Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass 2019

What is the Form 1 Massachusetts Resident Income Tax Return?

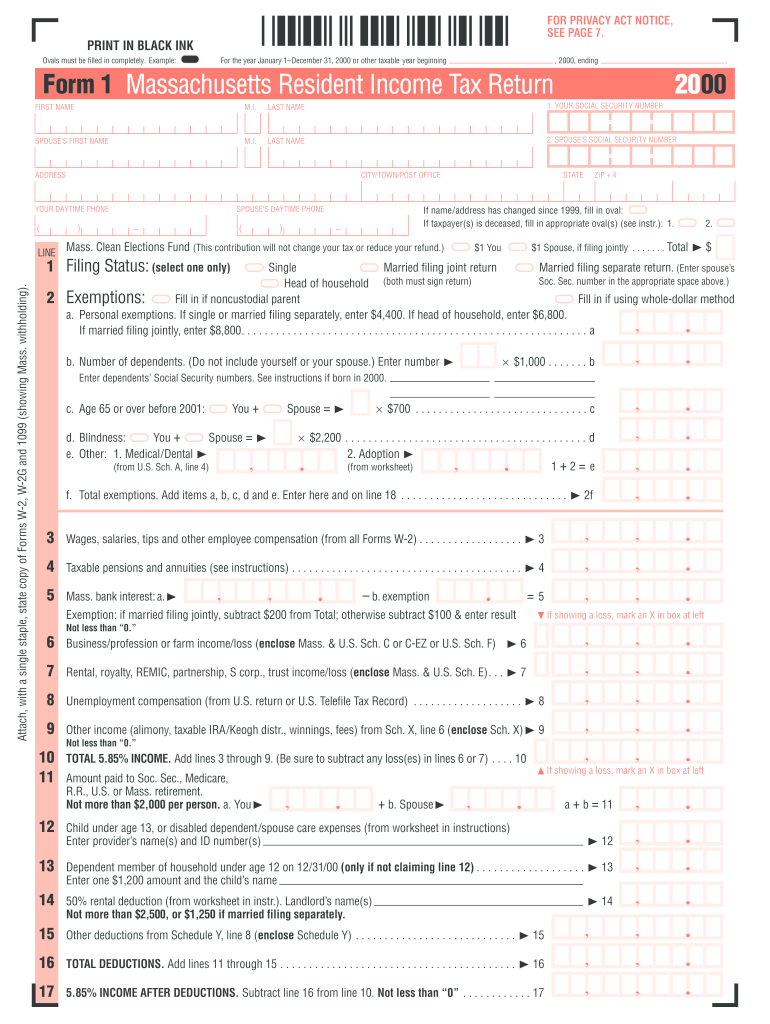

The Form 1 Massachusetts Resident Income Tax Return is an essential document used by residents of Massachusetts to report their income and calculate their state tax liability. This form is specifically designed for individuals who are considered full-year residents of the state. It allows taxpayers to detail their income sources, claim deductions, and determine the amount of tax owed or refund due. The form is part of the Massachusetts Department of Revenue’s efforts to ensure accurate tax reporting and compliance with state tax laws.

Steps to complete the Form 1 Massachusetts Resident Income Tax Return

Completing the Form 1 Massachusetts Resident Income Tax Return involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and records of any other income.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Detail your total income from all sources, including wages, interest, and dividends.

- Claim deductions: Identify and claim any applicable deductions, such as those for student loan interest or retirement contributions.

- Calculate tax liability: Use the provided tax tables to determine your tax owed based on your taxable income.

- Sign and date the form: Ensure you sign and date the form to validate your submission.

Legal use of the Form 1 Massachusetts Resident Income Tax Return

The Form 1 Massachusetts Resident Income Tax Return is legally binding when completed accurately and submitted according to state regulations. It must be signed by the taxpayer, and any false information can lead to penalties or legal repercussions. To ensure compliance, it is essential to adhere to the guidelines set forth by the Massachusetts Department of Revenue. This includes submitting the form by the designated filing deadline and paying any taxes owed to avoid interest and penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1 Massachusetts Resident Income Tax Return are crucial for taxpayers to avoid penalties. Typically, the form must be filed by April fifteenth for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file but not to pay any taxes owed.

Required Documents

To complete the Form 1 Massachusetts Resident Income Tax Return, taxpayers must gather several important documents:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Proof of any estimated tax payments made during the year

Having these documents ready will help ensure a smooth and accurate filing process.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Massachusetts have several options for submitting their Form 1 Resident Income Tax Return. The form can be filed electronically through the Massachusetts Department of Revenue’s online portal, which is often the fastest method. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate address provided by the state. In-person submissions are also accepted at designated state offices, but this method may require an appointment and is less common.

Quick guide on how to complete form 1 massachusetts resident income tax return 2000 massgov mass

Complete Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass without hassle

- Find Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Craft your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow accommodates your needs in document management in just a few clicks from any device of your preference. Modify and eSign Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1 massachusetts resident income tax return 2000 massgov mass

Create this form in 5 minutes!

How to create an eSignature for the form 1 massachusetts resident income tax return 2000 massgov mass

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass?

The Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass is the tax form that residents of Massachusetts must complete to report their annual income and calculate their state tax liability. It is essential for ensuring compliance with state tax laws and maximizing eligible deductions. Understanding this form is crucial for anyone residing in Massachusetts.

-

How can airSlate SignNow help with filing the Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass?

airSlate SignNow simplifies the process of handling the Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass by providing a user-friendly platform for eSigning and sending documents securely. Users can easily prepare and manage their tax forms digitally, saving time and reducing the risk of errors. This makes it an excellent choice for efficient tax filing.

-

What are the pricing plans for using airSlate SignNow for tax document management?

airSlate SignNow offers various pricing plans tailored to suit diverse user needs, making it a cost-effective solution for managing the Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass. Whether you are an individual or a business, you can access affordable plans. Each plan comes with features that enhance your document management and eSigning experience.

-

What features does airSlate SignNow offer for eSigning tax documents?

airSlate SignNow includes advanced features for eSigning tax documents like the Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass, including customizable templates, secure storage, and real-time tracking. Users can also collaborate with others and send reminders to ensure timely submissions. These features streamline the tax filing process.

-

Is airSlate SignNow compliant with Massachusetts tax regulations?

Yes, airSlate SignNow is designed to comply with all relevant Massachusetts tax regulations, including those for filing the Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass. This ensures that all electronic signatures and document submissions meet the legal standards required by the state. Users can have peace of mind knowing they're adhering to the law.

-

Can I integrate airSlate SignNow with other software to manage my taxes more effectively?

Absolutely! airSlate SignNow supports integrations with various accounting and tax software, allowing users to manage their Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass within their existing workflows. This seamless integration enhances productivity and makes it easier to maintain organized tax records. You can connect your favorite tools with ease.

-

What are the benefits of using airSlate SignNow for my Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass?

Using airSlate SignNow for your Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass offers several benefits, including faster turnaround times, enhanced security, and reduced paperwork. The electronic signing process speeds up submissions, and the secure storage ensures your confidential information is protected. It’s a convenient and efficient way to handle tax documents.

Get more for Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass

- Guam divorce records form

- Fishing tournament weigh in sheet form

- How to fill sworn affidavit form

- Union bank dd form pdf download 509597881

- Printable bladder diary template form

- Montana polst form pdf

- Firerescue richmond cawp contentuploadsrichmond fire rescue mobile food truck inspection application form

- Product request form uoftmedstorecom

Find out other Form 1 Massachusetts Resident Income Tax Return Mass Gov Mass

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe