TC 40 Utah Individual Income Tax Return Tax Utah 2019

What is the TC 40 Utah Individual Income Tax Return?

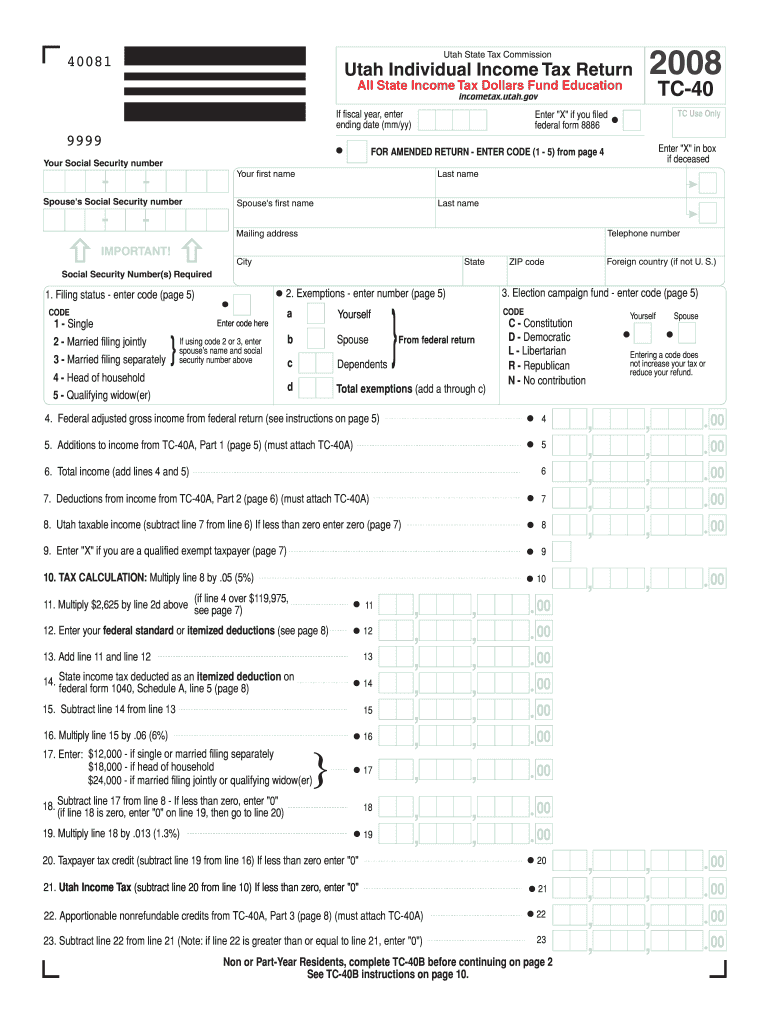

The TC 40 Utah Individual Income Tax Return is a tax form used by residents of Utah to report their annual income and calculate their state tax liability. This form is essential for individuals who earn income within the state, as it ensures compliance with state tax laws. The TC 40 captures various income sources, deductions, and credits that may apply to the taxpayer's situation, ultimately determining the amount owed or the refund due. Understanding this form is crucial for accurate tax reporting and financial planning.

Steps to Complete the TC 40 Utah Individual Income Tax Return

Completing the TC 40 involves several key steps to ensure accuracy and compliance with state regulations. Begin by gathering all necessary documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, dividends, and any other relevant earnings.

- Claim deductions and credits you qualify for, such as the standard deduction or specific tax credits available in Utah.

- Calculate your total tax liability based on the provided instructions.

- Review your completed form for accuracy before submission.

Legal Use of the TC 40 Utah Individual Income Tax Return

The TC 40 is legally recognized as a valid document for reporting income to the state of Utah. To ensure its legal standing, it must be completed accurately and submitted within the designated filing period. Electronic signatures are acceptable, provided they comply with state eSignature laws. Using a reliable eSigning platform can help maintain the integrity and legality of the completed form, ensuring that it meets all necessary requirements for acceptance by the state tax authority.

Filing Deadlines / Important Dates

Timely filing of the TC 40 is crucial to avoid penalties. The standard deadline for submitting the TC 40 is typically April 15 of the following year. However, taxpayers may request an extension if additional time is needed. It is important to check for any specific changes in deadlines or requirements each tax year, as these can vary. Keeping track of these dates helps ensure compliance and avoids unnecessary fees.

Required Documents for the TC 40 Utah Individual Income Tax Return

To complete the TC 40, several documents are required to provide accurate information. These include:

- W-2 forms from employers, detailing annual wages and withheld taxes.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation for deductions, such as mortgage interest statements or charitable contributions.

Having these documents ready will facilitate a smoother filing process and help ensure that all income and deductions are reported accurately.

How to Obtain the TC 40 Utah Individual Income Tax Return

The TC 40 form can be obtained through several channels. It is available for download directly from the Utah State Tax Commission's website, where taxpayers can access the most current version. Additionally, physical copies may be available at local tax offices or libraries. Utilizing online resources allows for easy access and ensures that the correct form is used for filing.

Quick guide on how to complete tc 40 2008 utah individual income tax return tax utah

Complete TC 40 Utah Individual Income Tax Return Tax Utah effortlessly on any device

Managing documents online has gained signNow traction among companies and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle TC 40 Utah Individual Income Tax Return Tax Utah on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign TC 40 Utah Individual Income Tax Return Tax Utah with ease

- Obtain TC 40 Utah Individual Income Tax Return Tax Utah and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Don’t worry about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign TC 40 Utah Individual Income Tax Return Tax Utah, ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 40 2008 utah individual income tax return tax utah

Create this form in 5 minutes!

How to create an eSignature for the tc 40 2008 utah individual income tax return tax utah

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is the TC 40 Utah Individual Income Tax Return Tax Utah?

The TC 40 Utah Individual Income Tax Return Tax Utah is the main form utilized by residents to report their income tax obligations to the state of Utah. Completing this form accurately is crucial for determining the amount of tax owed or the refund due. By using airSlate SignNow, you can efficiently manage and eSign your TC 40 submission, ensuring a smooth tax filing experience.

-

How does airSlate SignNow simplify the TC 40 Utah Individual Income Tax Return Tax Utah process?

airSlate SignNow provides a user-friendly platform for handling your TC 40 Utah Individual Income Tax Return Tax Utah by allowing easy document uploads and eSignatures. This means you can complete your tax return without any hassle, all while ensuring compliance with Utah's tax regulations. Utilizing this solution saves you time and reduces the likelihood of errors.

-

Is there a cost associated with using airSlate SignNow for TC 40 Utah tax returns?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective, especially for individuals and small businesses managing their TC 40 Utah Individual Income Tax Return Tax Utah. Various pricing plans are available to suit different needs and budgets, making it easy to find an option that works for you.

-

What features does airSlate SignNow offer for managing TC 40 Utah tax documents?

airSlate SignNow includes essential features such as automated document creation, secure eSigning, and robust tracking options specifically for your TC 40 Utah Individual Income Tax Return Tax Utah needs. These features help ensure that your documents are not only accurate but also securely managed throughout the filing process, giving you peace of mind.

-

Can I integrate airSlate SignNow with other software for handling my TC 40 Utah tax filing?

Absolutely! airSlate SignNow offers integration capabilities with popular accounting and finance software, which can simplify the management of your TC 40 Utah Individual Income Tax Return Tax Utah. This ensures that your financial workflows remain seamless and organized, allowing you to focus on completing your tax filings without additional complications.

-

What are the benefits of using airSlate SignNow for my TC 40 Utah tax return?

Using airSlate SignNow for your TC 40 Utah Individual Income Tax Return Tax Utah provides several benefits, such as saving time, reducing paper usage, and enhancing document security. The platform's ease of use allows you to streamline your tax preparation process, thus minimizing stress and maximizing efficiency during tax season.

-

How secure is the information I send with airSlate SignNow for TC 40 Utah tax returns?

The security of your information is a top priority at airSlate SignNow. When filing your TC 40 Utah Individual Income Tax Return Tax Utah, you can trust that the platform uses advanced encryption technology to protect your personal data, ensuring confidentiality and compliance with privacy regulations throughout the tax filing process.

Get more for TC 40 Utah Individual Income Tax Return Tax Utah

- Security guard employment status notification form

- Request letter for siphoning septic tank form

- Kyc format for company

- Nutrition crossword puzzle form

- Pharmacy customer satisfaction survey examples form

- English language information immigration new zealand

- Bed bath and beyond donation request form

- Asb kiwisaver scheme changing your fund switch f form

Find out other TC 40 Utah Individual Income Tax Return Tax Utah

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free