Ct Eitc Seq Form 2020

What is the Ct Eitc Seq Form

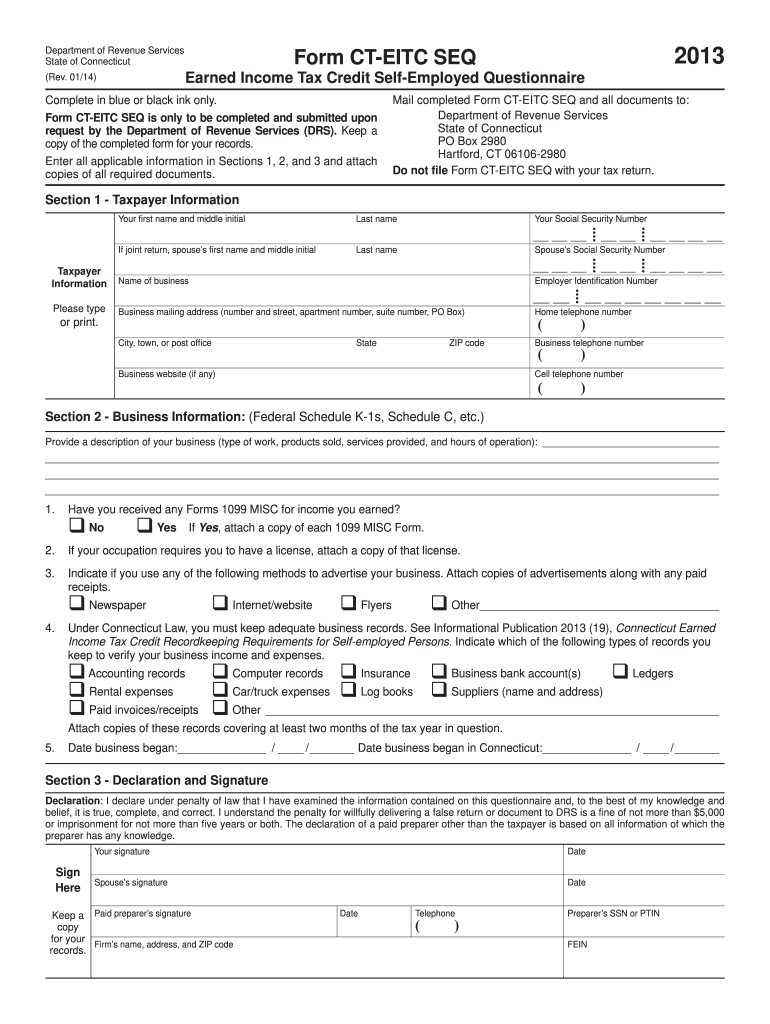

The Ct Eitc Seq Form is a specific document used in the state of Connecticut to apply for the Earned Income Tax Credit (EITC). This form is designed to help eligible taxpayers receive a credit that reduces their overall tax liability. The EITC is aimed at low to moderate-income workers, providing financial relief and encouraging employment. Understanding this form is essential for those who qualify, as it can significantly impact their tax refund and financial situation.

How to use the Ct Eitc Seq Form

Using the Ct Eitc Seq Form involves several straightforward steps. First, ensure that you meet the eligibility criteria for the Earned Income Tax Credit. Next, gather all necessary documentation, including your income statements and personal identification. Once you have the required information, complete the form accurately, ensuring that all details are correct to avoid delays in processing. After filling out the form, submit it according to the specified guidelines, either electronically or by mail, to ensure timely consideration of your application.

Steps to complete the Ct Eitc Seq Form

Completing the Ct Eitc Seq Form requires careful attention to detail. Here are the steps to follow:

- Review the eligibility requirements to confirm that you qualify for the EITC.

- Gather all relevant documents, such as W-2 forms, 1099s, and any other income records.

- Fill out the form, providing accurate information about your income, filing status, and dependents.

- Double-check the form for any errors or omissions before submission.

- Submit the completed form through the appropriate channels, ensuring that you keep a copy for your records.

Legal use of the Ct Eitc Seq Form

The legal use of the Ct Eitc Seq Form is governed by state tax laws and regulations. It is important to ensure that the information provided is truthful and accurate, as any discrepancies can lead to penalties or denial of the credit. The form must be submitted within the designated filing period to be considered valid. Compliance with these legal requirements not only protects the taxpayer but also ensures that the state can effectively administer the EITC program.

Eligibility Criteria

To qualify for the Earned Income Tax Credit through the Ct Eitc Seq Form, taxpayers must meet specific criteria. This includes having earned income from employment or self-employment, meeting income limits based on family size, and having a valid Social Security number. Additionally, the taxpayer must be a resident of Connecticut and file a state tax return. Understanding these eligibility criteria is crucial for ensuring that you can successfully claim the credit.

Form Submission Methods

The Ct Eitc Seq Form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file electronically, which often results in faster processing times. Alternatively, the form can be mailed to the appropriate state tax office. In-person submissions may also be possible at designated locations. Each method has its own set of guidelines and timelines, so it is important to select the one that best fits your needs.

Quick guide on how to complete ct eitc seq 2013 form

Accomplish Ct Eitc Seq Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Ct Eitc Seq Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Ct Eitc Seq Form without a hassle

- Find Ct Eitc Seq Form and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Ct Eitc Seq Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct eitc seq 2013 form

Create this form in 5 minutes!

How to create an eSignature for the ct eitc seq 2013 form

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Ct Eitc Seq Form and why is it important?

The Ct Eitc Seq Form is a crucial document for individuals applying for the Connecticut Earned Income Tax Credit (EITC). It ensures that you are eligible for the credit and helps maximize your tax return. Understanding this form is essential for taking full advantage of available financial benefits.

-

How does airSlate SignNow simplify the process of handling the Ct Eitc Seq Form?

airSlate SignNow streamlines the process of completing and signing the Ct Eitc Seq Form by providing an intuitive platform for electronic signatures and document management. Our solution ensures that all required information is easily accessible and securely stored. This helps reduce errors and enhances compliance during the submission process.

-

Is there a cost associated with using airSlate SignNow for the Ct Eitc Seq Form?

Yes, airSlate SignNow offers a cost-effective solution tailored to various business needs, including handling the Ct Eitc Seq Form. We provide different pricing plans, ensuring you can choose one that fits your budget while making the process efficient. Our pricing model is transparent with no hidden fees.

-

Can I integrate airSlate SignNow with other software when working on the Ct Eitc Seq Form?

Absolutely! airSlate SignNow supports seamless integrations with various popular platforms such as Google Drive, Dropbox, and CRM systems. This flexibility allows you to easily access and manage your Ct Eitc Seq Form alongside your other business documents, enhancing workflow efficiency.

-

What features does airSlate SignNow offer for completing the Ct Eitc Seq Form?

airSlate SignNow offers features such as custom templates, automated reminders, and a user-friendly editor, specifically designed to assist with the Ct Eitc Seq Form. You can easily customize fields, add electronic signatures, and collaborate with others to ensure accurate and timely submissions. These features promote a smooth user experience.

-

How secure is the information shared on the Ct Eitc Seq Form using airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect all data, including the details within the Ct Eitc Seq Form. Your sensitive information is safe, ensuring peace of mind when sending and signing documents electronically.

-

Can I track the status of my Ct Eitc Seq Form submissions?

Yes, airSlate SignNow allows you to monitor the status of your Ct Eitc Seq Form submissions in real-time. You receive notifications when documents are viewed or signed, making it easy to keep track of your submissions. This feature enhances accountability and helps you manage your time effectively.

Get more for Ct Eitc Seq Form

- Form 40 commission

- Glvar transfer and drop notice pdf form

- Downloadable blank league table template form

- 8005552546 form

- Fw 004 order on application for waiver of additional alpine courts ca form

- Interpreter request form superior court riverside riverside courts ca

- Gc 400e1gc 405e1 cash assets on hand at end of account period standard and simplified accounts judicial council forms courts ca

- Subject access request sar form subject access request gdpr

Find out other Ct Eitc Seq Form

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free