199 Form 2019

What is the 199 Form

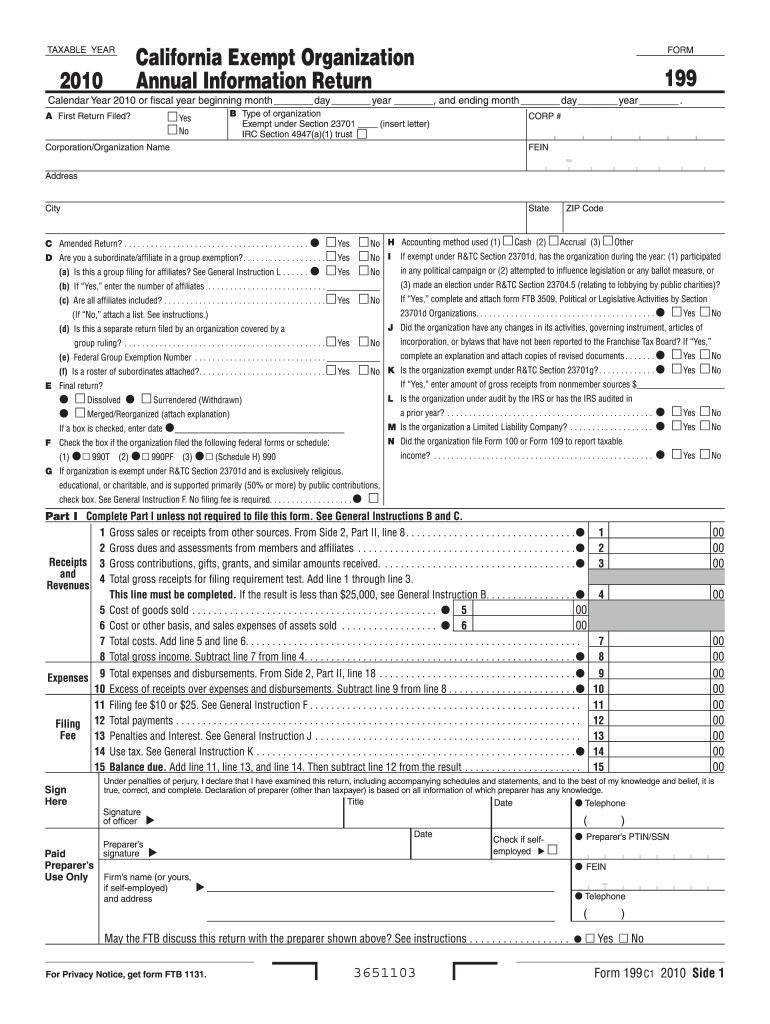

The 199 Form is a tax document used primarily by partnerships and limited liability companies (LLCs) to report income, deductions, and credits. This form is essential for entities that are taxed as partnerships, allowing them to inform the IRS about their financial activities. The information provided on the 199 Form helps the IRS ensure compliance with tax regulations and assists in the accurate assessment of tax liabilities for the involved parties.

How to use the 199 Form

Using the 199 Form involves several steps. First, gather all necessary financial information, including income, expenses, and any applicable deductions. Next, accurately fill out the form, ensuring that all sections are completed with the correct data. It is crucial to review the form for accuracy before submission, as any errors may lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on the preferences of the entity filing.

Steps to complete the 199 Form

Completing the 199 Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including profit and loss statements and balance sheets.

- Fill in the entity's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report total income and expenses in the appropriate sections.

- Calculate any deductions and credits applicable to the entity.

- Review all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the 199 Form

The legal use of the 199 Form is governed by IRS regulations, which require accurate reporting of financial information. Filing this form is mandatory for partnerships and LLCs that meet specific criteria. Failure to file or inaccuracies in the information provided can result in penalties or audits by the IRS. It is essential to ensure compliance with all legal requirements when using the 199 Form to avoid potential legal issues.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 199 Form. These guidelines include instructions on how to report various types of income, allowable deductions, and the proper way to calculate tax liabilities. It is advisable to consult the latest IRS publications or seek professional tax advice to ensure adherence to all regulations and to stay updated on any changes that may affect the filing process.

Form Submission Methods

The 199 Form can be submitted through various methods, including:

- Online submission via the IRS e-file system, which allows for faster processing and confirmation.

- Mailing a paper copy of the form to the appropriate IRS address, as specified in the form instructions.

- In-person submission at designated IRS offices, though this option may be less common.

Quick guide on how to complete 2010 199 form

Complete 199 Form effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage 199 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to modify and eSign 199 Form effortlessly

- Locate 199 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign 199 Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 199 form

Create this form in 5 minutes!

How to create an eSignature for the 2010 199 form

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is a 199 Form, and how is it used?

The 199 Form is a tax document that helps businesses report their income to the IRS. It's particularly relevant for pass-through entities, allowing them to avoid double taxation. Utilizing airSlate SignNow to eSign a 199 Form provides a streamlined process for compliance and accuracy.

-

How can airSlate SignNow help with the 199 Form signing process?

airSlate SignNow simplifies the 199 Form signing process by allowing users to eSign documents securely and efficiently. The platform offers customizable templates and a user-friendly interface, making it easy to prepare and send your 199 Form for signatures without delays.

-

Are there any costs associated with using airSlate SignNow for the 199 Form?

Yes, while airSlate SignNow offers a free trial, there are subscription plans that provide access to additional features for managing the 199 Form. Pricing is competitive, ensuring that businesses can choose a package that suits their eSigning needs without breaking the budget.

-

What features of airSlate SignNow are beneficial for managing 199 Forms?

airSlate SignNow provides several features that benefit 199 Form management, including secure cloud storage, real-time document tracking, and reminders for pending signatures. These tools enhance productivity by ensuring that the 199 Form is completed efficiently and stays organized.

-

Can I integrate airSlate SignNow with other software for handling 199 Forms?

Absolutely! airSlate SignNow seamlessly integrates with various business tools, enhancing your workflow for managing the 199 Form. This includes platforms like Google Drive, Salesforce, and other productivity applications, allowing for easier document management.

-

Is airSlate SignNow compliant with industry regulations for the 199 Form?

Yes, airSlate SignNow complies with major industry regulations, ensuring that your 199 Form is handled securely and legally. The platform uses encryption and authentication methods, so you can trust that your sensitive information remains protected.

-

What are the advantages of using airSlate SignNow for 199 Forms over traditional methods?

Using airSlate SignNow for 199 Forms offers numerous advantages over traditional methods, such as faster turnaround times and lower costs. With eSigning, you eliminate printing, scanning, and mailing hassles, enabling quicker processing of your 199 Form and improved efficiency.

Get more for 199 Form

Find out other 199 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors