706 Nt Form 2020

What is the 706 Nt Form

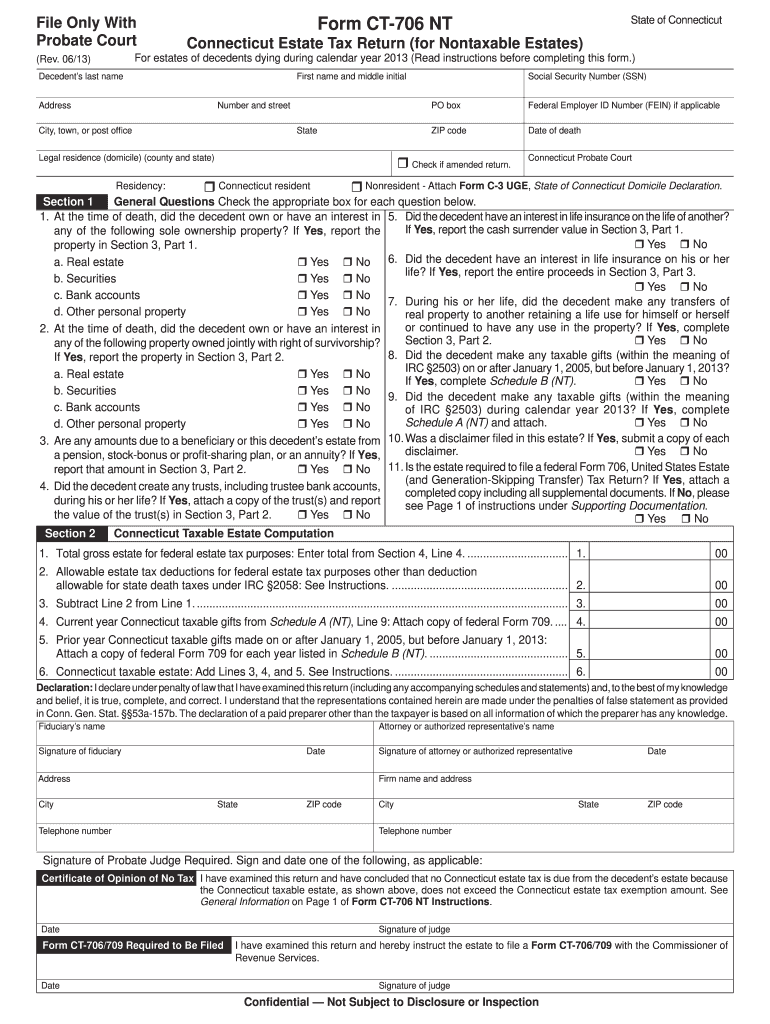

The 706 Nt Form, officially known as the Estate Tax Return for Non-Residents, is a crucial document used in the United States for reporting the estate tax liability of non-resident aliens. This form is specifically designed for individuals who are not U.S. citizens or residents but have assets situated in the U.S. upon their death. The 706 Nt Form helps determine the value of the estate and the corresponding tax obligations, ensuring compliance with federal tax laws.

How to use the 706 Nt Form

Using the 706 Nt Form involves a systematic approach to accurately report the estate's value and calculate any taxes owed. The form requires detailed information about the decedent's assets, including real estate, bank accounts, and investments located in the U.S. Executors or administrators of the estate must fill out the form, ensuring all required sections are completed. It is essential to provide accurate valuations and any necessary documentation to support the reported values.

Steps to complete the 706 Nt Form

Completing the 706 Nt Form requires careful attention to detail. Here are the key steps:

- Gather necessary documentation, including asset valuations and ownership records.

- Fill out the decedent's information, including name, date of death, and social security number.

- List all U.S.-situated assets, providing detailed descriptions and fair market values.

- Calculate the total estate value and determine any deductions or exemptions applicable.

- Review the form for accuracy and completeness before submission.

Legal use of the 706 Nt Form

The legal use of the 706 Nt Form is governed by federal tax laws, which stipulate the requirements for reporting estate taxes for non-residents. It is essential to ensure that the form is filed within the designated time frame to avoid penalties. The information provided must be truthful and accurate, as discrepancies can lead to legal repercussions and additional tax liabilities.

Filing Deadlines / Important Dates

Timely filing of the 706 Nt Form is critical to avoid penalties. The form must typically be filed within nine months of the decedent's date of death. If additional time is needed, a six-month extension may be requested. It is important to keep track of these deadlines to ensure compliance with IRS regulations and to avoid unnecessary complications.

Required Documents

To successfully complete the 706 Nt Form, several documents are required. These include:

- Death certificate of the decedent.

- Valuations of all U.S. assets, including appraisals and bank statements.

- Documentation of any debts or liabilities owed by the estate.

- Records of any prior gift tax returns filed by the decedent.

Form Submission Methods (Online / Mail / In-Person)

The 706 Nt Form can be submitted through various methods, depending on the preferences of the executor or administrator. The form can be mailed to the appropriate IRS address, ensuring it is sent via a method that provides tracking. Currently, the IRS does not offer an online submission option for this form, so it is essential to plan for mailing well in advance of the deadline.

Quick guide on how to complete 706 nt 2013 form

Complete 706 Nt Form effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage 706 Nt Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 706 Nt Form effortlessly

- Locate 706 Nt Form and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools provided by airSlate SignNow designed for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choosing. Modify and eSign 706 Nt Form and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 706 nt 2013 form

Create this form in 5 minutes!

How to create an eSignature for the 706 nt 2013 form

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the 706 Nt Form?

The 706 Nt Form is a tax return for estate tax purposes, specifically for estates that qualify for the marital deduction. It allows executors to report the value of the taxable estate and determine the taxes owed. Understanding this form is crucial for managing estate taxes efficiently.

-

How can airSlate SignNow help with the 706 Nt Form?

AirSlate SignNow provides a streamlined platform for electronically signing and sending the 706 Nt Form and other important documents. This secure solution ensures compliance while simplifying the process, allowing users to focus on managing their estate rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for the 706 Nt Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, ensuring that customers can efficiently manage their documentation, including the 706 Nt Form, without overspending.

-

What features does airSlate SignNow offer for managing the 706 Nt Form?

AirSlate SignNow offers features such as document templates, e-signature capabilities, and real-time tracking, making it easier to manage the 706 Nt Form. Additionally, the platform ensures compliant storage and seamless collaboration among stakeholders involved in the estate process.

-

Can I integrate airSlate SignNow with other tools for the 706 Nt Form?

Yes, airSlate SignNow integrates with various popular applications, allowing for a seamless workflow when handling the 706 Nt Form. This integration enhances productivity by connecting your existing tools with the e-signing process, making document management easier.

-

How secure is the electronic signing process for the 706 Nt Form?

AirSlate SignNow employs advanced security measures, including encryption and secure storage, to protect your data when signing the 706 Nt Form. This ensures that your sensitive estate information remains confidential and safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for the 706 Nt Form?

Using airSlate SignNow for the 706 Nt Form offers numerous benefits, such as increased efficiency and reduced paperwork. The platform simplifies the signing process, decreases turnaround time, and helps ensure that documents are completed and submitted accurately.

Get more for 706 Nt Form

Find out other 706 Nt Form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure