Form 540 2018

What is the Form 540

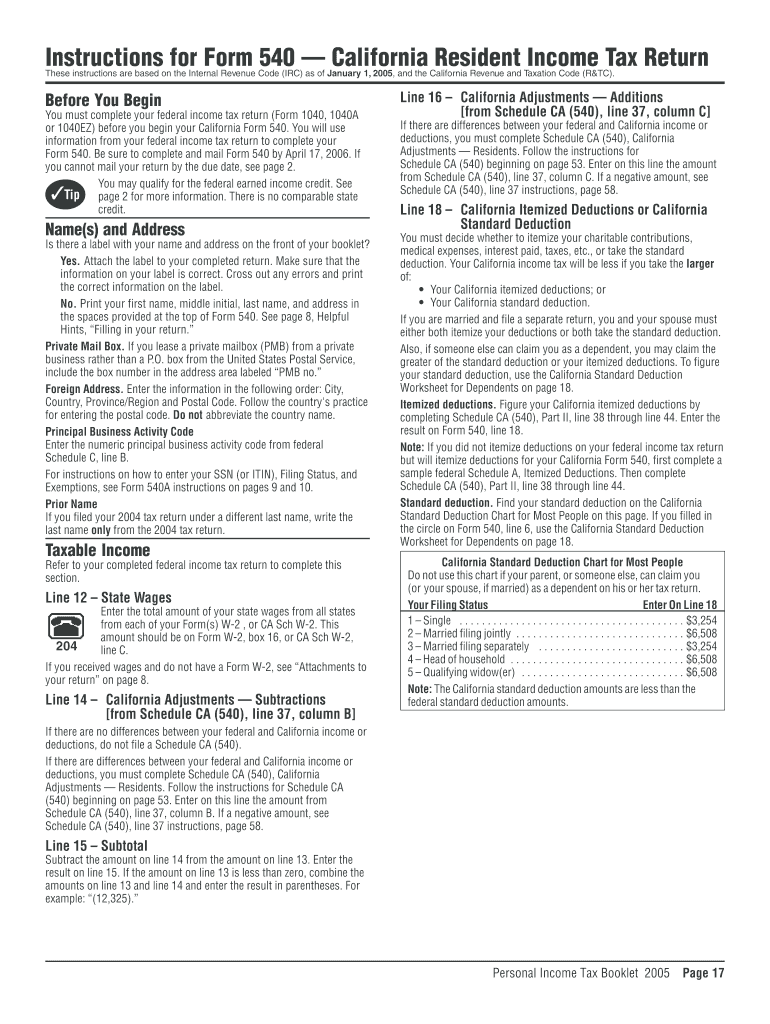

The 2005 Form 540 is the California state income tax return used by residents to report their income, claim deductions, and calculate their tax liability. This form is essential for individuals and families who earned income in California during the tax year. It provides a comprehensive overview of income sources, deductions, and credits available to taxpayers, ensuring compliance with state tax laws.

How to use the Form 540

Using the 2005 Form 540 involves several steps to accurately report your income and calculate your taxes. Taxpayers must gather all necessary financial documents, including W-2s, 1099s, and receipts for deductible expenses. After completing the form, individuals can submit it electronically or by mail. It is crucial to ensure that all information is accurate to avoid delays or penalties.

Steps to complete the Form 540

Completing the 2005 Form 540 requires careful attention to detail. Here are the essential steps:

- Gather documents: Collect all income statements, deduction records, and tax-related documents.

- Fill out personal information: Enter your name, address, and Social Security number.

- Report income: List all sources of income, including wages, interest, and dividends.

- Claim deductions: Identify and apply any eligible deductions to reduce taxable income.

- Calculate tax liability: Use the tax tables to determine your tax owed based on your taxable income.

- Review and sign: Double-check all entries for accuracy and sign the form.

Legal use of the Form 540

The 2005 Form 540 is legally binding when completed and submitted according to California state tax laws. To ensure its legal validity, taxpayers must provide accurate information and comply with all filing requirements. Electronic signatures are accepted, provided they meet the necessary legal standards, ensuring that the form is recognized by the state as a legitimate submission.

Filing Deadlines / Important Dates

Timely filing of the 2005 Form 540 is crucial to avoid penalties. The standard deadline for submitting this tax return typically falls on April 15 of the following year. If taxpayers require additional time, they may file for an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the 2005 Form 540 accurately, taxpayers need various documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Records of tax credits claimed

- Previous year's tax return for reference

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the 2005 Form 540. The form can be filed electronically through approved e-filing software, which may offer a faster processing time. Alternatively, individuals can mail their completed forms to the appropriate state tax office. In-person submissions may also be available at designated tax assistance centers, providing additional support for those who need help with their filings.

Quick guide on how to complete 2005 form 540

Easily prepare Form 540 on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form 540 on any platform using airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The easiest way to modify and eSign Form 540 effortlessly

- Locate Form 540 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark signNow sections of your documents or redact confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 540 to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2005 form 540

Create this form in 5 minutes!

How to create an eSignature for the 2005 form 540

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the 2005 form 540, and why is it important?

The 2005 form 540 is a California resident income tax return form used for reporting income, deductions, and credits. It is essential for ensuring accurate tax compliance and determining potential refunds or liabilities. Filing this form correctly can help taxpayers receive any eligible tax benefits.

-

How does airSlate SignNow help with the 2005 form 540?

airSlate SignNow simplifies the process of filling out and signing the 2005 form 540 by providing a user-friendly platform. Users can easily upload, edit, and eSign their tax documents securely, ensuring they meet all submission requirements without hassle. This makes tax season more efficient for individuals and businesses.

-

What features does airSlate SignNow offer for the 2005 form 540?

With airSlate SignNow, you have access to features like document templates, easy collaboration, and secure eSignature options, specifically designed for forms like the 2005 form 540. These functionalities streamline the tax filing process, allow for real-time updates, and enhance document security. This means you can focus less on paperwork and more on your financial planning.

-

Is airSlate SignNow cost-effective for filing the 2005 form 540?

Yes, airSlate SignNow offers competitive pricing plans that cater to various budgets, making it a cost-effective solution for filing the 2005 form 540. Users can choose from different subscription options that best fit their needs, ensuring they get the features they require without overspending. This helps both individuals and businesses manage their tax documents efficiently.

-

Can airSlate SignNow integrate with other tax software for the 2005 form 540?

airSlate SignNow can seamlessly integrate with popular tax software, allowing you to work on the 2005 form 540 within your existing workflow. This integration means you can transfer data easily and manage your tax documents all in one place. It enhances overall productivity and ensures that you can access your files wherever you are.

-

What are the benefits of using airSlate SignNow for the 2005 form 540?

Using airSlate SignNow for the 2005 form 540 provides numerous benefits, including increased efficiency, enhanced security, and improved compliance with tax regulations. Users can track document statuses, ensure timely submissions, and maintain organized records. Additionally, the platform's simplicity means that anyone can use it without extensive technical knowledge.

-

How secure is my information when using airSlate SignNow for the 2005 form 540?

airSlate SignNow employs industry-standard security measures to protect your information while you complete the 2005 form 540. Data encryption, secure access, and compliance with regulations ensure that your sensitive information remains safe. Users can confidently handle their tax documents knowing that security is a top priority.

Get more for Form 540

Find out other Form 540

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document