199 Form 2019

What is the 199 Form

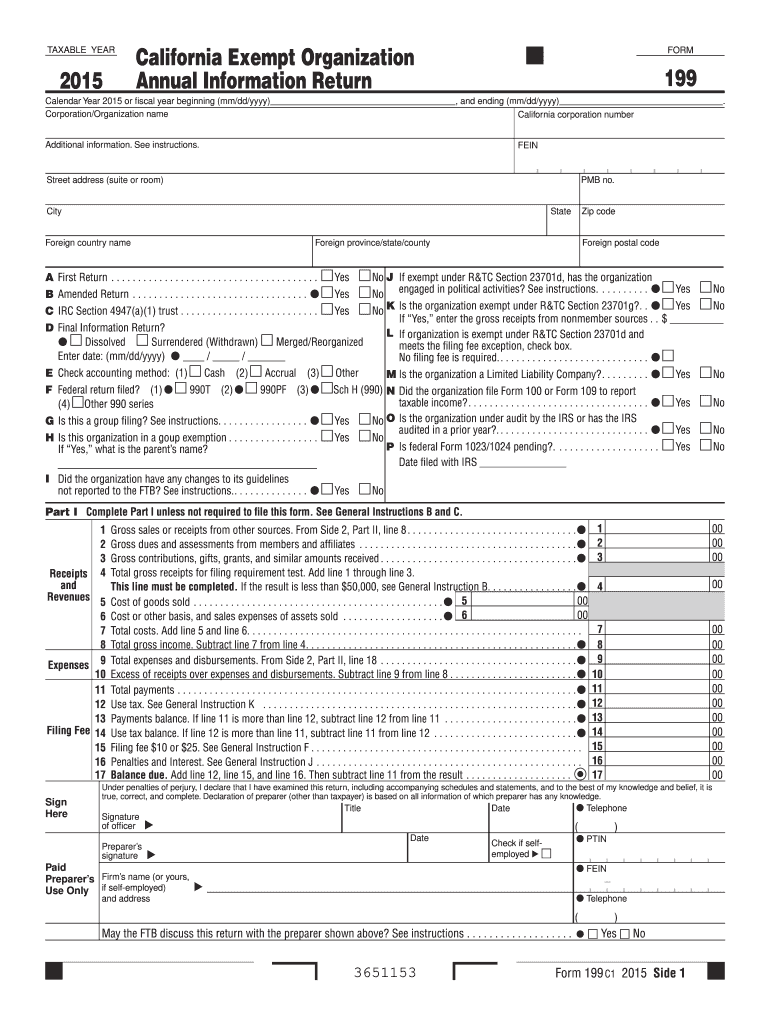

The 199 Form is a tax document used primarily by certain types of businesses to report income and expenses. It is often associated with partnerships, limited liability companies (LLCs), and other pass-through entities. This form helps in the calculation of taxable income and the distribution of income among partners or members. Understanding the purpose and requirements of the 199 Form is essential for compliance and accurate reporting.

How to use the 199 Form

Using the 199 Form involves several steps that ensure accurate reporting of financial information. First, gather all necessary financial records, including income statements and expense reports. Next, complete the form by entering the relevant details, such as total income, deductions, and credits. After filling out the form, review it for accuracy before submitting it to the appropriate tax authority. It is important to keep copies of the completed form for your records.

Steps to complete the 199 Form

Completing the 199 Form requires careful attention to detail. Follow these steps for successful completion:

- Gather all required financial documents, including income and expense statements.

- Fill in the entity's name, address, and tax identification number at the top of the form.

- Report total income on the designated line, ensuring all sources are included.

- List allowable deductions and credits, following IRS guidelines.

- Calculate the taxable income by subtracting deductions from total income.

- Sign and date the form before submission.

Legal use of the 199 Form

The 199 Form must be used in accordance with IRS regulations to ensure its legal validity. This includes accurate reporting of all financial information and adherence to deadlines. Failure to comply with these regulations can result in penalties or audits. It is advisable to consult with a tax professional to ensure that the form is filled out correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the 199 Form can vary depending on the type of entity and the tax year. Generally, the form must be submitted by the due date of the entity's tax return. For partnerships and LLCs, this is typically March fifteenth of the following year. It is essential to stay updated on any changes to filing deadlines to avoid late fees or penalties.

Who Issues the Form

The 199 Form is issued by the Internal Revenue Service (IRS). It is important to ensure that you are using the most current version of the form, as updates may occur. The IRS provides guidelines and instructions for completing the form, which can be accessed through their official website or by contacting their office directly.

Quick guide on how to complete 2015 199 form

Complete 199 Form effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents swiftly and without issues. Handle 199 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

How to alter and eSign 199 Form seamlessly

- Locate 199 Form and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Adjust and eSign 199 Form to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 199 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 199 form

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 199 Form and how is it used?

The 199 Form is a crucial document for various business transactions, specifically for partnerships and LLCs that wish to report income to the IRS. It consolidates all relevant financial data and provides a summary of the entity’s income and deductions. Using airSlate SignNow, you can efficiently eSign and manage your 199 Form to streamline your tax processes.

-

How can I electronically sign a 199 Form using airSlate SignNow?

To electronically sign a 199 Form with airSlate SignNow, simply upload your document to the platform and specify the signers. You can add fields for signatures and other necessary information. Once everything is set up, you can send the 199 Form for eSignature, ensuring a smooth signing experience.

-

Are there any costs associated with using airSlate SignNow for the 199 Form?

airSlate SignNow offers various pricing plans tailored to meet different business needs, including options suitable for handling multiple 199 Forms. The cost is competitive, particularly when you consider the time saved in document management and eSigning. You can choose a plan that best fits your organization’s budget and requirements.

-

What features does airSlate SignNow provide for managing the 199 Form?

airSlate SignNow provides several features specifically designed to facilitate the management of the 199 Form. These include customizable templates, automated reminders for signers, and secure document storage. Additionally, tracking tools allow you to monitor the progress of your 199 Form in real time.

-

Can I integrate airSlate SignNow with other software to manage my 199 Form?

Yes, airSlate SignNow integrates seamlessly with various software applications such as CRM systems and cloud storage services. This integration allows you to access and manage your 199 Form efficiently alongside other important business documents. By connecting these tools, you can create a streamlined workflow.

-

What are the benefits of using airSlate SignNow for the 199 Form?

Using airSlate SignNow for your 199 Form offers signNow benefits, including enhanced security and reduced turnaround times for document signing. The platform ensures that your sensitive information is protected while providing easy access for all parties involved. It also simplifies the process, allowing you to focus on your core business activities.

-

Is airSlate SignNow easy to use for non-technical users handling the 199 Form?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible even for non-technical users. The intuitive interface allows anyone to efficiently prepare, send, and sign the 199 Form without requiring extensive training or technical know-how.

Get more for 199 Form

- Thunder bay housing application form

- Primerica fna form

- Medical records request kentuckyone health form

- Indiana state form 5473

- Affidavit for change of signature tsr darashaw limited fill andaffidavit for change of signaturechange of signature form

- Public service superannuation scheme form

- Nuclear reading intervention form

- Wellspring university dress code form

Find out other 199 Form

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast