Maine Pass through Withholding 1099ME Maine 2019

What is the Maine Pass Through Withholding 1099ME Maine

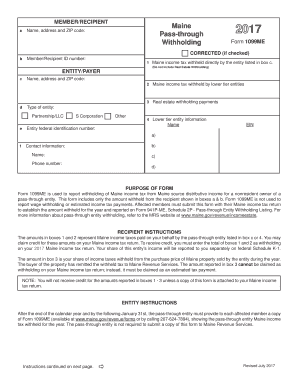

The Maine Pass Through Withholding 1099ME form is a tax document used by businesses and individuals in Maine to report income that has been passed through to partners, shareholders, or beneficiaries. This form is essential for ensuring that the appropriate state taxes are withheld from income distributed by pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs). It helps maintain compliance with state tax laws and ensures that income is reported accurately to the Maine Revenue Services.

Steps to complete the Maine Pass Through Withholding 1099ME Maine

Completing the Maine Pass Through Withholding 1099ME form involves several key steps:

- Gather necessary information: Collect details about the entity, including its name, address, and federal identification number, along with information about the recipients of the income.

- Report income amounts: Enter the total income amounts distributed to each recipient during the tax year. Ensure accuracy to avoid discrepancies.

- Calculate withholding amounts: Determine the appropriate amount of state tax to withhold from each recipient's income based on Maine's tax rates.

- Complete the form: Fill out the 1099ME form with the gathered information, ensuring all sections are completed accurately.

- Submit the form: File the completed form with the Maine Revenue Services by the specified deadline.

Legal use of the Maine Pass Through Withholding 1099ME Maine

The Maine Pass Through Withholding 1099ME form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, the form must be filled out accurately, and all required information must be provided. Additionally, electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This allows for secure and efficient processing of the form in a digital format.

Filing Deadlines / Important Dates

Filing deadlines for the Maine Pass Through Withholding 1099ME form are crucial to avoid penalties. Typically, the form must be submitted to the Maine Revenue Services by January thirty-first of the year following the tax year in which the income was distributed. It is important to stay informed about any changes to these deadlines, as they can vary based on state regulations or specific circumstances.

Who Issues the Form

The Maine Pass Through Withholding 1099ME form is issued by the Maine Revenue Services. This state agency is responsible for the administration and enforcement of tax laws in Maine. They provide guidelines and resources to assist businesses and individuals in understanding their tax obligations, including the proper use of the 1099ME form.

Examples of using the Maine Pass Through Withholding 1099ME Maine

There are various scenarios in which the Maine Pass Through Withholding 1099ME form is utilized:

- Partnership distributions: A partnership distributing profits to its partners must file the 1099ME form to report the income and any withheld taxes.

- S corporation distributions: Shareholders receiving dividends or distributions from an S corporation need the 1099ME form for accurate tax reporting.

- LLC member distributions: Members of a limited liability company receiving income must have this form filed to ensure proper state tax withholding.

Quick guide on how to complete 2017 maine pass through withholding 1099me maine

Complete Maine Pass Through Withholding 1099ME Maine effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without holdups. Manage Maine Pass Through Withholding 1099ME Maine on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Maine Pass Through Withholding 1099ME Maine effortlessly

- Obtain Maine Pass Through Withholding 1099ME Maine and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your alterations.

- Decide how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Maine Pass Through Withholding 1099ME Maine and ensure exceptional communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 maine pass through withholding 1099me maine

Create this form in 5 minutes!

How to create an eSignature for the 2017 maine pass through withholding 1099me maine

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is Maine Pass Through Withholding 1099ME Maine?

Maine Pass Through Withholding 1099ME Maine refers to the taxation process involving income earned by non-resident individuals or entities that pass through a Maine business. This withholding is essential for compliance with state tax regulations and ensuring that proper taxes are collected on income sourced in Maine. For businesses operating in Maine, understanding this withholding is crucial for accurate tax reporting.

-

How does airSlate SignNow streamline the process of handling Maine Pass Through Withholding 1099ME Maine?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign documents related to Maine Pass Through Withholding 1099ME Maine. With its user-friendly interface, users can quickly generate the necessary forms and ensure compliance, reducing the complexity and time associated with traditional paperwork. This feature is particularly beneficial for businesses that need to handle multiple 1099 forms.

-

Are there any fees associated with generating Maine Pass Through Withholding 1099ME Maine through airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, which include the ability to generate Maine Pass Through Withholding 1099ME Maine forms. Each plan offers a set number of documents to be sent and signed, making it easy for businesses to select the option that best fits their budget. Additionally, there are no hidden fees, ensuring transparency in pricing.

-

Can I integrate airSlate SignNow with other accounting software for managing Maine Pass Through Withholding 1099ME Maine?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software solutions, allowing businesses to manage their Maine Pass Through Withholding 1099ME Maine paperwork alongside their financial operations. This integration ensures that all data remains synchronized, making the tax reporting process more accessible and efficient. You can seamlessly connect your platforms with just a few clicks.

-

What are the benefits of using airSlate SignNow for Maine Pass Through Withholding 1099ME Maine documentation?

Using airSlate SignNow for your Maine Pass Through Withholding 1099ME Maine documentation offers numerous benefits, including increased efficiency, reduced errors, and enhanced compliance. The platform automatically checks for common mistakes, streamlining the preparation process. Additionally, with secure eSigning, your documents are legally binding and easy to track.

-

Is there customer support available for issues related to Maine Pass Through Withholding 1099ME Maine?

Yes, airSlate SignNow provides dedicated customer support for all users, including assistance with Maine Pass Through Withholding 1099ME Maine documentation. Support channels include email, chat, and phone, ensuring you can get help whenever you need it. The knowledgeable team is equipped to address your queries related to document management and compliance.

-

How can I ensure compliance with Maine Pass Through Withholding 1099ME Maine using airSlate SignNow?

To ensure compliance with Maine Pass Through Withholding 1099ME Maine, businesses can utilize airSlate SignNow’s automated reminders and alerts that help keep track of deadlines and necessary submissions. The platform also provides templates that are compliant with the latest state tax regulations, minimizing the risk of errors. This proactive approach to document management ensures you are always up-to-date with compliance requirements.

Get more for Maine Pass Through Withholding 1099ME Maine

- North carolina minor child power of attorney form 3525617

- Hsbc authority to remit fund form

- Omega psi phi form 9a 20

- Ppuca form

- Nutritional assessment and risk level form

- Application for issue of a duplicate qualification certificate form

- Adult disability checklist form

- Canada medical report injuries form

Find out other Maine Pass Through Withholding 1099ME Maine

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement