Ca Form 199 2019

What is the Ca Form 199

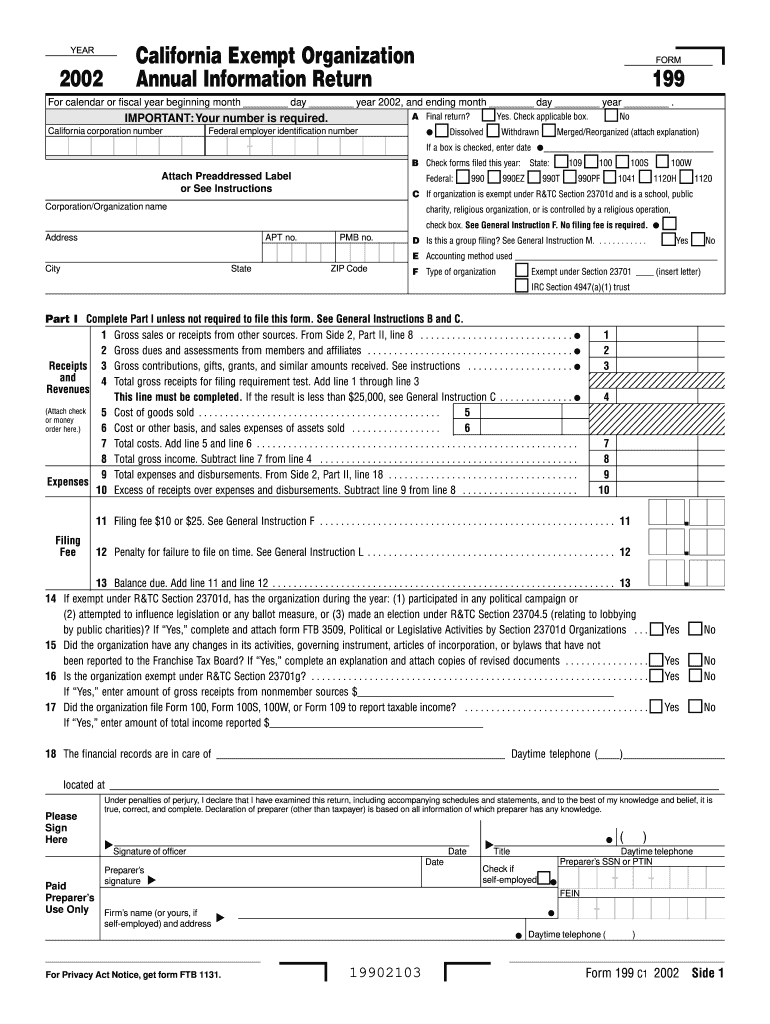

The Ca Form 199 is a California tax form used for reporting specific income and expenses related to business activities. This form is essential for individuals and entities engaged in business operations within the state. It provides a structured way to report income, deductions, and credits, ensuring compliance with California tax laws. Understanding this form is crucial for accurate tax reporting and fulfilling legal obligations.

How to use the Ca Form 199

Using the Ca Form 199 involves several steps to ensure that all necessary information is accurately reported. Begin by gathering all relevant financial documents, such as income statements and expense receipts. Next, fill out the form by entering your business income and applicable deductions. It is important to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and compliance requirements.

Steps to complete the Ca Form 199

Completing the Ca Form 199 can be streamlined by following these steps:

- Gather all necessary financial records, including income and expense documentation.

- Download the latest version of the Ca Form 199 from the California tax authority's website.

- Fill in your business information, including name, address, and tax identification number.

- Report your total income and itemize deductions as applicable.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, ensuring you keep copies for your records.

Legal use of the Ca Form 199

The legal use of the Ca Form 199 is governed by California tax regulations. It is essential to ensure that the information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. The form must be filed in accordance with state deadlines to avoid late fees. Additionally, businesses should maintain records that support the information reported on the form for at least four years, as required by California law.

Filing Deadlines / Important Dates

Filing deadlines for the Ca Form 199 vary depending on the type of business entity. Typically, the form is due on the 15th day of the fourth month following the close of the tax year. For calendar year filers, this means the deadline is April 15. It is essential to be aware of these dates to ensure timely filing and avoid penalties. Additionally, extensions may be available, but they must be requested before the original deadline.

Required Documents

To complete the Ca Form 199, several documents are typically required:

- Income statements, such as profit and loss statements.

- Receipts and documentation for all business expenses.

- Previous year’s tax return for reference.

- Any relevant schedules or forms that pertain to specific deductions or credits.

Form Submission Methods (Online / Mail / In-Person)

The Ca Form 199 can be submitted through various methods, providing flexibility for businesses. Electronic submission is available through the California tax authority's online portal, which is often the quickest option. Alternatively, forms can be mailed to the appropriate tax office, ensuring they are postmarked by the filing deadline. In-person submissions may also be possible at designated tax offices, but it is advisable to check for availability and hours of operation.

Quick guide on how to complete 2002 ca form 199

Effortlessly Prepare Ca Form 199 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Handle Ca Form 199 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Ca Form 199 with Ease

- Locate Ca Form 199 and click on Obtain Form to begin.

- Use the tools we offer to complete your document.

- Mark pertinent sections of your documents or obscure sensitive information using specialized tools provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and press the Finished button to preserve your changes.

- Decide how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ca Form 199 to ensure seamless communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2002 ca form 199

Create this form in 5 minutes!

How to create an eSignature for the 2002 ca form 199

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the CA Form 199 and why is it important?

The CA Form 199 is a critical tax form for corporations operating in California, allowing you to report your business income and expenses. Filing this form accurately is essential to comply with state tax regulations, prevent penalties, and ensure your business remains in good standing.

-

How can airSlate SignNow help with filing the CA Form 199?

airSlate SignNow simplifies the process of filling out and eSigning your CA Form 199. With our intuitive platform, you can easily gather signatures, share documents securely, and streamline your submission process, ensuring timely and accurate filings.

-

What are the pricing options for airSlate SignNow related to CA Form 199?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes, including those needing to file CA Form 199. Explore our tiered options to find the best fit for your organization's needs while benefiting from cost-effective eSignature solutions.

-

What features does airSlate SignNow offer for CA Form 199 processing?

With airSlate SignNow, you have access to advanced features like document templates, automated workflows, and real-time tracking for CA Form 199 submissions. These capabilities enhance efficiency, reduce errors, and ensure a smooth signing experience.

-

Can I integrate airSlate SignNow with my current accounting software for CA Form 199?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, allowing you to easily manage your CA Form 199 alongside your other financial documents. This integration enhances your productivity and ensures a consistent workflow.

-

What benefits can I expect from using airSlate SignNow for CA Form 199?

Using airSlate SignNow for your CA Form 199 provides a range of benefits, including enhanced security, compliance with state regulations, and improved collaboration. You'll save time and reduce the risk of errors, making tax season less stressful.

-

Is airSlate SignNow suitable for small businesses needing to file CA Form 199?

Absolutely! airSlate SignNow is designed with small businesses in mind, offering an easy-to-use platform that is cost-effective and fits their unique needs. You can streamline your CA Form 199 process without overwhelming your budget.

Get more for Ca Form 199

Find out other Ca Form 199

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist