California Exempt Organization Annual Information Return 2019

What is the California Exempt Organization Annual Information Return

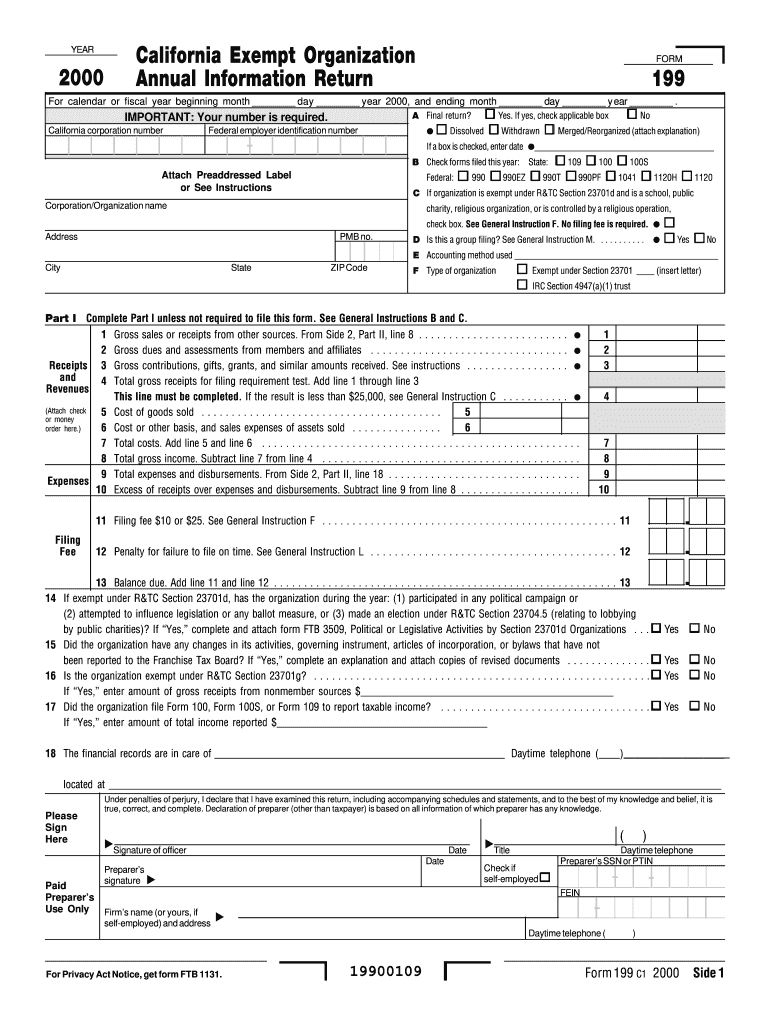

The California Exempt Organization Annual Information Return is a crucial document for non-profit organizations operating in California. This form, often referred to as Form 199, is required for organizations that are exempt from federal income tax under Section 501(c) of the Internal Revenue Code. It provides the state with essential information about the organization’s activities, finances, and governance. Filing this return ensures compliance with state regulations and helps maintain the organization’s tax-exempt status.

Steps to complete the California Exempt Organization Annual Information Return

Completing the California Exempt Organization Annual Information Return involves several key steps. First, gather all necessary financial records, including income statements, balance sheets, and details of expenditures. Next, ensure that your organization meets the eligibility criteria for exemption and has maintained proper governance practices. Then, accurately fill out the form, providing detailed information about your organization’s activities and finances. After completing the form, review it for accuracy and ensure all required signatures are obtained before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the California Exempt Organization Annual Information Return. Generally, the form is due on the 15th day of the fifth month after the end of your organization’s fiscal year. For organizations operating on a calendar year, this typically means the form is due by May 15. Failure to file by the deadline may result in penalties or loss of tax-exempt status, so it is important to mark your calendar and ensure timely submission.

Required Documents

To successfully complete the California Exempt Organization Annual Information Return, several documents are required. These typically include:

- Financial statements, including income and expense reports.

- Records of contributions and grants received.

- Documentation of any governance changes or significant organizational updates.

- Copies of previous returns, if applicable.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state requirements.

Legal use of the California Exempt Organization Annual Information Return

The California Exempt Organization Annual Information Return serves a legal purpose by providing transparency and accountability for non-profit organizations. It is a legal requirement that helps the state monitor compliance with tax-exempt regulations. Properly filing this return can protect the organization from potential legal issues and ensure that it continues to operate within the bounds of the law. Organizations must understand the legal implications of this form and ensure accurate and timely submission to maintain their status.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting the California Exempt Organization Annual Information Return. The form can be filed online through the California Franchise Tax Board’s website, which is often the most efficient method. Alternatively, organizations may choose to mail the completed form to the appropriate address or submit it in person at designated state offices. Each method has its own set of guidelines and requirements, so it is important to choose the one that best fits your organization’s needs.

Quick guide on how to complete california exempt organization annual information return 2011 2000

Handle California Exempt Organization Annual Information Return effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without interruptions. Manage California Exempt Organization Annual Information Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign California Exempt Organization Annual Information Return with ease

- Locate California Exempt Organization Annual Information Return and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal significance as a conventional handwritten signature.

- Verify all the details and click on the Done button to apply your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors requiring the printing of new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign California Exempt Organization Annual Information Return and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california exempt organization annual information return 2011 2000

Create this form in 5 minutes!

How to create an eSignature for the california exempt organization annual information return 2011 2000

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the California Exempt Organization Annual Information Return?

The California Exempt Organization Annual Information Return is a required filing for organizations that are exempt from federal income tax. This return provides the California Franchise Tax Board with necessary information to ensure compliance with state regulations. Understanding this return is essential for maintaining your organization's tax-exempt status.

-

Why is the California Exempt Organization Annual Information Return important?

Filing the California Exempt Organization Annual Information Return is crucial for preserving your organization's tax-exempt status. It helps state authorities ensure transparency and accountability within nonprofit organizations. Not completing this return can result in penalties or loss of exempt status.

-

How much does it cost to file the California Exempt Organization Annual Information Return?

The cost to file the California Exempt Organization Annual Information Return can vary based on the size and type of the organization. It's important to check for any filing fees with the California Franchise Tax Board. Utilizing services like airSlate SignNow may help streamline the process without incurring high costs.

-

What features does airSlate SignNow offer for filing the California Exempt Organization Annual Information Return?

airSlate SignNow provides an easy-to-use platform that allows organizations to prepare, sign, and send documents securely. Features such as document templates, electronic signatures, and cloud storage aid in efficiently managing your California Exempt Organization Annual Information Return. These tools save time and ensure accuracy in submissions.

-

Can airSlate SignNow integrate with other applications for filing the California Exempt Organization Annual Information Return?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your document management process. You can connect with popular tools like Google Drive and Microsoft Office to manage your California Exempt Organization Annual Information Return and other important documents. This integration streamlines the workflow and enhances accessibility.

-

How can airSlate SignNow benefit my organization when filing the California Exempt Organization Annual Information Return?

Using airSlate SignNow can signNowly benefit your organization by simplifying the filing process for the California Exempt Organization Annual Information Return. Its user-friendly interface and efficient document management tools reduce the time spent on paperwork. This allows you to focus more on your organization's mission and less on administrative tasks.

-

What documents do I need to prepare for the California Exempt Organization Annual Information Return?

To complete the California Exempt Organization Annual Information Return, you will need basic information about your organization, including financial statements, bylaws, and proof of tax-exempt status. Collecting these documents ahead of time can facilitate a smoother filing process with airSlate SignNow. Ensuring all documents are prepared correctly helps avoid delays and issues.

Get more for California Exempt Organization Annual Information Return

- How to open selfsponsored file form

- Zs qu1 form

- Id995a form

- Real estate buyer questionnaire form pdf 60055667

- Assessment for intervention of children with fetal canfasd ableschool form

- Dws water service request form

- Refund application 787171305 form

- Amway of australia abn 49 004 807 756 level 12 67 form

Find out other California Exempt Organization Annual Information Return

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement