Form 568 2019

What is the Form 568

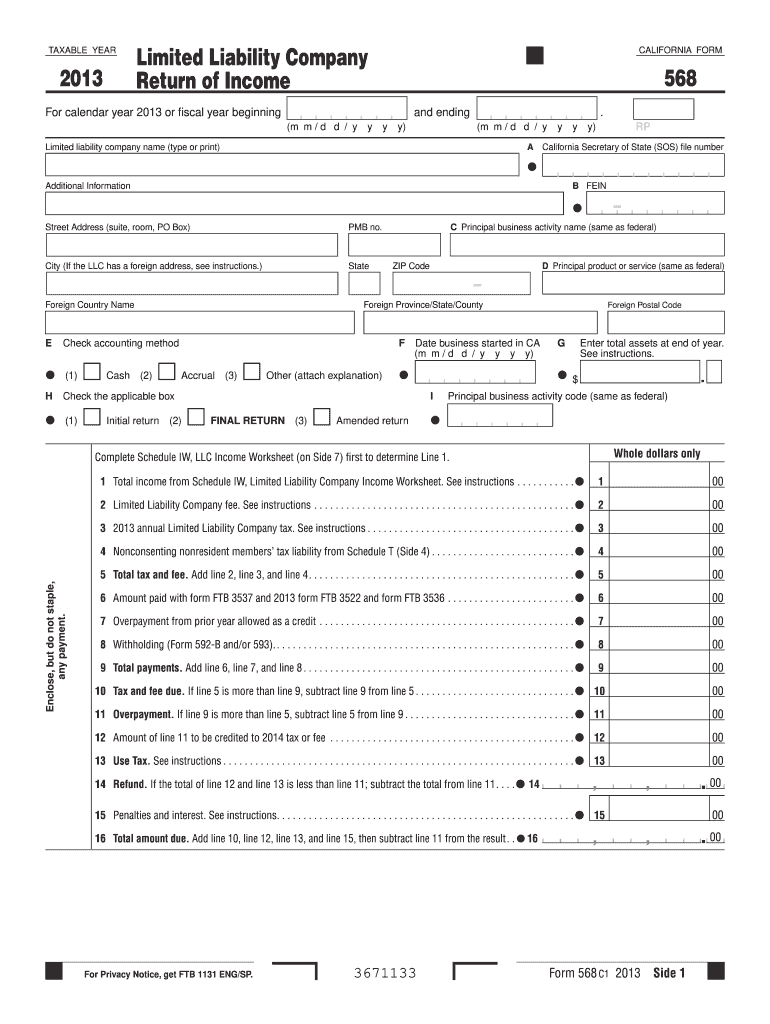

The Form 568, officially known as the Limited Liability Company Return of Income, is a tax form used by limited liability companies (LLCs) in California. This form is essential for reporting the income, deductions, and credits of an LLC, ensuring compliance with state tax regulations. It is primarily utilized by multi-member LLCs and single-member LLCs that elect to be treated as corporations for tax purposes. The information provided on Form 568 helps the California Franchise Tax Board (FTB) assess the tax obligations of the LLC and its members.

How to use the Form 568

Using the Form 568 involves several steps to ensure accurate completion and compliance with tax laws. First, gather all necessary financial documents, including income statements, expense records, and any relevant supporting documentation. Next, fill out the form by entering the required information about the LLC, including its name, address, and federal employer identification number (EIN). Be sure to report all income and deductions accurately. Once completed, the form can be filed electronically or via mail, depending on the preference of the LLC and its members.

Steps to complete the Form 568

Completing the Form 568 requires careful attention to detail. Follow these steps for successful completion:

- Step 1: Download the latest version of Form 568 from the California Franchise Tax Board's website.

- Step 2: Fill in the LLC's identifying information, including the name and address.

- Step 3: Report total income and allowable deductions in the appropriate sections.

- Step 4: Calculate the total tax due based on the reported income.

- Step 5: Review the form for accuracy and completeness.

- Step 6: Submit the form electronically or mail it to the appropriate address provided by the FTB.

Legal use of the Form 568

The legal use of Form 568 is crucial for compliance with California tax laws. Filing this form accurately ensures that the LLC meets its tax obligations and avoids potential penalties. It is important to understand that the information reported must be truthful and complete, as any discrepancies can lead to audits or legal issues. Additionally, maintaining proper records and documentation to support the entries on Form 568 is essential for legal protection and compliance.

Filing Deadlines / Important Dates

Filing deadlines for Form 568 are critical for LLCs to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month after the close of the LLC's tax year. For most LLCs operating on a calendar year, this means the filing deadline is April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is advisable for LLCs to mark these dates on their calendars to ensure timely submission.

Required Documents

To complete Form 568, certain documents are necessary to support the information reported. These documents typically include:

- Income statements detailing revenue generated by the LLC.

- Expense records to substantiate deductions claimed.

- Previous year's tax returns for reference.

- Any applicable schedules or forms related to specific deductions or credits.

Having these documents organized and readily available will facilitate the accurate completion of Form 568.

Quick guide on how to complete 2013 form 568

Complete Form 568 seamlessly on any device

Managing documents online has gained more traction among companies and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your paperwork quickly without delays. Handle Form 568 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-oriented task today.

How to edit and eSign Form 568 effortlessly

- Locate Form 568 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the frustration of lost or misplaced files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 568 and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 568

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 568

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is Form 568 and why is it important?

Form 568 is a California tax form used by Limited Liability Companies (LLCs) to report their income and calculate their annual franchise tax. Understanding Form 568 is crucial for business compliance, as it helps avoid potential penalties from the state. Utilizing tools like airSlate SignNow can streamline the submission process for Form 568.

-

How can airSlate SignNow help me with Form 568?

airSlate SignNow offers an intuitive platform that simplifies the signing and sending process for important documents like Form 568. You can easily prepare your Form 568 for eSignature, ensuring a fast and secure submission. This not only saves time but also enhances accuracy and compliance.

-

What are the pricing options for using airSlate SignNow for Form 568?

airSlate SignNow offers various pricing plans to cater to different business needs, including options for those frequently managing Form 568. Our plans are designed to be cost-effective, allowing businesses to choose a subscription that best fits their volume and requirements. Check our pricing page for details on how you can manage your Form 568 efficiently.

-

Can I integrate airSlate SignNow with other tools for managing Form 568?

Yes, airSlate SignNow supports integrations with various tools and software to enhance your workflow for managing Form 568. This includes popular accounting software and document management systems, allowing you to streamline your operations. With these integrations, you can keep your Form 568 organized and easily accessible.

-

What features does airSlate SignNow offer for completing Form 568?

airSlate SignNow provides features such as eSignature, document templates, and automated workflows specifically designed for forms like Form 568. These tools facilitate the quick preparation and signing of documents, reducing the risk of errors. Moreover, it makes tracking your Form 568 submissions straightforward and efficient.

-

Is airSlate SignNow secure for submitting Form 568?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including Form 568. With encryption and secure cloud storage, your information is safeguarded throughout the signing process. This means you can focus on your business without worrying about the security of your sensitive data.

-

How do I get started with airSlate SignNow for Form 568?

Getting started with airSlate SignNow for managing Form 568 is easy. Simply sign up for an account, choose a plan that suits your needs, and start exploring the features. You can quickly create, fill out, and send your Form 568 for signatures, simplifying your tax compliance process.

Get more for Form 568

Find out other Form 568

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple