Form 100 Es 2020

What is the Form 100 Es

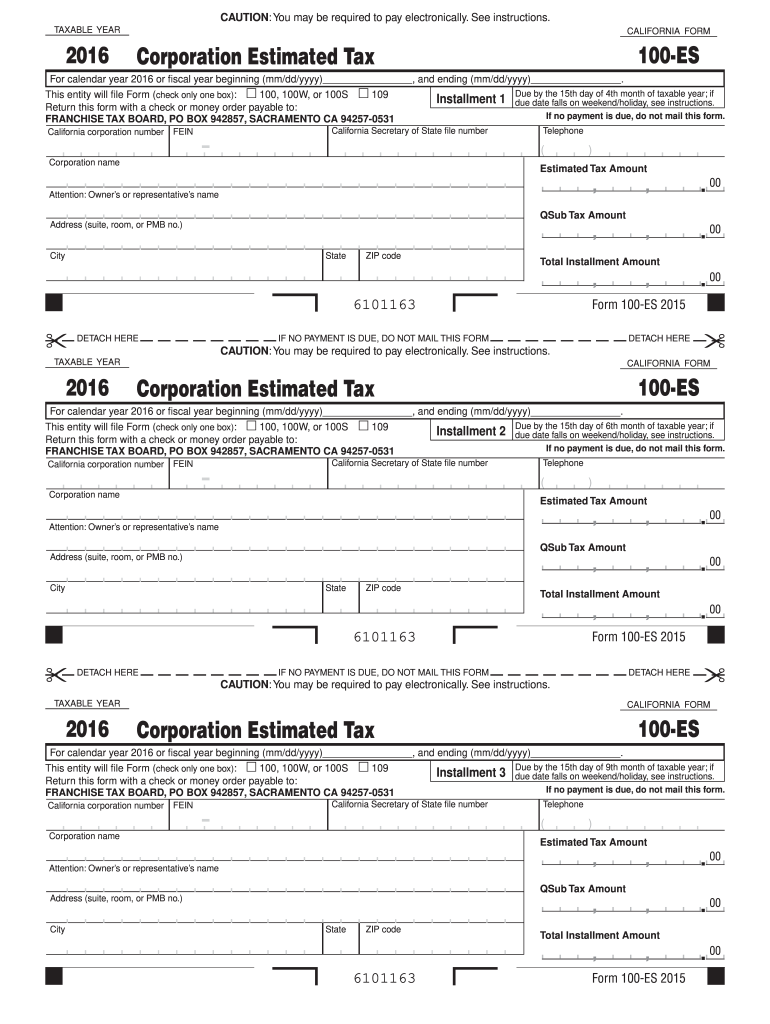

The Form 100 Es is a tax form utilized by corporations in the United States to report their income, deductions, and credits. This form is specifically designed for California corporations and is part of the state’s franchise tax requirements. It is essential for businesses to accurately complete this form to ensure compliance with state tax laws and to avoid potential penalties.

How to use the Form 100 Es

Using the Form 100 Es involves several steps to ensure that all required information is accurately reported. Businesses need to gather financial records, including income statements and expense reports. The form requires details about the corporation's income, deductions, and tax credits. Once the information is compiled, it can be entered into the form, either electronically or in paper format, depending on the preference of the business.

Steps to complete the Form 100 Es

Completing the Form 100 Es can be broken down into a series of clear steps:

- Gather all necessary financial documents, including income statements and receipts for deductions.

- Fill out the corporation's identifying information at the top of the form.

- Report total income from all sources on the designated lines.

- List allowable deductions and credits that the corporation is eligible for.

- Calculate the total tax owed based on the reported income and deductions.

- Review the completed form for accuracy before submission.

Legal use of the Form 100 Es

The Form 100 Es is legally binding when completed correctly and submitted on time. It is important for corporations to adhere to the guidelines set forth by the California Franchise Tax Board to ensure that their filings are accepted. Failure to comply with the legal requirements can lead to penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines associated with the Form 100 Es. Generally, the form is due on the 15th day of the fourth month after the end of the corporation's fiscal year. For most corporations operating on a calendar year, this means the form is typically due by April 15. It is crucial to submit the form on time to avoid late fees and penalties.

Required Documents

To complete the Form 100 Es, corporations need to have several documents ready:

- Income statements detailing revenue for the tax year.

- Expense reports for all deductible business expenses.

- Documentation for any tax credits claimed.

- Prior year tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The Form 100 Es can be submitted through various methods, providing flexibility for corporations. Options include:

- Online submission through the California Franchise Tax Board's e-file system.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated Franchise Tax Board locations.

Quick guide on how to complete 2016 form 100 es

Complete Form 100 Es effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Form 100 Es on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 100 Es with ease

- Locate Form 100 Es and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your updates.

- Choose how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device. Edit and eSign Form 100 Es and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 100 es

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 100 es

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is Form 100 Es and how can airSlate SignNow help with it?

Form 100 Es is a crucial document for businesses seeking to streamline their operations. airSlate SignNow provides an effective platform to electronically sign, send, and manage Form 100 Es, making the process efficient and compliant.

-

How much does airSlate SignNow cost for handling Form 100 Es?

The pricing for airSlate SignNow varies based on the subscription plan you choose. Each plan offers a range of features perfect for managing Form 100 Es, ensuring that your business gets the best value for its needs.

-

What features does airSlate SignNow offer for Form 100 Es?

airSlate SignNow includes features like customizable templates, automated workflows, and robust security measures for efficiently processing Form 100 Es. These tools help in reducing turnaround time and enhancing productivity for your business.

-

Can I integrate airSlate SignNow with other applications when working on Form 100 Es?

Yes, airSlate SignNow seamlessly integrates with various apps to enhance its functionality. These integrations allow you to manage Form 100 Es alongside your existing software, improving overall workflow and convenience.

-

What are the benefits of using airSlate SignNow for Form 100 Es?

Using airSlate SignNow for Form 100 Es provides several benefits, including faster processing times and reduced paper use. Additionally, it enhances team collaboration and ensures that all necessary signatures are obtained in a timely manner.

-

Is airSlate SignNow secure for handling sensitive information in Form 100 Es?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with global data protection regulations. This ensures that your Form 100 Es and other sensitive documents remain safe and secure throughout the signing process.

-

How can businesses ensure compliance when using airSlate SignNow for Form 100 Es?

airSlate SignNow is designed to help businesses comply with legal standards when dealing with Form 100 Es. By utilizing features like audit trails and legally binding signatures, you can ensure compliance with ease.

Get more for Form 100 Es

Find out other Form 100 Es

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document