Form 540nr 2018

What is the Form 540nr

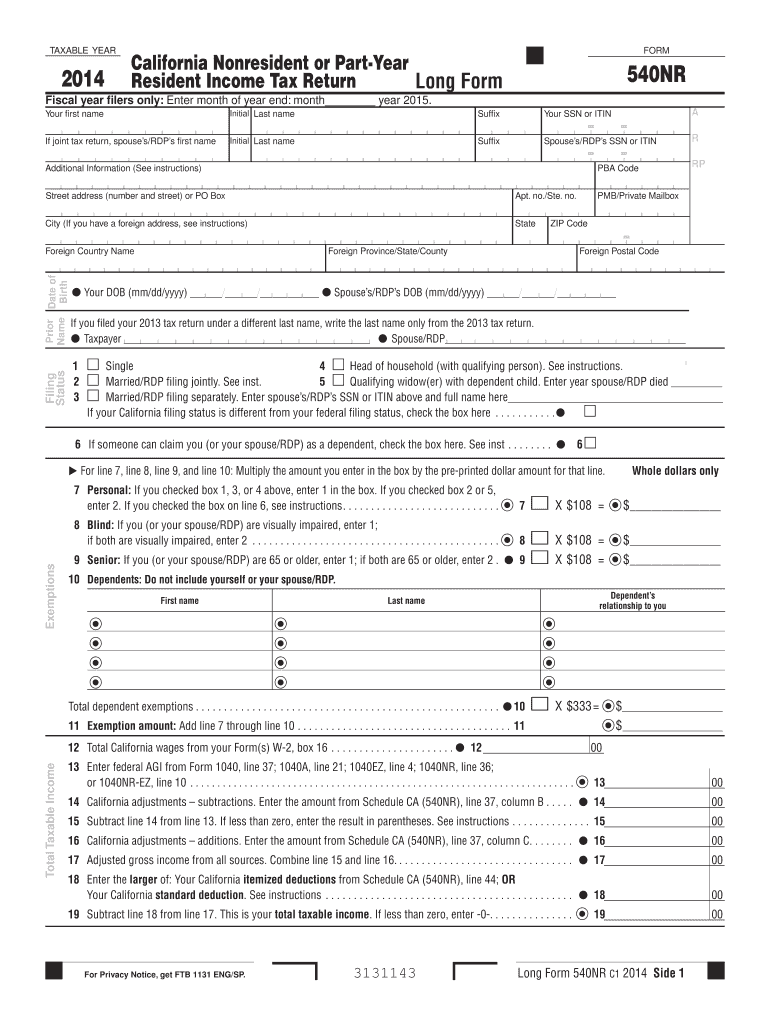

The Form 540nr is a California state tax form specifically designed for non-residents and part-year residents who need to report their income earned within California. This form is essential for individuals who do not meet the residency requirements but have income sourced from California, such as wages, rental income, or business earnings. Understanding the purpose of Form 540nr ensures compliance with state tax laws and helps avoid potential penalties.

How to use the Form 540nr

Using the Form 540nr involves several steps to ensure accurate reporting of income and tax obligations. Begin by gathering all necessary financial documents, including W-2s, 1099s, and records of any other income earned in California. Next, complete the form by entering your personal information, income details, and applicable deductions. Be sure to follow the instructions carefully to avoid errors, as incorrect information can lead to delays or issues with your tax filing.

Steps to complete the Form 540nr

Completing the Form 540nr requires a systematic approach:

- Gather all income documentation, including forms like W-2 and 1099.

- Fill out your personal information at the top of the form.

- Report your total income from California sources on the appropriate lines.

- Claim any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Calculate your total tax liability based on the provided instructions.

- Review the completed form for accuracy before submission.

Legal use of the Form 540nr

The legal use of the Form 540nr is crucial for compliance with California tax laws. This form must be filed by the deadline set by the California Franchise Tax Board to avoid penalties. Additionally, electronic signatures can be used when submitting the form online, provided that all legal requirements for eSignatures are met, ensuring that the submission is valid and enforceable.

Filing Deadlines / Important Dates

Filing deadlines for the Form 540nr are typically aligned with the federal tax deadlines. For most taxpayers, the due date is April 15 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to stay informed about any changes in deadlines, especially for extensions or special circumstances.

Required Documents

To complete the Form 540nr accurately, several documents are necessary:

- W-2 forms from employers for income earned in California.

- 1099 forms for any freelance or contract work completed.

- Records of any other income sources, such as rental properties or investments.

- Documentation for any deductions you plan to claim, such as mortgage interest or state taxes paid.

Form Submission Methods (Online / Mail / In-Person)

The Form 540nr can be submitted through various methods to accommodate different preferences. Taxpayers can file online using approved e-filing software, which often provides a streamlined process. Alternatively, the form can be mailed to the California Franchise Tax Board or submitted in person at designated locations. Each method has specific guidelines and requirements, so it is important to choose the one that best suits your needs.

Quick guide on how to complete 2014 form 540nr

Prepare Form 540nr effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 540nr on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 540nr effortlessly

- Locate Form 540nr and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Modify and eSign Form 540nr and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 540nr

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 540nr

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is Form 540nr and who needs it?

Form 540nr is the California Nonresident or Part-Year Resident Income Tax Return. It is essential for individuals who earn income in California but do not reside there full-time. Proper submission ensures compliance with California tax laws and optimizes potential refunds.

-

How can airSlate SignNow assist with filing Form 540nr?

airSlate SignNow simplifies the process of filing Form 540nr by allowing users to digitally sign and send documents securely. Our platform ensures that the Form 540nr is completed accurately and promptly, which can greatly reduce the stress of tax season.

-

What features does airSlate SignNow offer for Form 540nr?

With airSlate SignNow, you can easily create, edit, and sign Form 540nr online. The platform also provides templates, collaborative options for multiple parties, and secure cloud storage, ensuring that all documentation related to Form 540nr is managed efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 540nr?

Yes, there is a cost for using airSlate SignNow, but it is known for being a cost-effective solution for handling documents like Form 540nr. We offer various pricing plans to accommodate different business needs, ensuring value while providing powerful tools for eSigning and document management.

-

Can I integrate airSlate SignNow with other software for processing Form 540nr?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications and CRMs, enhancing your ability to manage Form 540nr alongside your existing workflows. This integration helps streamline your document processes, ensuring efficiency and organization.

-

What benefits does airSlate SignNow provide for businesses handling Form 540nr?

Using airSlate SignNow for Form 540nr offers numerous benefits, including improved turnaround time and enhanced security for sensitive tax information. Additionally, the user-friendly interface allows your team to focus more on their core tasks rather than document management.

-

How secure is my information when using airSlate SignNow for Form 540nr?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like Form 540nr. We utilize advanced encryption and secure data storage practices to ensure that your information remains confidential and protected throughout the process.

Get more for Form 540nr

- Food mood poop journal sheets form

- Ibas user registration form word format

- Merit badge worksheets form

- Words their way spelling inventory upper form

- Kalpesh chotaliya form

- Food truck project rubric form

- Chapter 5code of ordinancesnorth miami fl form

- Chronic pain management program referral form sjcg net

Find out other Form 540nr

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF