California K 1 Form 2019

What is the California K-1 Form

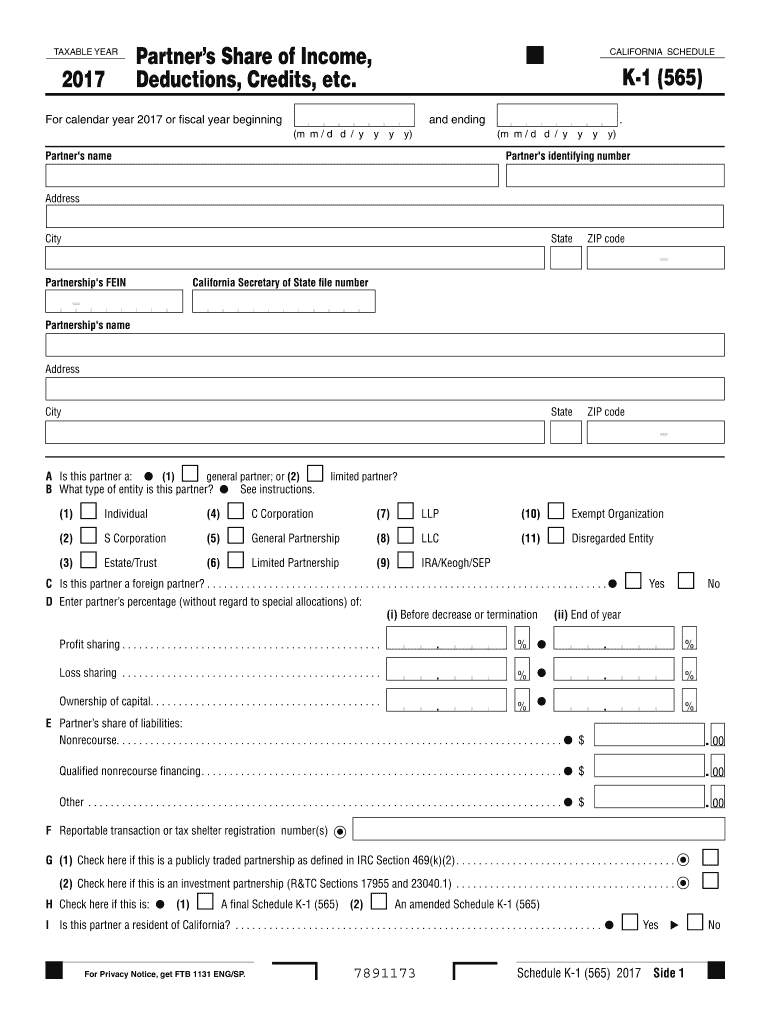

The California K-1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who receive income from these entities, as it provides detailed information that must be included in their personal tax returns. The California K-1 Form is specifically designed to comply with state tax regulations, ensuring that all income is accurately reported to the California Franchise Tax Board.

How to use the California K-1 Form

To effectively use the California K-1 Form, recipients must first ensure they have received the form from the entity that generated it. The form includes various sections that detail the income allocated to the recipient, including ordinary income, capital gains, and other taxable items. Recipients should carefully review each section and transfer the relevant amounts to their individual tax returns. It is important to retain a copy of the form for personal records and future reference.

Steps to complete the California K-1 Form

Completing the California K-1 Form involves several key steps:

- Obtain the form from the partnership, S corporation, estate, or trust.

- Review the information provided, including your share of income, deductions, and credits.

- Fill in your personal details, including your name, address, and taxpayer identification number.

- Accurately report the amounts from the K-1 on your personal tax return.

- Keep a copy of the completed form for your records.

Legal use of the California K-1 Form

The California K-1 Form is legally binding and must be used in accordance with state tax laws. It is important for recipients to ensure that the information reported on the form matches their tax filings. Any discrepancies can lead to penalties or audits by the California Franchise Tax Board. Therefore, understanding the legal implications of the K-1 is crucial for compliance and accurate tax reporting.

Key elements of the California K-1 Form

The California K-1 Form contains several key elements that are vital for accurate tax reporting:

- Entity Information: Details about the partnership, S corporation, estate, or trust, including name and identification number.

- Recipient Information: Personal details of the individual receiving the K-1.

- Income Allocations: Breakdown of various types of income, including ordinary income and capital gains.

- Deductions and Credits: Information on any deductions or credits that can be claimed.

Filing Deadlines / Important Dates

Filing deadlines for the California K-1 Form are aligned with the overall tax filing deadlines for individuals. Generally, the form must be provided to recipients by the entity by March 15 of the tax year. Recipients should ensure they include the information from the K-1 when filing their personal tax returns, which are typically due by April 15. It is essential to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or state regulations.

Quick guide on how to complete california k 1 form 2017

Complete California K 1 Form effortlessly on any gadget

Online document management has become widespread among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle California K 1 Form on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign California K 1 Form without any hassle

- Find California K 1 Form and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Select relevant portions of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tiring document searches, or errors requiring printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and eSign California K 1 Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california k 1 form 2017

Create this form in 5 minutes!

How to create an eSignature for the california k 1 form 2017

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is a California K 1 Form?

The California K 1 Form is a tax document used to report income to partners in partnerships and shareholders in S corporations. This form details each partner's share of income, deductions, and credits. Understanding how to complete the California K 1 Form is essential for accurate tax filing.

-

How can airSlate SignNow help with the California K 1 Form?

airSlate SignNow provides an easy-to-use platform for businesses to digitally sign and send the California K 1 Form. With its automated workflows, you can ensure that your documents are signed promptly and securely. This enhances efficiency, particularly during tax season.

-

What are the pricing options for using airSlate SignNow for the California K 1 Form?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan includes features specifically designed to manage documents like the California K 1 Form efficiently. You'll find that the cost-effective solution enhances your document management process.

-

Are there any integrations available with airSlate SignNow for managing California K 1 Forms?

Yes, airSlate SignNow integrates smoothly with several popular applications and software, such as CRMs and accounting tools. These integrations allow users to streamline the process of preparing and sending California K 1 Forms without switching between multiple platforms. This interconnectedness saves time and reduces errors.

-

What are the benefits of using airSlate SignNow for California K 1 Forms?

Using airSlate SignNow for California K 1 Forms improves efficiency and reduces the likelihood of errors through its user-friendly interface. It allows you to send documents quickly and track their status in real-time. Additionally, the electronic signature feature enhances your compliance and security.

-

Is it easy to eSign the California K 1 Form using airSlate SignNow?

Absolutely! airSlate SignNow simplifies the eSignature process for California K 1 Forms. Users can sign documents electronically from any device, making it convenient for partners who need to review and sign quickly, ensuring timely completion of tax filings.

-

Can I store my completed California K 1 Forms securely with airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for all your completed California K 1 Forms. This means you can access your documents at any time from anywhere while ensuring they are protected with advanced security features. It's a reliable way to keep your important tax documents organized.

Get more for California K 1 Form

Find out other California K 1 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors