Colorado Form 104x 2019

What is the Colorado Form 104x

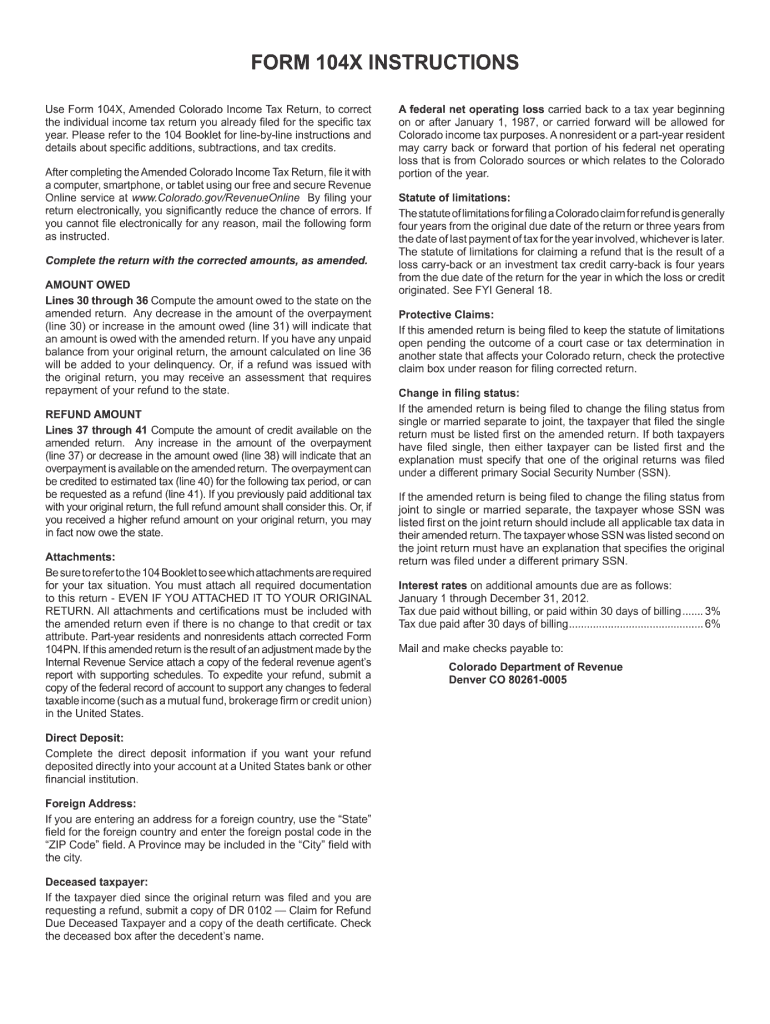

The Colorado Form 104x is a tax form used by taxpayers in Colorado to amend their previously filed state income tax returns. This form allows individuals to correct errors or make changes to their original filings, ensuring that their tax records accurately reflect their financial situation. It is essential for taxpayers who need to adjust their income, deductions, or credits after submitting their initial return.

How to use the Colorado Form 104x

To effectively use the Colorado Form 104x, you must first identify the specific changes that need to be made to your original tax return. After determining the amendments, you can fill out the form by providing the corrected information in the appropriate sections. Ensure that you include any supporting documentation that justifies the changes, such as revised W-2 forms or additional schedules. Once completed, the form should be submitted to the Colorado Department of Revenue for processing.

Steps to complete the Colorado Form 104x

Completing the Colorado Form 104x involves several key steps:

- Obtain the latest version of the form from the Colorado Department of Revenue website or other official sources.

- Review your original tax return to identify the specific areas that require amendments.

- Fill out the form, ensuring that all relevant sections are completed accurately.

- Attach any necessary supporting documents that substantiate your claims.

- Double-check your entries for accuracy and completeness.

- Submit the completed form to the appropriate address as indicated in the instructions.

Legal use of the Colorado Form 104x

The Colorado Form 104x is legally recognized for amending tax returns, provided it is completed and submitted according to state regulations. It is crucial to ensure that all amendments comply with the Colorado tax laws and guidelines. Failure to adhere to these rules may result in penalties or delays in processing your amended return.

Filing Deadlines / Important Dates

When submitting the Colorado Form 104x, it is important to be aware of the relevant deadlines. Generally, taxpayers have up to three years from the original filing date to submit an amendment. However, if the amendment involves a claim for a refund, it must be filed within the specified timeframe to ensure eligibility for any potential tax refunds.

Form Submission Methods (Online / Mail / In-Person)

The Colorado Form 104x can be submitted through various methods, including:

- Online: Some taxpayers may have the option to file electronically through approved tax software, which can streamline the process.

- Mail: The completed form can be printed and mailed to the Colorado Department of Revenue at the address specified in the form instructions.

- In-Person: Taxpayers may also choose to deliver the form in person at designated state revenue offices, ensuring immediate receipt.

Quick guide on how to complete 2011 colorado form 104x

Effortlessly Prepare Colorado Form 104x on Any Device

Managing documents online has surged in popularity among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle Colorado Form 104x on any platform using airSlate SignNow apps for Android or iOS and enhance your document-centered activities today.

The easiest way to modify and eSign Colorado Form 104x without hassle

- Obtain Colorado Form 104x and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Colorado Form 104x and ensure outstanding communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 colorado form 104x

Create this form in 5 minutes!

How to create an eSignature for the 2011 colorado form 104x

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the Colorado Form 104x?

The Colorado Form 104x is an amended tax return form that allows taxpayers to correct errors or omissions on their original Colorado state tax return. Utilizing this form is essential for ensuring that your filings are accurate and compliant with state regulations. By using airSlate SignNow, you can effortlessly eSign and submit your Colorado Form 104x online, streamlining the amendment process.

-

How can airSlate SignNow help with my Colorado Form 104x?

airSlate SignNow provides a user-friendly platform that simplifies the process of completing and eSigning your Colorado Form 104x. With its intuitive interface, you can quickly fill in your amended return and securely send it for signatures. This helps ensure your amendments are processed without delays or complications.

-

What are the pricing options for using airSlate SignNow for my Colorado Form 104x?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, allowing you to choose a package that fits your budget, whether you are a small business or a large enterprise. Each plan provides access to essential features needed to manage documents like the Colorado Form 104x efficiently. You can find more details on our pricing page.

-

Can I integrate airSlate SignNow with other applications for my Colorado Form 104x?

Yes, airSlate SignNow integrates seamlessly with various applications and tools, enhancing your workflow when handling documents like the Colorado Form 104x. Whether you use CRM systems or other productivity tools, our integrations make it easy to manage your documents and keep your processes interconnected.

-

What features does airSlate SignNow offer for handling Colorado Form 104x?

airSlate SignNow offers robust features, including eSignature capabilities, secure cloud storage, and document templates tailored for Colorado Form 104x. These features ensure that you can quickly prepare, sign, and manage your amended tax return with ease and efficiency.

-

Is it safe to use airSlate SignNow for my Colorado Form 104x?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your sensitive data when handling forms like the Colorado Form 104x. Our platform uses encryption and secure servers to ensure that your information remains confidential and secure throughout the signing process.

-

How long does it take to process a Colorado Form 104x with airSlate SignNow?

The processing time for a Colorado Form 104x using airSlate SignNow is typically quicker than traditional methods, thanks to our electronic submission and signature features. Once your form is completed and signed, you can submit it immediately, reducing waiting times and expediting any potential refunds or corrections.

Get more for Colorado Form 104x

Find out other Colorado Form 104x

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online