Form 590 P 2019

What is the Form 590 P

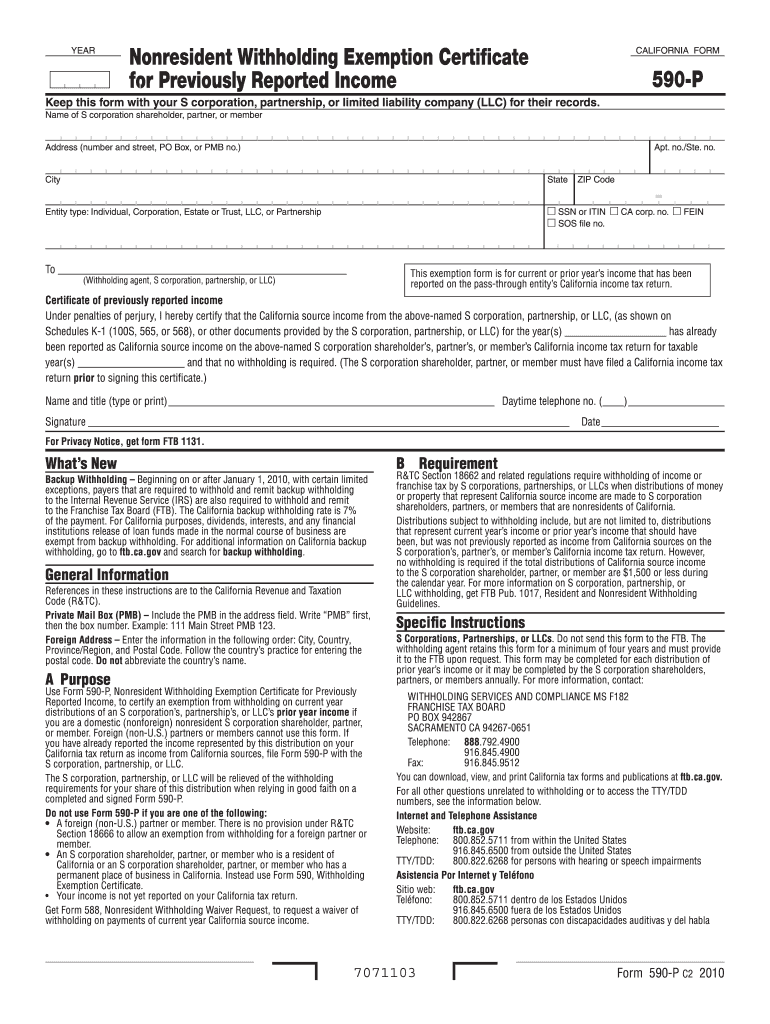

The Form 590 P is a tax form used in the United States, specifically designed for individuals and businesses to report certain types of income and tax information. This form is crucial for ensuring compliance with state tax regulations, particularly in California. It serves as a declaration of the amount of California source income that is subject to withholding. Understanding the purpose and requirements of Form 590 P is essential for accurate tax reporting and avoiding potential penalties.

How to Obtain the Form 590 P

Obtaining the Form 590 P is straightforward. Individuals can access the form directly from the California Franchise Tax Board (FTB) website. The form is available for download in PDF format, allowing users to print it for completion. Additionally, physical copies may be available at local tax offices or public libraries. It is important to ensure that you are using the most current version of the form to comply with the latest regulations.

Steps to Complete the Form 590 P

Completing the Form 590 P involves several key steps:

- Gather necessary information, including your personal details and income sources.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate your submission.

By following these steps, you can ensure that your Form 590 P is completed correctly, minimizing the risk of issues with your tax filings.

Legal Use of the Form 590 P

The legal use of Form 590 P is governed by California tax law. This form is used to report income that is subject to withholding and must be submitted to the FTB. Failing to use this form correctly can lead to penalties, including fines and interest on unpaid taxes. It is essential to understand the legal implications of the information reported on the form to ensure compliance with state regulations.

Key Elements of the Form 590 P

Several key elements are essential for completing the Form 590 P:

- Personal Information: This includes your name, address, and taxpayer identification number.

- Income Details: Report all sources of California-source income that are subject to withholding.

- Withholding Amount: Indicate the amount of tax that has been withheld from your income.

- Signature: Your signature is required to validate the form and affirm the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 590 P are crucial to avoid penalties. Typically, the form must be submitted by the due date of the income tax return for the year in which the income was earned. It is advisable to check the California FTB website for specific deadlines, as they may vary based on individual circumstances or changes in state tax law. Staying informed about these dates can help ensure timely compliance.

Quick guide on how to complete form 590 p 2011

Effortlessly Prepare Form 590 P on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without delays. Handle Form 590 P on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Modify and eSign Form 590 P with Ease

- Locate Form 590 P and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 590 P and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 590 p 2011

Create this form in 5 minutes!

How to create an eSignature for the form 590 p 2011

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is Form 590 P?

Form 590 P is a declaration that helps businesses confirm whether recipients are subject to California withholding requirements. With airSlate SignNow, you can easily create, send, and eSign Form 590 P efficiently, ensuring compliance with state regulations.

-

How does airSlate SignNow simplify the signing process for Form 590 P?

airSlate SignNow streamlines the signing process for Form 590 P by providing an intuitive interface that guides users through each step. The platform allows you to upload, edit, and eSign the form in just a few clicks, saving you valuable time and effort.

-

What are the pricing options for using airSlate SignNow for Form 590 P?

airSlate SignNow offers flexible pricing plans tailored to suit the needs of businesses of all sizes. You can choose from monthly or annual subscriptions that provide full access to eSigning tools, including those for Form 590 P, ensuring you get the best value.

-

Can airSlate SignNow integrate with other software for managing Form 590 P?

Yes, airSlate SignNow seamlessly integrates with various third-party applications such as CRM systems and cloud storage services. This integration allows you to manage Form 590 P more effectively alongside your existing workflows, enhancing productivity.

-

What security features does airSlate SignNow offer for Form 590 P?

airSlate SignNow prioritizes security with advanced encryption technology and secure cloud storage for all your documents, including Form 590 P. Additionally, it provides customizable access controls and audit trails to protect sensitive information during the signing process.

-

How can I track the status of my Form 590 P documents with airSlate SignNow?

Tracking the status of your Form 590 P documents is simple with airSlate SignNow's robust dashboard. You can see who has viewed, signed, or is still pending to sign, which helps you manage deadlines and keep your workflow on track.

-

Is airSlate SignNow user-friendly for creating and managing Form 590 P?

Absolutely! airSlate SignNow is designed with users in mind, making it easy to create and manage Form 590 P even for those with minimal technical skills. Its drag-and-drop features and guided setup ensure a smooth experience for all users.

Get more for Form 590 P

Find out other Form 590 P

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now