Dc Resale Certificate 2016-2026

What is the DC Resale Certificate

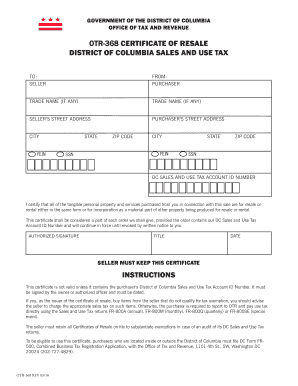

The DC resale certificate is a legal document that allows businesses in the District of Columbia to purchase goods tax-free for resale purposes. This certificate is essential for retailers who intend to buy items that they will later sell to consumers. By using this certificate, businesses can avoid paying sales tax on their purchases, which can help reduce overall operational costs. It is important to note that this certificate is only valid for items that will be resold and not for personal use.

How to Use the DC Resale Certificate

To use the DC resale certificate, a business must present it to the vendor at the time of purchase. This document serves as proof that the buyer is exempt from sales tax on the items being purchased. The seller must retain a copy of the certificate for their records. It is crucial for businesses to ensure that the certificate is filled out correctly, including the seller's name, address, and the buyer's information, to avoid any potential issues with tax authorities.

Steps to Complete the DC Resale Certificate

Completing the DC resale certificate involves several straightforward steps:

- Obtain the correct form, which can typically be found on the official District of Columbia government website.

- Fill in the required information, including the name and address of the buyer and seller.

- Specify the type of goods being purchased for resale.

- Sign and date the certificate to validate it.

Once completed, the certificate should be provided to the vendor during the purchase transaction.

Legal Use of the DC Resale Certificate

The legal use of the DC resale certificate is governed by specific regulations. Businesses must ensure they are using the certificate only for eligible purchases, as misuse can lead to penalties. The certificate is designed for items intended for resale, and using it for personal purchases or items not intended for resale can result in legal consequences, including fines and back taxes owed.

Eligibility Criteria

To qualify for a DC resale certificate, a business must meet certain eligibility criteria. This includes being a registered retailer in the District of Columbia and having a valid sales tax registration number. Businesses must also be engaged in the sale of tangible personal property or taxable services. It is essential for applicants to maintain accurate records of their purchases and sales to ensure compliance with tax regulations.

Required Documents

When applying for a DC resale certificate, businesses must provide several documents to demonstrate their eligibility. These typically include:

- A valid sales tax registration number.

- Proof of business registration in the District of Columbia.

- Identification documents, such as a driver's license or business ID.

Having these documents ready can streamline the application process and facilitate compliance with local tax laws.

Quick guide on how to complete dc resale certificate

Complete Dc Resale Certificate effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a superior eco-friendly option to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and smoothly. Manage Dc Resale Certificate on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign Dc Resale Certificate without difficulty

- Locate Dc Resale Certificate and then click Get Form to begin.

- Utilize the tools we offer to populate your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that task.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or mislaid files, tiresome document searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Dc Resale Certificate and maintain effective communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dc resale certificate

Create this form in 5 minutes!

How to create an eSignature for the dc resale certificate

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the dc certificate resale sales use tax?

The dc certificate resale sales use tax is a tax imposed on the sale of tangible personal property in Washington, D.C. For businesses, obtaining a resale certificate allows them to purchase goods tax-free with the intention of reselling those goods. Understanding this tax is crucial for ensuring compliance while maximizing profit margins.

-

How can airSlate SignNow help with dc certificate resale sales use tax documentation?

airSlate SignNow provides a streamlined solution for managing paperwork associated with dc certificate resale sales use tax. With our platform, you can easily create, send, and eSign documents that pertain to tax compliance. This ensures that all necessary paperwork is in order, helping to avoid potential penalties.

-

What features does airSlate SignNow offer for managing resale certificates?

Our platform includes features specifically designed for managing resale certificates, such as customizable templates and automated workflows. You can quickly generate and track dc certificate resale sales use tax documents, which helps simplify the compliance process. These features enhance efficiency and help you stay organized.

-

Is airSlate SignNow affordable for small businesses dealing with dc certificate resale sales use tax?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses. We understand that managing dc certificate resale sales use tax documentation can be costly, so our solution helps you save money while remaining compliant. Our pricing structure is designed to fit within the budgets of businesses of all sizes.

-

Can airSlate SignNow integrate with other software systems to manage dc certificate resale sales use tax?

Absolutely! airSlate SignNow integrates seamlessly with various business tools, including accounting and tax software. This means you can easily synchronize your dc certificate resale sales use tax documents with your existing systems, improving overall efficiency and reducing errors in your tax reporting.

-

What benefits can I expect from using airSlate SignNow for my dc certificate resale sales use tax needs?

Using airSlate SignNow for your dc certificate resale sales use tax needs offers numerous benefits, including increased efficiency, greater compliance, and enhanced security. Our platform enables you to quickly manage and store your documents, ensuring you can access them anytime. This saves time and reduces the risk of errors in tax documentation.

-

How secure is airSlate SignNow when handling sensitive tax information?

airSlate SignNow prioritizes security and compliance when it comes to handling sensitive data related to dc certificate resale sales use tax. We implement advanced encryption protocols and ensure that your documents are stored securely in compliance with industry standards. You can trust us to protect your confidential information.

Get more for Dc Resale Certificate

Find out other Dc Resale Certificate

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word