Form 12N Nebraska Nonresident Income Tax Agreement 2020

What is the Form 12N Nebraska Nonresident Income Tax Agreement

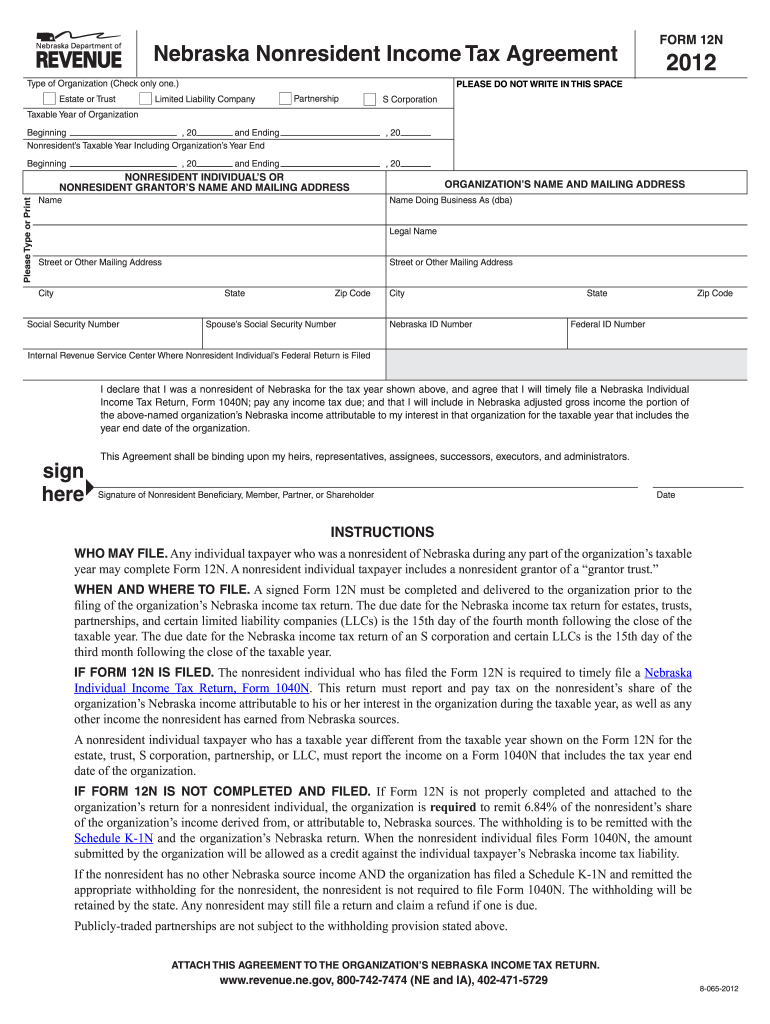

The Form 12N Nebraska Nonresident Income Tax Agreement is a tax document used by nonresidents who earn income in Nebraska. This form allows nonresidents to report their income earned within the state and calculate their tax obligations accordingly. It is essential for ensuring compliance with Nebraska tax laws while allowing nonresidents to claim any applicable deductions or credits. By completing this form, nonresidents can accurately determine their tax liability and avoid potential penalties associated with underreporting income.

Steps to complete the Form 12N Nebraska Nonresident Income Tax Agreement

Completing the Form 12N requires several steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s and 1099s, that reflect your income earned in Nebraska. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your Nebraska-sourced income, which may include wages, business income, or rental income. After calculating your total income, apply any eligible deductions or credits as outlined in the form instructions. Finally, review the completed form for accuracy before signing and submitting it.

How to obtain the Form 12N Nebraska Nonresident Income Tax Agreement

The Form 12N can be obtained through the Nebraska Department of Revenue's official website. The form is available for download in PDF format, allowing individuals to print and fill it out manually. Alternatively, some tax preparation software may include the form, enabling users to complete it digitally. Ensure you are using the most current version of the form to comply with any recent changes in tax laws or requirements.

Legal use of the Form 12N Nebraska Nonresident Income Tax Agreement

To be considered legally binding, the Form 12N must be completed in accordance with Nebraska tax regulations. This includes providing accurate information regarding income and ensuring that all required signatures are present. When submitted electronically, it is crucial to use a secure and compliant eSignature solution that meets the standards set by the ESIGN Act and UETA. Proper execution of the form helps protect against legal disputes and ensures that the tax obligations are fulfilled appropriately.

