generally, individual taxpayers must submit their forms by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to tax laws that may affect filing deadlines.

Form Submission Methods

The Minnesota M8 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Minnesota Department of Revenue's e-file system.

- Mailing a paper copy of the completed form to the appropriate address as indicated on the form.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete minnesota m8 2014 form

Prepare Minnesota M8 Form effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without complications. Manage Minnesota M8 Form on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Minnesota M8 Form without hassle

- Obtain Minnesota M8 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Minnesota M8 Form and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota m8 2014 form

Create this form in 5 minutes!

How to create an eSignature for the minnesota m8 2014 form

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is the Minnesota M8 Form?

The Minnesota M8 Form is a state-specific document utilized for reporting and documenting income tax withholdings in Minnesota. It is essential for both employers and employees to ensure compliance with state tax regulations. Completing the Minnesota M8 Form accurately helps prevent tax-related issues in the future.

-

How can airSlate SignNow assist with the Minnesota M8 Form?

airSlate SignNow simplifies the eSigning process of the Minnesota M8 Form, allowing users to send, sign, and store documents securely online. Our easy-to-use platform ensures that users can complete the form quickly and efficiently. Plus, with our templates, generating a Minnesota M8 Form becomes seamless.

-

What are the pricing options for airSlate SignNow when using the Minnesota M8 Form?

airSlate SignNow offers various pricing plans to fit different business needs, whether you're an individual or a larger organization. Our cost-effective solutions enable you to eSign documents, including the Minnesota M8 Form, without breaking the bank. Visit our pricing page for detailed information on subscriptions and features.

-

Can I integrate airSlate SignNow with other software for the Minnesota M8 Form?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications, enhancing your workflow for the Minnesota M8 Form. Whether you're using CRM systems, cloud storage, or accounting tools, our integrations streamline the eSigning and document management process. Check out our integration options to learn more.

-

What are the benefits of using airSlate SignNow for the Minnesota M8 Form?

Using airSlate SignNow for the Minnesota M8 Form offers multiple benefits, including improved efficiency, enhanced security, and reduced paper waste. Our eSigning solution is legally binding and compliant with eSignature laws, making it ideal for businesses. Additionally, the platform's user-friendly interface makes it easy for anyone to navigate.

-

Is the Minnesota M8 Form available as a template in airSlate SignNow?

Absolutely! airSlate SignNow provides a pre-built template for the Minnesota M8 Form that can be customized to suit your specific needs. This feature saves time and ensures that all relevant information is captured accurately. You can access the template directly within the application.

-

What security measures does airSlate SignNow implement for the Minnesota M8 Form?

Security is a top priority for airSlate SignNow when handling the Minnesota M8 Form. We utilize advanced encryption protocols and secure cloud storage to protect your sensitive information. Additionally, our platform complies with industry standards and regulations to ensure peace of mind while eSigning your documents.

Get more for Minnesota M8 Form

Find out other Minnesota M8 Form

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease