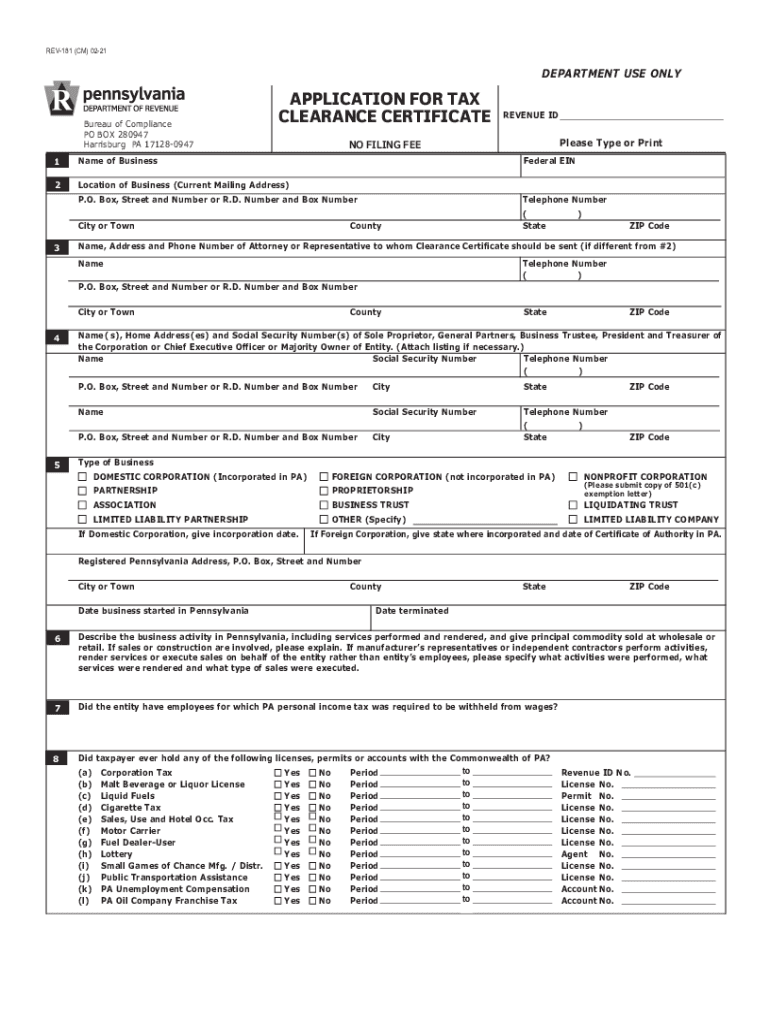

Application for Tax Clearance Certificate REV 181 FormsPublications 2021-2026

Understanding the PA Tax Exemption Application

The PA tax exemption application is a crucial document for individuals and businesses seeking tax relief in Pennsylvania. This application allows eligible parties to request an exemption from certain state taxes, which can significantly reduce their financial burden. It is essential to understand the specific criteria and qualifications required to successfully apply for this exemption, as well as the implications of receiving it. The application process involves submitting the appropriate forms to the Pennsylvania Department of Revenue, which reviews each submission to determine eligibility based on established guidelines.

Steps to Complete the PA Tax Exemption Application

Completing the PA tax exemption application involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including proof of eligibility, such as financial statements or tax returns. Next, fill out the application form, ensuring that all sections are completed thoroughly. It is important to double-check for any errors or omissions, as these can delay processing. Once the form is completed, submit it according to the specified guidelines, either online or via mail. Keeping a copy of the submitted application for your records is also advisable.

Required Documents for the PA Tax Exemption Application

When applying for a tax exemption in Pennsylvania, certain documents are required to support your application. These may include:

- Proof of income or financial status

- Previous tax returns

- Documentation of any relevant expenses

- Identification information, such as a driver's license or Social Security number

Providing complete and accurate documentation is essential for a smooth application process, as it helps the reviewing authority assess your eligibility effectively.

Eligibility Criteria for the PA Tax Exemption Application

To qualify for the PA tax exemption application, applicants must meet specific eligibility criteria set forth by the Pennsylvania Department of Revenue. Generally, eligibility is determined based on factors such as income level, type of property, and intended use of the property. For instance, certain nonprofit organizations may qualify for exemptions if they meet the criteria of being charitable or educational. It is important to review the detailed guidelines to ensure that your application aligns with the stated requirements.

Form Submission Methods for the PA Tax Exemption Application

Submitting the PA tax exemption application can be done through various methods, depending on the preferences of the applicant. The primary submission methods include:

- Online submission through the Pennsylvania Department of Revenue's official website

- Mailing a physical copy of the completed application to the designated department address

- In-person submission at local revenue offices, if applicable

Choosing the appropriate submission method can affect the processing time, so applicants should consider their options carefully.

Legal Use of the PA Tax Exemption Application

The legal use of the PA tax exemption application is governed by state laws and regulations. It is essential for applicants to understand that submitting false information or failing to comply with the requirements can lead to penalties, including denial of the application or legal repercussions. Ensuring that all information provided is truthful and complete is vital for maintaining compliance with Pennsylvania tax laws. Additionally, applicants should be aware of the rights and responsibilities associated with receiving a tax exemption.

Quick guide on how to complete application for tax clearance certificate rev 181 formspublications

Prepare Application For Tax Clearance Certificate REV 181 FormsPublications effortlessly on any gadget

Online document management has gained traction among companies and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Application For Tax Clearance Certificate REV 181 FormsPublications on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign Application For Tax Clearance Certificate REV 181 FormsPublications without hassle

- Find Application For Tax Clearance Certificate REV 181 FormsPublications and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Adjust and eSign Application For Tax Clearance Certificate REV 181 FormsPublications while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for tax clearance certificate rev 181 formspublications

Create this form in 5 minutes!

How to create an eSignature for the application for tax clearance certificate rev 181 formspublications

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is a PA tax exemption application?

A PA tax exemption application is a form submitted to the Pennsylvania Department of Revenue to request tax exemptions on specific transactions. By applying, businesses can ensure compliance while potentially saving money on eligible purchases. Utilizing airSlate SignNow can simplify the process with eSigning capabilities, making it more efficient.

-

How do I complete a PA tax exemption application?

To complete a PA tax exemption application, gather the necessary documentation and fill out the form accurately. With airSlate SignNow, you can easily upload your completed application and eSign it to streamline the submission process. This ensures your application is handled quickly and in compliance with state requirements.

-

What features does airSlate SignNow offer for managing PA tax exemption applications?

airSlate SignNow offers features such as document templates, real-time tracking, and secure eSigning specifically designed to simplify the PA tax exemption application process. These tools help eliminate paperwork hassles and speed up application approvals. With a user-friendly interface, managing your forms has never been easier.

-

How much does it cost to use airSlate SignNow for PA tax exemption applications?

airSlate SignNow offers various pricing plans depending on your business needs. The service provides a competitive rate that includes features specifically beneficial for handling PA tax exemption applications. You can choose a plan that suits your requirements and start saving time and money on document management.

-

Can I integrate airSlate SignNow with my current software for PA tax exemption applications?

Yes, airSlate SignNow allows for seamless integration with various software applications to enhance your workflow for managing PA tax exemption applications. This means you can connect it with your existing tools, reducing duplication of efforts and ensuring a streamlined process. Such integrations help improve efficiency and collaboration.

-

What are the benefits of using airSlate SignNow for my PA tax exemption application?

Using airSlate SignNow for your PA tax exemption application provides several benefits, including time savings, enhanced accuracy, and reduced processing costs. The platform's eSigning capabilities help you get documents signed quickly, while also maintaining compliance. This leads to quicker approvals and less hassle in the long run.

-

Is airSlate SignNow secure for handling PA tax exemption applications?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and secure data handling to protect sensitive information related to your PA tax exemption application. You can confidently manage your documents without worrying about unauthorized access. Our commitment to security ensures your applications are safe and compliant.

Get more for Application For Tax Clearance Certificate REV 181 FormsPublications

Find out other Application For Tax Clearance Certificate REV 181 FormsPublications

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History