Filing Deadlines / Important Dates

Filing deadlines for the Form 12N are typically aligned with the federal tax deadlines. Nonresidents should be aware that the form must be submitted by April 15 for income earned in the previous calendar year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the Nebraska Department of Revenue's website for any updates or changes to deadlines that may occur due to special circumstances.

Form Submission Methods (Online / Mail / In-Person)

The Form 12N can be submitted through various methods to accommodate different preferences. Nonresidents may choose to file the form electronically via the Nebraska Department of Revenue's online portal, which offers a streamlined process for tax submission. Alternatively, individuals can mail a completed paper form to the appropriate address provided in the form instructions. In-person submissions may also be possible at designated tax offices, allowing for direct assistance if needed. Each submission method has its own processing times, so it is important to consider these when preparing to file.

Quick guide on how to complete form 12n 2012 nebraska nonresident income tax agreement

Effortlessly Prepare Form 12N Nebraska Nonresident Income Tax Agreement on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Form 12N Nebraska Nonresident Income Tax Agreement on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The simplest method to edit and electronically sign Form 12N Nebraska Nonresident Income Tax Agreement with ease

- Obtain Form 12N Nebraska Nonresident Income Tax Agreement and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your edits.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 12N Nebraska Nonresident Income Tax Agreement and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 12n 2012 nebraska nonresident income tax agreement

Create this form in 5 minutes!

How to create an eSignature for the form 12n 2012 nebraska nonresident income tax agreement

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Form 12N Nebraska Nonresident Income Tax Agreement?

The Form 12N Nebraska Nonresident Income Tax Agreement is a tax form required for nonresidents receiving income in Nebraska. This form ensures that nonresident taxpayers comply with state tax laws while claiming any applicable credits or exemptions. Completing this form accurately is crucial to avoid potential penalties.

-

How can airSlate SignNow help with the Form 12N Nebraska Nonresident Income Tax Agreement?

airSlate SignNow facilitates the electronic signing and sending of the Form 12N Nebraska Nonresident Income Tax Agreement, making it easier for users to complete their tax responsibilities. Our platform streamlines document management, allowing users to securely prepare and sign this form online. This saves time and reduces the hassle associated with traditional paper forms.

-

Is there a cost associated with using airSlate SignNow for the Form 12N Nebraska Nonresident Income Tax Agreement?

Yes, airSlate SignNow offers various subscription plans, allowing you to choose a cost-effective solution that fits your needs when managing the Form 12N Nebraska Nonresident Income Tax Agreement. Pricing typically depends on the features you require, such as advanced integrations and additional storage. Explore our plans to find the best option for your situation.

-

What features are included in airSlate SignNow for handling the Form 12N Nebraska Nonresident Income Tax Agreement?

airSlate SignNow includes features such as custom templates, automated reminders, and secure storage that are beneficial for managing the Form 12N Nebraska Nonresident Income Tax Agreement. These tools ensure that your documents are organized and deadlines are met. Additionally, our signature tracking feature allows users to monitor the status of their agreements in real-time.

-

Can airSlate SignNow integrate with other tools for filing the Form 12N Nebraska Nonresident Income Tax Agreement?

Yes, airSlate SignNow integrates effortlessly with many popular business applications such as Google Drive, Dropbox, and various accounting software. This integration capability enhances your workflow when preparing the Form 12N Nebraska Nonresident Income Tax Agreement. Utilize these connections to manage your documents effectively within your existing systems.

-

What are the benefits of using airSlate SignNow for the Form 12N Nebraska Nonresident Income Tax Agreement?

Using airSlate SignNow for the Form 12N Nebraska Nonresident Income Tax Agreement provides numerous benefits, including increased efficiency, reduced processing time, and enhanced security. Our platform allows for easy tracking and management of documents, ensuring you stay compliant with Nebraska tax laws. Ultimately, these features lead to a smoother tax filing experience.

-

How secure is my information when signing the Form 12N Nebraska Nonresident Income Tax Agreement with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize industry-leading encryption and authentication protocols to safeguard your information while you prepare and sign the Form 12N Nebraska Nonresident Income Tax Agreement. Your data is protected against unauthorized access, ensuring that your personal and financial information remains confidential.

Get more for Form 12N Nebraska Nonresident Income Tax Agreement

- Sample letter of medical necessity for caregiver form

- Welding machine checklist excel form

- Authorization letter for rfid application form

- Prank letter templates form

- Annexure 1a bank attestation form

- Practice with monohybrid punnett squares answer key form

- Usindh marksheet form

- Certificate of appropriateness the town of dennis town dennis ma form

Find out other Form 12N Nebraska Nonresident Income Tax Agreement

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement