Sales Taxes Form Sample 2019

What is the Sales Taxes Form Sample

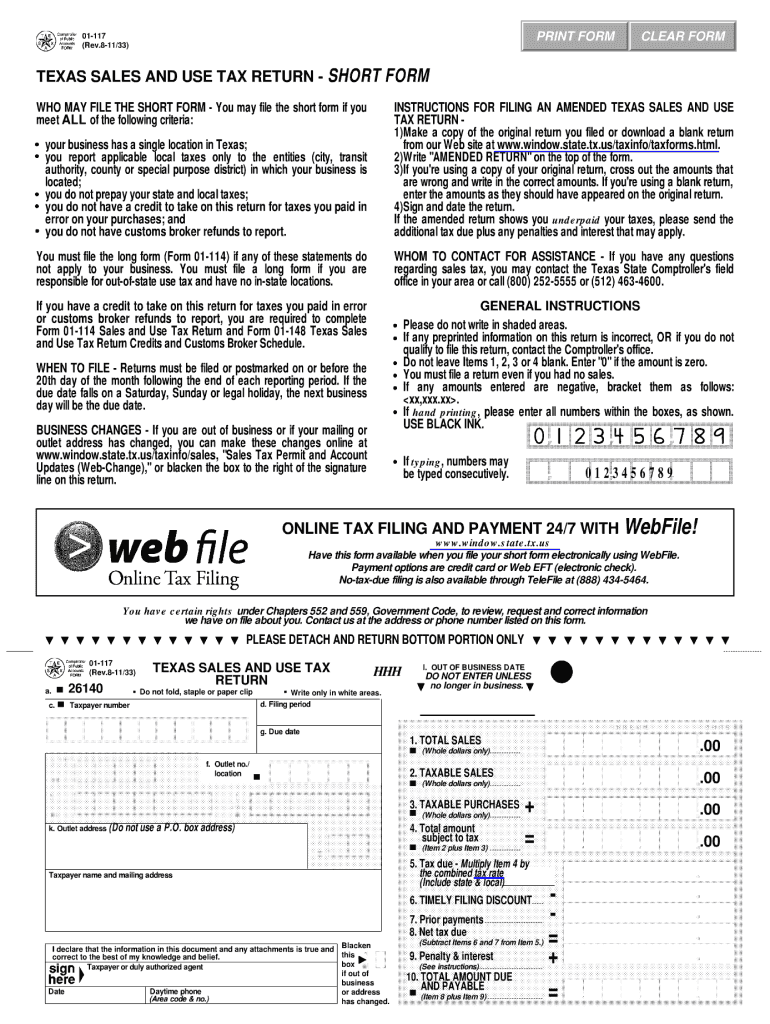

The Sales Taxes Form Sample is a standardized document used by businesses to report and remit sales tax collected from customers. This form is essential for compliance with state tax regulations and helps ensure that businesses fulfill their tax obligations accurately and on time. It typically includes information such as the total sales amount, the sales tax collected, and the business's identification details. Each state may have its own version of this form, reflecting specific requirements and rates applicable in that jurisdiction.

How to use the Sales Taxes Form Sample

Using the Sales Taxes Form Sample involves several straightforward steps. First, gather all necessary sales records for the reporting period. This includes invoices, receipts, and any other documentation that reflects sales transactions. Next, fill out the form by entering the total sales amount and the corresponding sales tax collected. Ensure that all figures are accurate to avoid discrepancies. Finally, submit the completed form to the appropriate state tax authority by the specified deadline, either electronically or via mail, depending on state regulations.

Steps to complete the Sales Taxes Form Sample

Completing the Sales Taxes Form Sample involves a series of clear steps:

- Gather sales records for the reporting period.

- Calculate the total sales and the sales tax collected.

- Fill in your business information, including name, address, and tax identification number.

- Enter the total sales amount and the total sales tax collected on the form.

- Review the completed form for accuracy.

- Submit the form to the state tax authority by the due date.

Legal use of the Sales Taxes Form Sample

The Sales Taxes Form Sample is legally recognized as a valid document for reporting sales tax obligations. To ensure its legal use, businesses must adhere to the specific requirements set forth by their state tax authorities. This includes timely submission, accurate reporting of sales and tax amounts, and proper retention of supporting documentation. Failing to comply with these regulations can result in penalties or audits, making it crucial for businesses to understand and follow the legal framework surrounding this form.

Filing Deadlines / Important Dates

Filing deadlines for the Sales Taxes Form Sample vary by state and can depend on the frequency of tax reporting required (monthly, quarterly, or annually). It is important for businesses to be aware of these dates to avoid late fees and penalties. Typically, states will specify the due date for each reporting period, which may fall on the last day of the month following the end of the reporting period. Keeping a calendar of these important dates can help ensure timely compliance.

Who Issues the Form

The Sales Taxes Form Sample is issued by the state tax authority in each respective state. Each state has its own department or agency responsible for overseeing sales tax collection and compliance. Businesses should obtain the correct version of the form from their state’s tax website or office to ensure they are using the most current and applicable document for their reporting needs.

Quick guide on how to complete sales taxes form sample 2011

Effortlessly prepare Sales Taxes Form Sample on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Sales Taxes Form Sample on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Sales Taxes Form Sample effortlessly

- Find Sales Taxes Form Sample and click Get Form to initiate the process.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specially provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for delivering your form, be it by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Sales Taxes Form Sample to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales taxes form sample 2011

Create this form in 5 minutes!

How to create an eSignature for the sales taxes form sample 2011

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is a Sales Taxes Form Sample?

A Sales Taxes Form Sample is a template that businesses can use to create sales tax documents efficiently. It provides a standardized format to record sales tax information, ensuring compliance with local regulations. Utilizing a Sales Taxes Form Sample simplifies the process of document preparation and eSigning.

-

How can airSlate SignNow help in managing Sales Taxes Form Samples?

airSlate SignNow offers features that streamline the creation and eSigning of Sales Taxes Form Samples. Users can easily customize templates, ensuring all necessary fields are included. Additionally, the platform provides secure storage and easy retrieval for compliance needs.

-

Are there costs associated with using Sales Taxes Form Samples on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs for using Sales Taxes Form Samples. Each plan provides a range of features, including eSigning and document management. It's recommended to review the pricing page for detailed information on what each plan includes.

-

What features does airSlate SignNow offer for creating Sales Taxes Form Samples?

airSlate SignNow provides a variety of features for creating Sales Taxes Form Samples, including customizable templates, bulk sending, and seamless eSignature capabilities. The platform also supports form fields for data capture, which helps in collecting required information efficiently. This makes it easy to handle sales tax documentation.

-

Can I integrate airSlate SignNow with other software for Sales Taxes Form Samples?

Yes, airSlate SignNow integrates with various applications, enhancing the utility of Sales Taxes Form Samples. Popular integrations include CRM systems, cloud storage solutions, and productivity tools. This connectivity allows businesses to manage their sales tax documents within their existing workflows seamlessly.

-

What are the benefits of using airSlate SignNow for Sales Taxes Form Samples?

Using airSlate SignNow for Sales Taxes Form Samples enhances efficiency and accuracy in document processing. The platform reduces the time spent on paperwork, minimizes errors, and ensures compliance with tax regulations. Additionally, eSigning allows for faster approvals, which accelerates business operations.

-

Is airSlate SignNow suitable for small businesses needing Sales Taxes Form Samples?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. Its intuitive interface and affordable pricing make it a perfect choice for managing Sales Taxes Form Samples without incurring high costs or complex setups.

Get more for Sales Taxes Form Sample

Find out other Sales Taxes Form Sample

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online