Nebraska 1040n Form 2020

What is the Nebraska 1040n Form

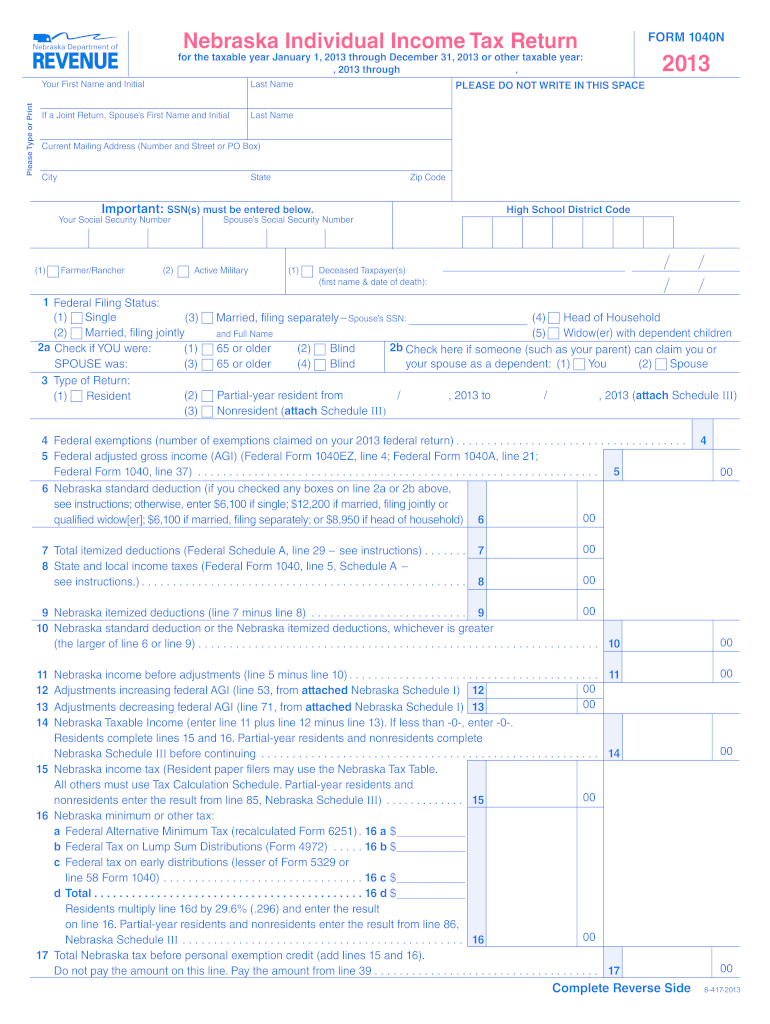

The Nebraska 1040n Form is a state tax form used by residents of Nebraska to report their income and calculate their state tax liability. This form is specifically designed for individuals who are filing their state income tax returns. It is essential for ensuring compliance with Nebraska tax laws and for determining the amount of tax owed or any refund due. The form captures various income sources, deductions, and credits applicable to Nebraska taxpayers.

How to use the Nebraska 1040n Form

Using the Nebraska 1040n Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as W-2 forms, 1099s, and records of any deductions or credits. Next, fill out the form by entering personal information, income details, and applicable deductions. It is important to follow the instructions provided with the form carefully to avoid errors. Once completed, the form can be submitted electronically or via mail to the Nebraska Department of Revenue.

Steps to complete the Nebraska 1040n Form

Completing the Nebraska 1040n Form requires a systematic approach:

- Gather all relevant financial documents, including income statements and deduction records.

- Fill in your personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any deductions and credits you qualify for, ensuring you have supporting documentation.

- Calculate your total tax liability and any refund or amount owed.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Nebraska 1040n Form to avoid penalties. Typically, the deadline for filing is April 15 of each year, aligning with federal tax deadlines. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions they may file for additional time to complete their returns.

Required Documents

To accurately complete the Nebraska 1040n Form, certain documents are required. These include:

- W-2 forms from employers, detailing annual wages.

- 1099 forms for any freelance or contract work.

- Documentation for any deductions, such as mortgage interest statements or medical expenses.

- Records of any tax credits claimed, including education or childcare credits.

Form Submission Methods

The Nebraska 1040n Form can be submitted through various methods. Taxpayers have the option to file electronically using approved e-filing software or through the Nebraska Department of Revenue's online portal. Alternatively, the form can be printed and mailed to the appropriate address. It is advisable to keep copies of submitted forms and any supporting documentation for personal records.

Quick guide on how to complete 2013 nebraska 1040n form

Effortlessly prepare Nebraska 1040n Form on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as a perfect environmentally-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Nebraska 1040n Form on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-related process today.

How to modify and electronically sign Nebraska 1040n Form with ease

- Locate Nebraska 1040n Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important parts of the documents or conceal confidential information using tools specifically available through airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, frustrating form hunts, or inaccuracies necessitating the printing of new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and electronically sign Nebraska 1040n Form to ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 nebraska 1040n form

Create this form in 5 minutes!

How to create an eSignature for the 2013 nebraska 1040n form

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the Nebraska 1040n Form?

The Nebraska 1040n Form is the state's individual income tax return used by residents of Nebraska. It allows taxpayers to report their income, calculate their tax liability, and determine any refunds or payments due. Understanding this form is essential for accurate tax filing.

-

How does airSlate SignNow help me with the Nebraska 1040n Form?

airSlate SignNow simplifies the process of signing and sending the Nebraska 1040n Form electronically. Our platform provides an easy-to-use interface that ensures your documents are signed quickly and securely. This streamlines tax preparation and submission.

-

Is there a cost to use airSlate SignNow for the Nebraska 1040n Form?

Yes, airSlate SignNow offers various pricing plans to suit your needs when handling the Nebraska 1040n Form. We provide cost-effective solutions for both individuals and businesses, ensuring that you can manage your tax documents efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other applications to manage my Nebraska 1040n Form?

Absolutely! airSlate SignNow can be integrated with various applications and software solutions, enhancing your ability to manage the Nebraska 1040n Form. This functionality allows for seamless workflows and better document management, improving your overall efficiency.

-

What are the benefits of using airSlate SignNow for tax forms like the Nebraska 1040n Form?

Using airSlate SignNow to handle the Nebraska 1040n Form offers numerous benefits, including speed, security, and ease of use. Our platform ensures that your documents are signed electronically in a secure environment, reducing paper waste and saving you time during tax season.

-

Is airSlate SignNow secure for signing the Nebraska 1040n Form?

Yes, airSlate SignNow implements the highest security standards to protect your documents, including the Nebraska 1040n Form. We use encrypted signatures and secure storage, ensuring your sensitive tax information remains confidential and secure throughout the signing process.

-

Can I save my completed Nebraska 1040n Form on airSlate SignNow?

Yes, airSlate SignNow allows you to save your completed Nebraska 1040n Form directly on our platform. You can access your documents anytime, anywhere, making it easy to retrieve and manage your tax paperwork whenever needed.

Get more for Nebraska 1040n Form

- Metrolist application form

- Name change petition form

- Colorado tangible net benefit disclosure form

- Printable income and expenditure form

- Key assignment form 83357614

- Printable communicable disease chart ohio form

- Standard form for presentation of loss ampamp damage claims

- The planning process sheet form

Find out other Nebraska 1040n Form

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form