Ne Form 1040n 2020

What is the Ne Form 1040n

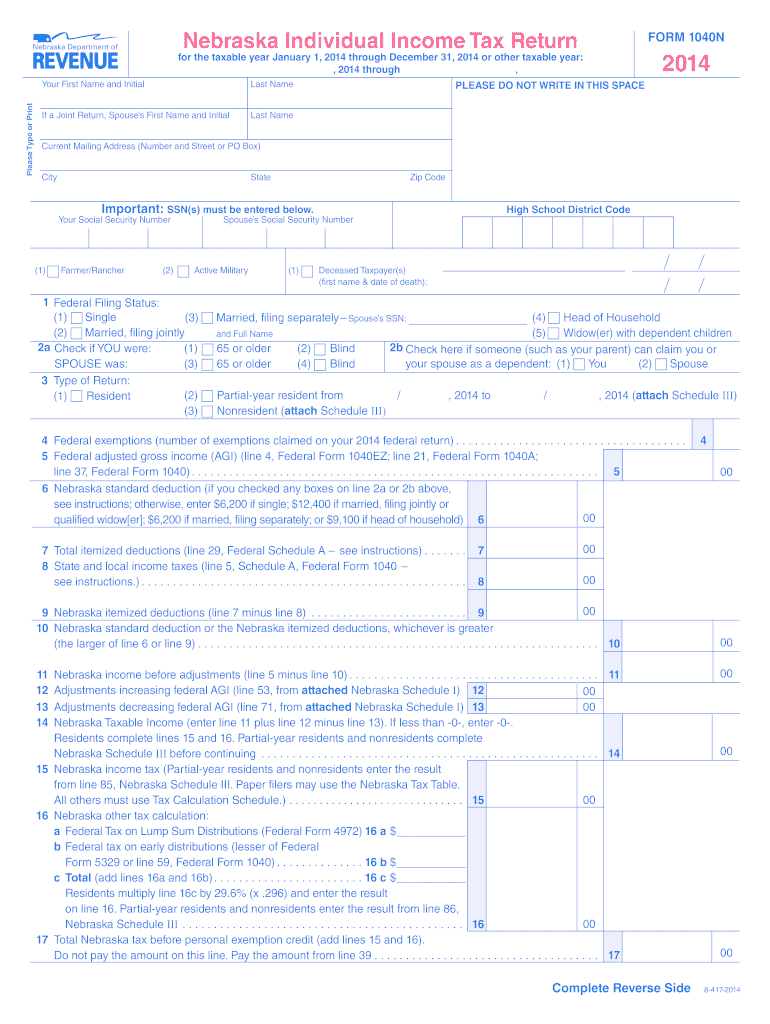

The Ne Form 1040n is a tax form used by residents of Nebraska to report their income and calculate their state tax obligations. This form is essential for individuals and businesses operating within the state, ensuring compliance with Nebraska tax laws. It includes sections for reporting various types of income, deductions, and credits applicable to Nebraska taxpayers. Understanding the Ne Form 1040n is crucial for accurate tax reporting and to avoid potential penalties.

How to use the Ne Form 1040n

Using the Ne Form 1040n involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2 forms, 1099s, and any other income statements. Next, carefully fill out the form, entering your personal information, income details, and any deductions or credits you may qualify for. After completing the form, review it for accuracy before submitting it to the Nebraska Department of Revenue. It is important to keep a copy for your records.

Steps to complete the Ne Form 1040n

Completing the Ne Form 1040n requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather all relevant income documentation, such as W-2s and 1099s.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income in the designated sections.

- Claim any deductions or credits applicable to your situation.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Ne Form 1040n

The Ne Form 1040n is legally binding when completed correctly and submitted to the appropriate tax authority. To ensure its legal standing, taxpayers must adhere to state regulations regarding income reporting and tax obligations. The form must be signed by the taxpayer, affirming that all information provided is true and accurate. Failure to comply with these legal requirements can result in penalties or legal actions from the Nebraska Department of Revenue.

Filing Deadlines / Important Dates

Timely filing of the Ne Form 1040n is crucial to avoid penalties. The typical deadline for submitting this form is April 15 of each year, coinciding with the federal tax filing deadline. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes to deadlines that may occur due to state legislation or emergencies.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Ne Form 1040n. The form can be filed online through the Nebraska Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax returns. Alternatively, taxpayers can mail their completed forms to the designated address provided by the state. In-person submission is also an option at local tax offices, allowing for direct assistance if needed. Each method has its own processing times and requirements, so it is essential to choose the one that best fits individual needs.

Quick guide on how to complete 2014 ne form 1040n

Complete Ne Form 1040n effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Manage Ne Form 1040n on any device using airSlate SignNow Android or iOS applications, and streamline any document-related process today.

How to alter and eSign Ne Form 1040n easily

- Obtain Ne Form 1040n and then click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Ne Form 1040n and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 ne form 1040n

Create this form in 5 minutes!

How to create an eSignature for the 2014 ne form 1040n

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Ne Form 1040n and why do I need it?

The Ne Form 1040n is an important tax document used by individuals to report their income and calculate their tax liability. Understanding how to properly fill out and submit the Ne Form 1040n is crucial for staying compliant with tax regulations. Using airSlate SignNow can help streamline this process, allowing you to eSign your documents easily and securely.

-

How does airSlate SignNow simplify the Ne Form 1040n submission process?

airSlate SignNow simplifies the submission of the Ne Form 1040n by providing an intuitive platform where you can prepare, sign, and send your documents electronically. This eliminates the need for printing, scanning, or faxing, saving you time and reducing errors. With airSlate SignNow, you can ensure that your Ne Form 1040n is submitted efficiently.

-

What features does airSlate SignNow offer for handling the Ne Form 1040n?

airSlate SignNow offers a variety of features specifically designed to assist with handling the Ne Form 1040n. These include document templates, customizable workflows, and a secure eSignature function. These tools work together to make the preparation and submission of your Ne Form 1040n as smooth as possible.

-

Is airSlate SignNow cost-effective for filing the Ne Form 1040n?

Yes, airSlate SignNow is a cost-effective solution for filing the Ne Form 1040n. With various pricing plans available, you can choose one that fits your budget while still gaining access to powerful features that enhance your document management. This affordability allows you to efficiently handle your tax documents without breaking the bank.

-

Can I integrate airSlate SignNow with my existing software for the Ne Form 1040n?

Absolutely! airSlate SignNow offers seamless integrations with many popular software applications, allowing you to manage the Ne Form 1040n alongside your existing tools. This feature enables a cohesive workflow, ensuring that you can eSign and submit your documents without any disruptions.

-

What benefits does using airSlate SignNow provide for businesses handling the Ne Form 1040n?

Using airSlate SignNow provides businesses with signNow benefits when handling the Ne Form 1040n, including increased efficiency and reduced paper usage. The platform enhances collaboration by allowing multiple users to access and sign the document from anywhere. Additionally, its security measures ensure that your sensitive tax information is protected.

-

Is it easy to learn how to use airSlate SignNow for the Ne Form 1040n?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it simple to learn how to use, even for those unfamiliar with electronic signing. The platform includes tutorials and support resources to guide you through the process of preparing and eSigning the Ne Form 1040n. You'll be able to navigate the system with ease, helping you complete your tax forms quickly.

Get more for Ne Form 1040n

- Fs form 4000

- Sample letter of criminal rehabilitation form

- Feature comforts heater manual form

- Quiz 1 medical terminology and general anatomy naaccr form

- 22 1 disclosure form illinois pdf

- Dl 101 form california

- 3 day notice to quit and vacate comal county texas co comal tx form

- 13 tourist accommodation inspection the cayman islands caymanislands co form

Find out other Ne Form 1040n

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe