Trs Form 228a

What is the TRS Form 228A?

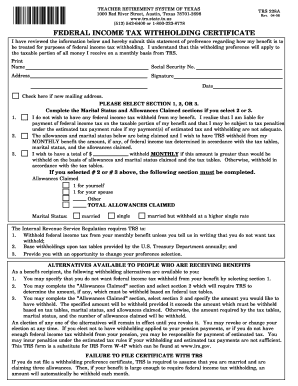

The TRS Form 228A is a tax withholding form used in Texas for reporting and managing tax withholdings related to retirement benefits. This form is essential for individuals who receive benefits from the Teacher Retirement System of Texas (TRS) and need to ensure that the correct amount of taxes is withheld from their payments. The TRS Form 228A helps recipients communicate their withholding preferences to the TRS, ensuring compliance with federal and state tax regulations.

How to Use the TRS Form 228A

Using the TRS Form 228A involves a few straightforward steps. First, download the printable version of the form from an official source. Next, fill in your personal information, including your name, address, and TRS member number. Specify your withholding preferences by indicating the percentage or amount you wish to have withheld from your benefits. After completing the form, review it for accuracy before submitting it to the TRS. This ensures that your tax withholdings align with your financial needs.

Steps to Complete the TRS Form 228A

Completing the TRS Form 228A requires attention to detail. Follow these steps for a smooth process:

- Download the TRS Form 228A from a reliable source.

- Enter your personal details accurately, including your full name and TRS member number.

- Indicate your desired withholding amount or percentage clearly.

- Sign and date the form to validate it.

- Submit the completed form to the TRS via mail or electronically, depending on the options available.

Legal Use of the TRS Form 228A

The TRS Form 228A is legally binding when completed and submitted correctly. It complies with federal and state laws regarding tax withholdings, ensuring that recipients of TRS benefits meet their tax obligations. To maintain its legal standing, it is crucial to provide accurate information and follow the submission guidelines set forth by the TRS. This form serves as a formal request for the TRS to withhold taxes as specified by the member.

Who Issues the TRS Form 228A?

The TRS Form 228A is issued by the Teacher Retirement System of Texas. This organization manages retirement benefits for educators in Texas and provides the necessary forms for members to manage their tax withholdings effectively. Members can access the form through the TRS website or request it directly from the TRS office to ensure they have the most current version available.

Filing Deadlines / Important Dates

When dealing with the TRS Form 228A, it is important to be aware of filing deadlines to avoid any issues with tax withholdings. Typically, members should submit the form at least thirty days before the start of a new tax year or when they first begin receiving benefits. Staying informed about these deadlines helps ensure that the correct amount of taxes is withheld from your retirement benefits, preventing any unexpected tax liabilities.

Quick guide on how to complete trs form 228a

Effortlessly Prepare Trs Form 228a on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without interruptions. Manage Trs Form 228a on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to modify and electronically sign Trs Form 228a effortlessly

- Obtain Trs Form 228a and select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or corrections that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and electronically sign Trs Form 228a and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the trs form 228a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are TRS tax withholding 228A forms in Texas?

TRS tax withholding 228A forms Texas printable are documents required by the Teacher Retirement System of Texas for tax withholding purposes. These forms help ensure that the correct amount of taxes is withheld from your retirement benefits. Understanding these forms is crucial for proper tax reporting and compliance.

-

How can I obtain TRS tax withholding 228A forms Texas printable?

You can easily obtain TRS tax withholding 228A forms Texas printable from the official TRS website or through trusted tax preparation resources. Additionally, airSlate SignNow provides a platform to access, fill out, and eSign these forms quickly and efficiently.

-

Are there any fees associated with using airSlate SignNow for TRS tax withholding 228A forms?

airSlate SignNow offers a cost-effective solution for managing TRS tax withholding 228A forms Texas printable. While there are subscription options available, the platform is designed to save you time and hassle, making it a valuable investment for document management.

-

Can I eSign TRS tax withholding 228A forms Texas printable with airSlate SignNow?

Yes, airSlate SignNow allows you to eSign TRS tax withholding 228A forms Texas printable seamlessly. The platform offers a user-friendly experience, enabling you to complete electronic signatures quickly and securely, ensuring your forms are ready for submission without delays.

-

What are the benefits of using airSlate SignNow for TRS tax withholding 228A forms?

Using airSlate SignNow for TRS tax withholding 228A forms Texas printable streamlines the document workflow with features like secure eSignatures and templates. Additionally, it increases your efficiency, allowing you to focus on other important tasks while managing your tax documents effortlessly.

-

Is airSlate SignNow compatible with other software for managing TRS tax withholding documents?

Yes, airSlate SignNow integrates with various software and applications to enhance your document management experience. This compatibility allows you to connect with tools you already use, facilitating a smooth process for handling TRS tax withholding 228A forms Texas printable.

-

How secure is airSlate SignNow when handling sensitive tax forms like TRS tax withholding 228A?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like TRS tax withholding 228A forms Texas printable. The platform employs advanced encryption and security measures to protect your information, ensuring that your documents remain confidential.

Get more for Trs Form 228a

Find out other Trs Form 228a

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile