Ct 3 S Form 2020

What is the Ct 3 S Form

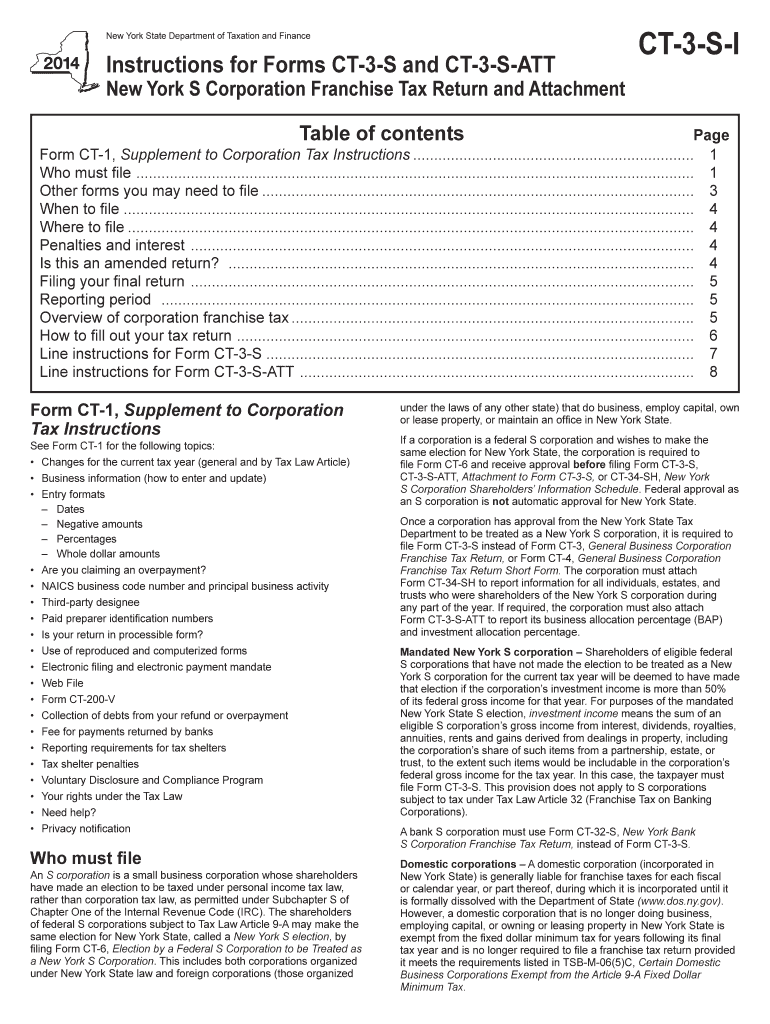

The Ct 3 S Form is a tax form used by corporations in the state of New York to report their income, deductions, and tax liability. This form is specifically designed for small businesses and is part of the New York State Corporation Tax system. It is essential for corporations to accurately complete this form to ensure compliance with state tax regulations and to determine the appropriate amount of tax owed. Understanding the purpose and requirements of the Ct 3 S Form is crucial for any business entity operating in New York.

How to use the Ct 3 S Form

Using the Ct 3 S Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, fill out the form by entering the required information in each section, including gross income, allowable deductions, and credits. It is important to follow the instructions carefully to avoid errors that could lead to penalties. After completing the form, review it thoroughly for accuracy before submission.

Steps to complete the Ct 3 S Form

Completing the Ct 3 S Form involves a systematic approach:

- Gather Financial Records: Collect all necessary documents, including income statements and expense reports.

- Fill Out Basic Information: Enter the corporation's name, address, and identification number at the top of the form.

- Report Income: Accurately report total income earned by the corporation during the tax year.

- Detail Deductions: List all allowable deductions to reduce taxable income.

- Calculate Tax Liability: Use the provided tax rates to calculate the total tax owed.

- Review and Sign: Ensure all information is correct, then sign and date the form.

Legal use of the Ct 3 S Form

The Ct 3 S Form is legally recognized as a valid document for corporate tax reporting in New York. To ensure its legal use, it must be completed accurately and submitted by the specified deadlines. Compliance with state tax laws is critical, as failure to file or inaccuracies can result in penalties or legal repercussions. The form must also be signed by an authorized representative of the corporation to affirm its validity.

Filing Deadlines / Important Dates

Timely filing of the Ct 3 S Form is essential for compliance with New York State tax regulations. The typical deadline for filing is the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year basis, this means the form is due by April fifteenth. It is important to be aware of any extensions that may apply and to file accordingly to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Ct 3 S Form can be submitted through various methods to accommodate different preferences. Corporations can file the form online through the New York State Department of Taxation and Finance website, which offers a streamlined process for electronic submission. Alternatively, the form can be mailed to the appropriate tax office, ensuring that it is postmarked by the filing deadline. In-person submissions may also be possible at designated tax offices, providing another option for businesses.

Quick guide on how to complete ct 3 s 2014 form 6962359

Complete Ct 3 S Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Ct 3 S Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign Ct 3 S Form without hassle

- Locate Ct 3 S Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ct 3 S Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 s 2014 form 6962359

Create this form in 5 minutes!

How to create an eSignature for the ct 3 s 2014 form 6962359

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a Ct 3 S Form?

The Ct 3 S Form is a tax return used by small businesses in Connecticut to report business income and expenses. This form is essential for compliance with state tax regulations and ensures that your business is accurately filing its taxes. Utilizing the Ct 3 S Form with airSlate SignNow simplifies the process by enabling electronic signatures and secure document handling.

-

How can airSlate SignNow help me with the Ct 3 S Form?

airSlate SignNow streamlines the completion and submission of the Ct 3 S Form by allowing users to fill out, sign, and send documents electronically. This process reduces the need for paper and in-person meetings, which saves time and enhances efficiency. With customizable templates and easy integrations, managing your Ct 3 S Form becomes hassle-free.

-

Is there a cost to use airSlate SignNow for the Ct 3 S Form?

Yes, there is a subscription fee associated with using airSlate SignNow, which varies based on the plan you choose. However, the cost is competitive, and many users find that the efficiency gained in managing forms like the Ct 3 S Form justifies the investment. Additionally, airSlate SignNow offers a free trial, allowing you to evaluate the service without upfront costs.

-

Can I save templates for the Ct 3 S Form in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and save templates for the Ct 3 S Form, making it easy to reuse them for future filings. This feature simplifies the filing process and ensures consistent formatting, reducing the chances of errors. Additionally, it speeds up the preparation time for each subsequent form.

-

What are the benefits of using airSlate SignNow for filing the Ct 3 S Form?

Using airSlate SignNow for filing the Ct 3 S Form provides numerous benefits, including increased efficiency, secure document storage, and legally binding electronic signatures. These features help streamline your tax filing process, allowing you to focus more on growing your business rather than paperwork. The intuitive interface ensures that even those unfamiliar with digital forms can navigate with ease.

-

Does airSlate SignNow integrate with other accounting software for the Ct 3 S Form?

Yes, airSlate SignNow is compatible with various accounting software solutions, which facilitates seamless integration when preparing the Ct 3 S Form. This compatibility allows users to import data directly into the form, saving time and reducing the risk of manual entry errors. It ensures that your financial records are consistently accurate across platforms.

-

Is airSlate SignNow secure for filing the Ct 3 S Form?

Security is a top priority for airSlate SignNow, which implements robust encryption and compliance measures to protect your data. When filing the Ct 3 S Form, you can trust that your sensitive information is safeguarded against unauthorized access. Regular security updates and a secure environment help ensure that your documents remain confidential.

Get more for Ct 3 S Form

- Unisa registration form for

- Sleep chart 24 hour sleep record surrey place centre surreyplace on form

- Psf form

- Maid application form

- Loss run report template form

- Zoning board of adjustment application city of lubbock form

- Homeowner projects city of round rock form

- Yearly income and expenses for rental property form

Find out other Ct 3 S Form

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement