Amending Income Tax Returns Utah State Tax Commission 2023-2026

Understanding the Amending Income Tax Returns for Utah

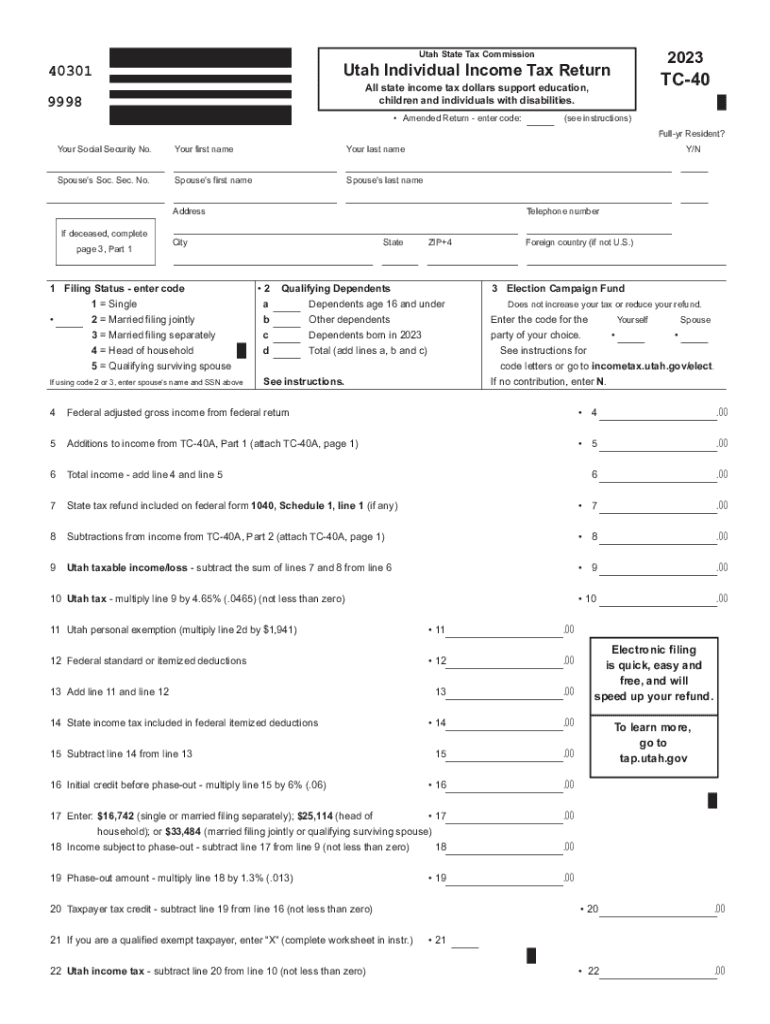

The Amending Income Tax Returns process for the Utah State Tax Commission allows taxpayers to correct errors on their previously filed tax returns. This is essential for ensuring that all information is accurate and up-to-date, which can affect tax liabilities and potential refunds. The form used for this process is the TC-40, specifically designed for individual income tax returns in Utah.

Steps to Complete the Amending Income Tax Returns

Completing the Amending Income Tax Returns involves several key steps:

- Gather all relevant documents from the original tax return.

- Obtain the TC-40 form, which can be downloaded as a PDF or printed from the Utah State Tax Commission website.

- Carefully fill out the TC-40, ensuring that all corrections are clearly indicated.

- Attach any necessary supporting documents, such as W-2s or 1099s, that reflect the changes made.

- Review the completed form for accuracy before submission.

How to Obtain the Amending Income Tax Returns

The TC-40 form can be obtained through the Utah State Tax Commission’s official website. It is available in both printable and fillable PDF formats. Taxpayers can choose to download the form directly or request a physical copy if needed. Ensure that you have the correct version for the year you are amending, such as the 2015 TC-40.

Legal Use of the Amending Income Tax Returns

Utilizing the Amending Income Tax Returns is not only a right but a legal obligation for taxpayers who need to correct their filings. Failing to amend an incorrect return can lead to penalties or interest on unpaid taxes. It is crucial to submit the amended return within the appropriate timeframe to avoid complications with the Utah State Tax Commission.

Filing Deadlines for Amending Tax Returns

Taxpayers should be aware of the deadlines for submitting an amended return. Generally, the deadline for filing an amended return in Utah is three years from the original due date of the return or two years from the date the tax was paid, whichever is later. Keeping track of these deadlines helps ensure compliance and avoids potential penalties.

Required Documents for Amending Returns

When amending a tax return using the TC-40, certain documents are required to support the changes made. These may include:

- Original tax return documentation.

- Any new forms that reflect changes, such as corrected W-2s or 1099s.

- Proof of payment for any additional taxes owed.

Having these documents ready will facilitate a smoother amendment process.

Penalties for Non-Compliance with Amended Returns

Failure to comply with the requirements for amending a tax return can result in penalties. These may include fines for late filing or additional interest on unpaid taxes. It is important to address any discrepancies promptly to avoid these repercussions and ensure that your tax records are accurate.

Quick guide on how to complete amending income tax returns utah state tax commission

Prepare Amending Income Tax Returns Utah State Tax Commission effortlessly on any device

Digital document management has become widely embraced by organizations and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow supplies all the resources you require to generate, alter, and electronically sign your documents rapidly without delays. Handle Amending Income Tax Returns Utah State Tax Commission across any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow now.

How to alter and electronically sign Amending Income Tax Returns Utah State Tax Commission with ease

- Obtain Amending Income Tax Returns Utah State Tax Commission and then click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and then click the Done button to retain your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Amending Income Tax Returns Utah State Tax Commission and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct amending income tax returns utah state tax commission

Create this form in 5 minutes!

How to create an eSignature for the amending income tax returns utah state tax commission

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2015 Utah TC 40 form and why is it important?

The 2015 Utah TC 40 form is essential for Utah taxpayers filing their individual income tax returns. This form allows individuals to report their income accurately and claim any eligible deductions or credits, ensuring compliance with state tax laws.

-

How can airSlate SignNow assist with the 2015 Utah TC 40 form?

airSlate SignNow simplifies the process of completing and eSigning the 2015 Utah TC 40 form. You can easily fill out the form electronically, ensuring all necessary information is included and submitted securely.

-

What are the main features of airSlate SignNow related to the 2015 Utah TC 40?

With airSlate SignNow, you can access templates for the 2015 Utah TC 40, enabling quick and efficient form preparation. Additionally, our platform allows for collaborative editing and secure document storage, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the 2015 Utah TC 40?

airSlate SignNow provides a range of pricing plans that cater to different needs. You can choose a cost-effective plan that includes features for managing the 2015 Utah TC 40 form and other documents, making it a sound investment for your business.

-

Can multiple users collaborate on the 2015 Utah TC 40 form using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the 2015 Utah TC 40 form seamlessly. This feature makes it easy for teams to review and finalize the form before submission, ensuring all input is collected and documented.

-

What integrations does airSlate SignNow offer for managing the 2015 Utah TC 40 form?

airSlate SignNow integrates with various apps and software that can help streamline your workflow when handling the 2015 Utah TC 40. These integrations allow for efficient data transfer and easier document management, enhancing productivity.

-

Is airSlate SignNow secure for submitting sensitive documents like the 2015 Utah TC 40?

Absolutely! airSlate SignNow prioritizes security, utilizing encrypted technologies to protect sensitive information like the 2015 Utah TC 40 form. You can confidently send and eSign documents, knowing that your data is secure.

Get more for Amending Income Tax Returns Utah State Tax Commission

- I of county iowa declare this to be form

- Article ten this article sets forth some legal construction intentions to clarify form

- It also contains a common disaster clause form

- In such a case form

- Nebraska last will and testamentlegal will formsus

- Montana legal last will and testament form with all

- Complete this field only if you want to leave your form

- Iowa passed away on form

Find out other Amending Income Tax Returns Utah State Tax Commission

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple