Welcome to the Connecticut Department of Revenue Services 2020

Understanding the Connecticut Department of Revenue Services

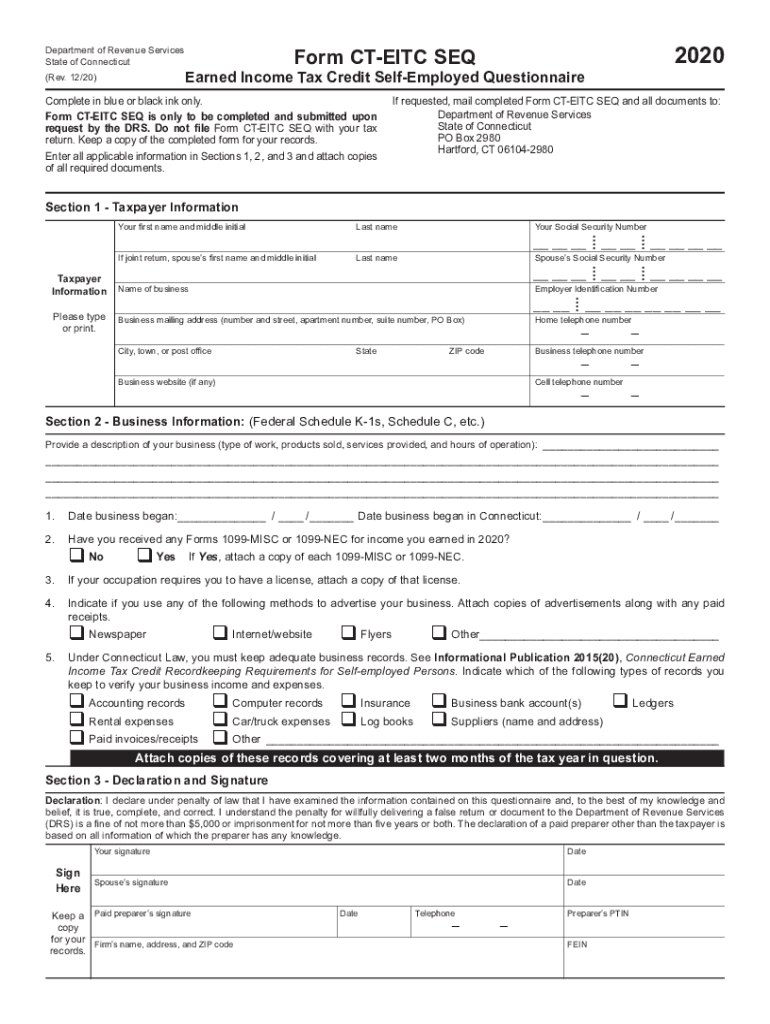

The Connecticut Department of Revenue Services (CT DRS) is responsible for administering the state's tax laws and ensuring compliance with tax regulations. It plays a crucial role in the collection of various taxes, including income tax, sales tax, and property tax. The department also oversees tax credits, such as the Earned Income Tax Credit (EITC), which provides financial relief to eligible low- to moderate-income individuals and families.

Steps to Complete the CT EITC Form

Completing the CT EITC form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including your federal tax return, W-2 forms, and any other income statements.

- Ensure you meet the eligibility criteria for the EITC, which includes income limits and filing status.

- Fill out the CT EITC form with accurate information, including your personal details and income sources.

- Double-check your entries for accuracy to avoid delays in processing.

- Submit the completed form electronically or via mail, following the submission guidelines provided by the CT DRS.

Eligibility Criteria for the CT EITC

To qualify for the Connecticut Earned Income Tax Credit, applicants must meet specific eligibility criteria:

- Must have earned income from employment or self-employment.

- Must meet income limits based on filing status and number of qualifying children.

- Must be a resident of Connecticut for the tax year in question.

- Must file a federal tax return, even if not required to file.

Form Submission Methods for the CT EITC

Submitting the CT EITC form can be done through various methods, ensuring convenience and accessibility:

- Online Submission: Use the CT DRS online portal for a quick and efficient filing process.

- Mail Submission: Print the completed form and send it to the designated address provided by the CT DRS.

- In-Person Submission: Visit a local CT DRS office for assistance and to submit your form directly.

Required Documents for the CT EITC

When applying for the CT EITC, certain documents are necessary to support your application:

- Your federal tax return (Form 1040).

- W-2 forms from all employers.

- Any additional income documentation, such as 1099 forms for self-employment income.

- Proof of residency in Connecticut, if applicable.

Penalties for Non-Compliance with CT EITC Regulations

Failure to comply with the regulations surrounding the CT EITC can result in penalties. These may include:

- Loss of the EITC for the tax year in question.

- Potential fines for incorrect reporting of income or eligibility.

- Increased scrutiny on future tax filings, leading to audits.

Quick guide on how to complete welcome to the connecticut department of revenue services

Complete Welcome To The Connecticut Department Of Revenue Services effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, as you can find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Welcome To The Connecticut Department Of Revenue Services on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign Welcome To The Connecticut Department Of Revenue Services with ease

- Find Welcome To The Connecticut Department Of Revenue Services and then click Get Form to begin.

- Take advantage of the tools we offer to fill out your document.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then press the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs within a few clicks from your preferred device. Modify and eSign Welcome To The Connecticut Department Of Revenue Services and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct welcome to the connecticut department of revenue services

Create this form in 5 minutes!

How to create an eSignature for the welcome to the connecticut department of revenue services

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the form ct eitc seq and how do I use it?

The form ct eitc seq is a tax form used to apply for the Connecticut Earned Income Tax Credit. To use it, businesses must complete the form and submit it along with their state tax returns. airSlate SignNow simplifies this process by allowing you to eSign and send your form ct eitc seq online, ensuring that everything is completed accurately and on time.

-

How can airSlate SignNow help with completing form ct eitc seq?

airSlate SignNow provides an intuitive platform for filling out and eSigning form ct eitc seq efficiently. You can easily upload the form, add necessary signatures, and ensure all relevant fields are filled in correctly. This signNowly reduces the chance of errors that could delay your tax filing.

-

What are the pricing options for using airSlate SignNow for form ct eitc seq?

airSlate SignNow offers several pricing plans to fit different business needs, making it affordable to manage documents such as form ct eitc seq. Plans include monthly and annual subscriptions, with various features available at each level. Check our website for the latest pricing details and special offers.

-

Is airSlate SignNow compliant with state regulations for form ct eitc seq?

Yes, airSlate SignNow is designed to comply with state regulations regarding document signing, including the requirements for form ct eitc seq. Our platform ensures that all eSignatures are legally binding and securely stored, giving you peace of mind when filing your tax documents.

-

Can I track the status of my form ct eitc seq with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your form ct eitc seq in real-time. You will receive notifications when the document is viewed, signed, or completed, keeping you informed throughout the process.

-

Does airSlate SignNow integrate with other tools for process automation related to form ct eitc seq?

Yes, airSlate SignNow integrates seamlessly with a variety of tools to enhance productivity related to form ct eitc seq. Whether you use CRMs, accounting software, or other document management systems, our integrations can streamline your workflow and automate tasks.

-

What security measures does airSlate SignNow implement for form ct eitc seq?

airSlate SignNow prioritizes security, employing advanced encryption and access controls to protect your form ct eitc seq. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure during the signing process.

Get more for Welcome To The Connecticut Department Of Revenue Services

Find out other Welcome To The Connecticut Department Of Revenue Services

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online