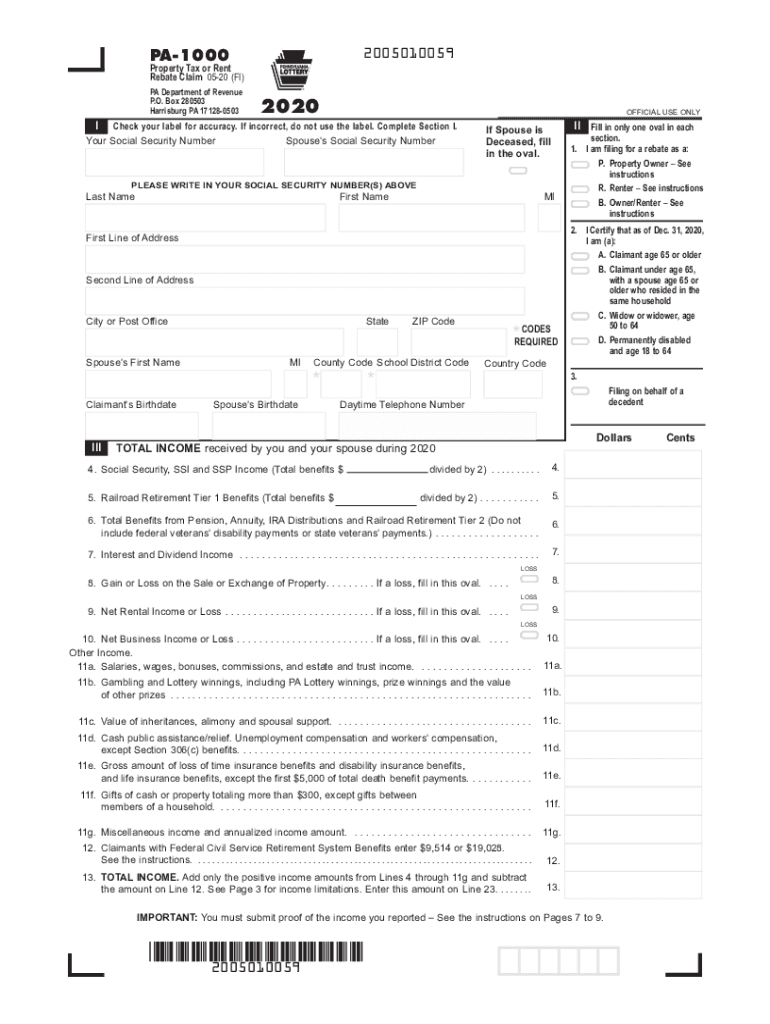

Property Tax or Rent Rebate Claim PA 1000 FormsPublications 2020

What is the Property Tax or Rent Rebate Claim PA 1000?

The Property Tax or Rent Rebate Claim PA 1000 is a form used by Pennsylvania residents to apply for a rebate on property taxes or rent paid during the previous year. This program is designed to provide financial relief to eligible individuals, particularly seniors, disabled persons, and low-income households. The form captures essential information regarding the applicant's income, property taxes or rent paid, and other relevant details that determine eligibility for the rebate. Understanding this form is crucial for those seeking to benefit from the financial assistance it offers.

Eligibility Criteria for the PA 1000 Form

To qualify for the Property Tax or Rent Rebate Claim PA 1000, applicants must meet specific eligibility requirements. Generally, applicants must be Pennsylvania residents aged sixty-five or older, or be a widow or widower aged fifty-one or older, or be permanently disabled. Additionally, the applicant's income must fall below a certain threshold, which is adjusted annually. It is important to review the current income limits and other criteria to ensure eligibility before submitting the form.

Steps to Complete the PA 1000 Form

Completing the Property Tax or Rent Rebate Claim PA 1000 involves several key steps. First, gather all necessary documents, including proof of income and records of property taxes or rent paid. Next, accurately fill out the form, ensuring all sections are completed with the correct information. Pay special attention to the income section, as this is critical for determining eligibility. After completing the form, review it for accuracy before submission. Finally, submit the form either online, by mail, or in person, depending on your preference and the available options.

Form Submission Methods

The PA 1000 form can be submitted through various methods to accommodate different preferences. Applicants may choose to submit the form online through the Pennsylvania Department of Revenue's website, ensuring a quick and efficient process. Alternatively, the form can be printed and mailed to the appropriate office. For those who prefer in-person interactions, visiting a local revenue office is also an option. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

Key Elements of the PA 1000 Form

The Property Tax or Rent Rebate Claim PA 1000 includes several key elements that applicants must complete. These elements typically include personal information such as name, address, and Social Security number, as well as details about income sources and amounts. Additionally, the form requires information about the property or rental situation, including the amount of property taxes paid or rent incurred. Understanding these elements is essential for accurately completing the form and ensuring eligibility for the rebate.

Filing Deadlines and Important Dates

Awareness of filing deadlines is crucial for applicants of the PA 1000 form. Typically, the deadline for submitting the form is set for a specific date each year, often around June 30. It is important to check the current year's deadline, as it may vary. Filing the form on time ensures that applicants do not miss out on potential rebates. Keeping track of these important dates can help in planning and preparing the necessary documentation in advance.

Quick guide on how to complete 2020 property tax or rent rebate claim pa 1000 formspublications

Prepare Property Tax Or Rent Rebate Claim PA 1000 FormsPublications effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly without interruptions. Manage Property Tax Or Rent Rebate Claim PA 1000 FormsPublications from any device with the airSlate SignNow Android or iOS applications and enhance any document-oriented operation today.

The simplest way to edit and eSign Property Tax Or Rent Rebate Claim PA 1000 FormsPublications with ease

- Obtain Property Tax Or Rent Rebate Claim PA 1000 FormsPublications and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Property Tax Or Rent Rebate Claim PA 1000 FormsPublications to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 property tax or rent rebate claim pa 1000 formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2020 property tax or rent rebate claim pa 1000 formspublications

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the papropertytaxrebate and how does it work?

The papropertytaxrebate is a program designed to help Pennsylvania homeowners reduce their property taxes. By applying for this rebate, eligible homeowners can receive a portion of their property tax payments back, making it easier to manage their finances. This program is typically aimed at low-income residents, senior citizens, and people with disabilities.

-

Who is eligible for the papropertytaxrebate?

Eligibility for the papropertytaxrebate generally includes homeowners in Pennsylvania who meet specific income requirements. Applicants must be either senior citizens or individuals with disabilities, as well as those who meet the necessary income threshold to qualify. It's essential to review the detailed eligibility criteria to understand if you can apply.

-

How can I apply for the papropertytaxrebate through airSlate SignNow?

To apply for the papropertytaxrebate using airSlate SignNow, simply access our platform to fill out the necessary forms electronically and securely. Our user-friendly interface allows for seamless document submission without the hassles of printing or mailing. Once your application is completed, you can eSign it and submit it directly through our system.

-

What features does airSlate SignNow offer for managing papropertytaxrebate applications?

airSlate SignNow provides robust features for managing your papropertytaxrebate applications, including electronic signatures, document templates, and automated workflows. These tools simplify the application process and ensure that you can track and manage your paperwork efficiently. Additionally, our platform enhances collaboration by allowing users to share documents easily.

-

Are there any costs associated with using airSlate SignNow for the papropertytaxrebate?

While airSlate SignNow offers a cost-effective solution, there may be fees depending on the plan you choose. We provide various pricing tiers to cater to different needs, ensuring that accessing essential services, including the papropertytaxrebate application process, remains affordable. You can explore our pricing page for detailed information.

-

What are the benefits of using airSlate SignNow for my papropertytaxrebate application?

Using airSlate SignNow for your papropertytaxrebate application offers numerous benefits, including convenience, speed, and security. By utilizing our platform, you can complete your application from anywhere, at any time, ensuring you meet important deadlines. Additionally, our secure eSigning feature protects your personal information throughout the process.

-

Can I integrate airSlate SignNow with other tools for my papropertytaxrebate needs?

Yes, airSlate SignNow supports various integrations with popular tools and applications to enhance your papropertytaxrebate management. You can easily connect with services such as CRM systems or payment processors, allowing for streamlined workflows and management of your applications. Check our integrations page for a full list of compatible tools.

Get more for Property Tax Or Rent Rebate Claim PA 1000 FormsPublications

- Calorimetry lab gizmo answers form

- Disability tax form

- Nyc doe forms

- Special support program application form

- International financial questionnaire form

- Xcel energy solarrewards final electrical inspection form

- Architectural control committee submission form lascolinas org

- Prince william county public schools bemergencyb permission bformb

Find out other Property Tax Or Rent Rebate Claim PA 1000 FormsPublications

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online