D 400 Form 2019

What is the D 400 Form

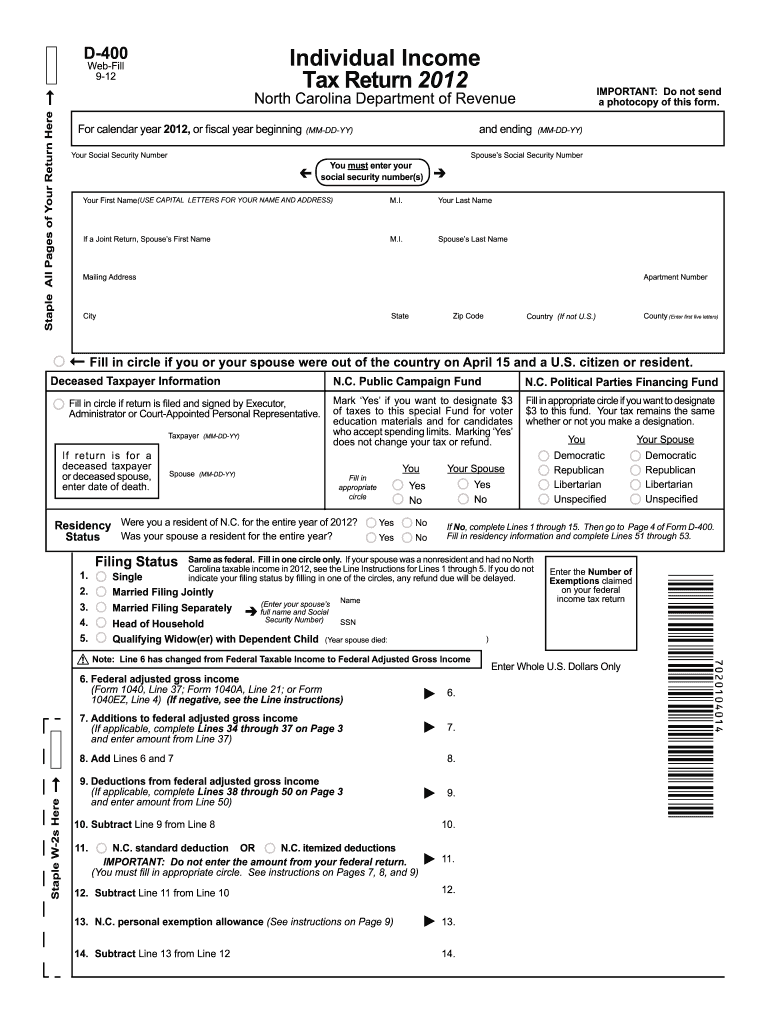

The D 400 Form is a tax document used by residents of the state of Delaware to report their income and calculate their state tax liability. This form is essential for individuals and businesses that need to comply with Delaware's tax regulations. It includes sections for personal information, income details, and applicable deductions or credits. The D 400 Form helps ensure that taxpayers accurately report their earnings and fulfill their tax obligations to the state.

How to obtain the D 400 Form

To obtain the D 400 Form, individuals can visit the official Delaware Division of Revenue website. The form is available for download in PDF format, allowing taxpayers to print it for completion. Additionally, physical copies of the form may be available at local tax offices or public libraries throughout Delaware. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to complete the D 400 Form

Completing the D 400 Form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income in the designated sections, ensuring accuracy to avoid penalties.

- Apply any eligible deductions or credits as outlined in the form instructions.

- Review the completed form for accuracy before submitting it.

Legal use of the D 400 Form

The D 400 Form is legally binding and must be completed in accordance with Delaware tax laws. Accurate reporting of income and adherence to filing deadlines are critical to avoid penalties. The form serves as an official document that the state uses to assess tax liabilities. Submitting the form electronically or by mail provides a record of compliance with state regulations.

Form Submission Methods

Taxpayers can submit the D 400 Form through various methods:

- Online Submission: Delaware residents can file the D 400 Form electronically through the Delaware Division of Revenue's e-filing system.

- Mail: Completed forms can be mailed to the appropriate address listed on the form. It is advisable to use certified mail for tracking purposes.

- In-Person: Taxpayers may also submit the form in person at local tax offices, where assistance may be available.

Filing Deadlines / Important Dates

Filing deadlines for the D 400 Form are typically aligned with federal tax deadlines. Generally, the form must be submitted by April 30 for the previous tax year. It is crucial to stay informed about any changes to deadlines, as extensions may be available under specific circumstances. Filing on time helps avoid late fees and interest charges on unpaid taxes.

Quick guide on how to complete 2012 d 400 form

Manage D 400 Form effortlessly on any gadget

Digital document administration has gained traction among companies and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed papers, as you can obtain the necessary format and securely keep it online. airSlate SignNow provides you with all the tools required to generate, modify, and eSign your documents swiftly without interruptions. Process D 400 Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

Steps to modify and eSign D 400 Form with ease

- Find D 400 Form and click Retrieve Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that function.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Finish button to secure your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choosing. Modify and eSign D 400 Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 d 400 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 d 400 form

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the D 400 Form, and why is it important?

The D 400 Form is a vital document used for certain business tax purposes. Understanding this form can help ensure compliance with tax regulations and avoid potential penalties. Using airSlate SignNow makes it easy to fill out and eSign your D 400 Form securely and conveniently.

-

How can airSlate SignNow simplify the process of completing the D 400 Form?

airSlate SignNow streamlines the process by allowing you to easily create, edit, and eSign the D 400 Form online. Its user-friendly interface guides you through each step, ensuring that you fill out the form accurately without any hassle. This efficiency saves you valuable time and reduces the likelihood of errors.

-

Is there a cost associated with using airSlate SignNow for the D 400 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when using services like the D 400 Form. Each plan is designed to provide comprehensive tools for efficient document management at a cost-effective rate. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow provide for the D 400 Form?

With airSlate SignNow, you get features like document templates, eSignature options, real-time collaboration, and secure cloud storage for the D 400 Form. These features enhance efficiency and ensure that all your documents remain organized and accessible anytime. Additionally, you can track the status of your form in real time.

-

How does airSlate SignNow ensure the security of the D 400 Form?

Security is a top priority with airSlate SignNow. The platform utilizes advanced encryption technology to protect your D 400 Form and other sensitive documents. Furthermore, it complies with industry standards and regulations to ensure that your data is safe from unauthorized access.

-

Can I integrate airSlate SignNow with other tools for the D 400 Form?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, enhancing your workflow for handling the D 400 Form. Popular integrations include CRM systems, file storage solutions, and productivity tools, allowing for a more connected and efficient document management process.

-

What are the benefits of using airSlate SignNow for the D 400 Form over traditional methods?

Using airSlate SignNow for the D 400 Form offers numerous benefits compared to traditional paper methods. You gain instant access to online forms, reduce processing time, and eliminate the need for printing and scanning. This approach also provides a more eco-friendly option by minimizing paper waste.

Get more for D 400 Form

- Preliminary change of ownership report form

- Paramedical examiner certification online form

- Imo maritime declaration of health form excel

- Geometry proofs examples and answers pdf form

- United welsh housing application form

- Tai chi 37 form yang style pdf

- Clinical reference medsource travelers form

- Self helprepairpacket form

Find out other D 400 Form

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free