Connecticut Si Form 2019

What is the Connecticut Si Form

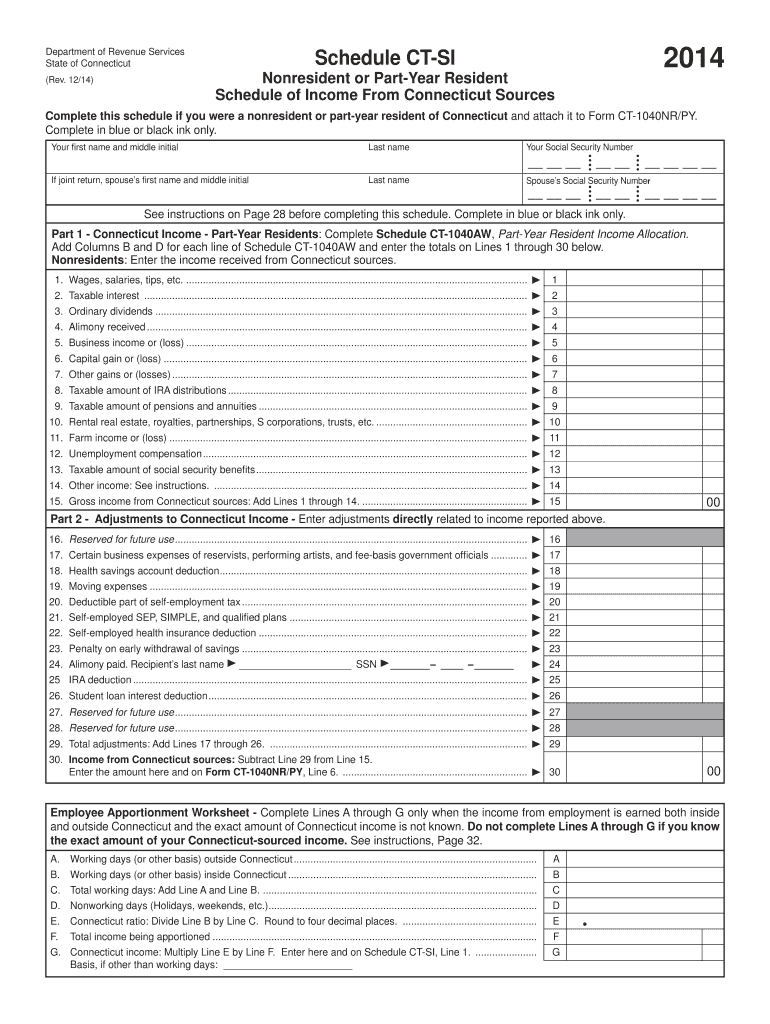

The Connecticut Si Form, also known as the Connecticut State Income Tax Form, is a crucial document used by residents to report their income and calculate their state tax obligations. This form is specifically designed for individuals and businesses operating within Connecticut, ensuring compliance with state tax laws. It includes sections for income reporting, deductions, and credits applicable to Connecticut taxpayers.

How to use the Connecticut Si Form

To effectively use the Connecticut Si Form, begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Carefully follow the instructions provided on the form, ensuring that each section is filled out accurately. It is important to double-check calculations and ensure that all applicable deductions and credits are claimed. Once completed, the form can be submitted electronically or via mail, depending on the chosen filing method.

Steps to complete the Connecticut Si Form

Completing the Connecticut Si Form involves several key steps:

- Gather all relevant income documentation, such as W-2 forms and 1099 statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report total income earned during the tax year.

- Claim any deductions or credits you qualify for, ensuring to follow the guidelines provided.

- Calculate your total tax liability based on the information provided.

- Review the form for accuracy before submission.

Legal use of the Connecticut Si Form

The Connecticut Si Form is legally recognized as the official means for reporting state income taxes. It must be filled out in accordance with Connecticut state tax laws to ensure compliance. Failure to accurately complete and submit this form can result in penalties, including fines or additional taxes owed. It is essential for taxpayers to understand their obligations and the legal implications of submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the Connecticut Si Form typically align with federal tax deadlines. Generally, the form must be submitted by April 15 of each year for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to stay informed about any changes to deadlines or important dates related to state tax filing.

Required Documents

To complete the Connecticut Si Form, taxpayers must have several documents on hand, including:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as mortgage interest statements or medical expenses

Form Submission Methods (Online / Mail / In-Person)

The Connecticut Si Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Connecticut Department of Revenue Services website

- Mailing a printed copy to the appropriate state tax office

- In-person submission at designated tax offices, if available

Quick guide on how to complete connecticut si 2014 form

Complete Connecticut Si Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Connecticut Si Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign Connecticut Si Form with ease

- Obtain Connecticut Si Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal efficacy as a traditional wet ink signature.

- Review the information and click on the Done button to confirm your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, inconvenient form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Connecticut Si Form and guarantee exceptional communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct connecticut si 2014 form

Create this form in 5 minutes!

How to create an eSignature for the connecticut si 2014 form

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the Connecticut Si Form?

The Connecticut Si Form is a critical document that businesses use to report tax information related to the state of Connecticut. It's essential for compliance and can often require signNowd signatures. airSlate SignNow simplifies this process by allowing for easy electronic signatures and secure document management.

-

How can airSlate SignNow help with the Connecticut Si Form?

airSlate SignNow provides an intuitive platform that enables users to easily eSign the Connecticut Si Form and other essential documents. With features like customizable templates and secure document storage, businesses can streamline their filing processes. This helps ensure accuracy and timeliness when submitting the Connecticut Si Form.

-

Is airSlate SignNow cost-effective for signing the Connecticut Si Form?

Yes, airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes. Our cost-effective solution allows unlimited document signing, including for the Connecticut Si Form, without hidden fees. This ensures that you can manage your document needs without straining your budget.

-

What features does airSlate SignNow offer for the Connecticut Si Form?

airSlate SignNow includes robust features such as document templates, automated workflows, and real-time tracking, all of which can be beneficial for handling the Connecticut Si Form. The platform also supports multiple formats, ensuring your forms are compatible. With airSlate SignNow, you can reduce paperwork and enhance efficiency.

-

Can I integrate airSlate SignNow with other applications for the Connecticut Si Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, making it easy to handle the Connecticut Si Form alongside your existing tools. This includes integration with CRMs, email, and cloud storage systems. Such connectivity streamlines your operation and saves you valuable time.

-

Is my data secure when using airSlate SignNow for the Connecticut Si Form?

Data security is a top priority for us. When using airSlate SignNow to manage the Connecticut Si Form, your information is protected with industry-leading encryption methods. We also comply with data privacy regulations to ensure your sensitive information remains confidential and secure.

-

How does eSigning the Connecticut Si Form work with airSlate SignNow?

eSigning the Connecticut Si Form with airSlate SignNow is straightforward and user-friendly. Simply upload your document, add the necessary fields for signatures, and send it to recipients. Once signed, you receive a notification and a final copy, making the entire process hassle-free.

Get more for Connecticut Si Form

Find out other Connecticut Si Form

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free