CT DRS CT EITC SEQ Fill Out Tax Template 2021

What is the CT DRS CT EITC SEQ Fill Out Tax Template

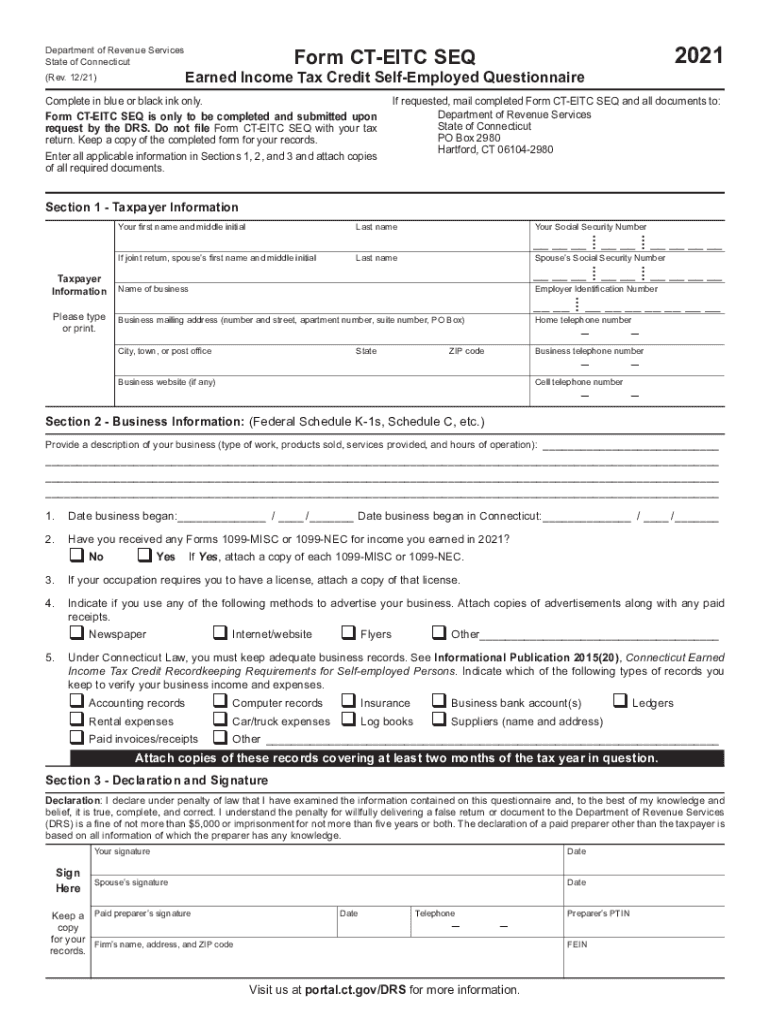

The CT DRS CT EITC SEQ is a tax template designed for Connecticut residents to apply for the Earned Income Tax Credit (EITC). This form allows eligible taxpayers to claim a credit that reduces their state income tax liability. The EITC is aimed at supporting low to moderate-income working individuals and families, helping to alleviate some of the financial burdens associated with raising children and managing household expenses.

Steps to complete the CT DRS CT EITC SEQ Fill Out Tax Template

Completing the CT DRS CT EITC SEQ requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including proof of income, Social Security numbers for all family members, and any relevant tax forms.

- Access the CT DRS CT EITC SEQ template, either online or in printed form.

- Fill in your personal information, including name, address, and filing status.

- Input your income details, ensuring accuracy to avoid delays or issues with your claim.

- Review the eligibility criteria to confirm that you meet the requirements for the EITC.

- Sign and date the form, ensuring that all information is complete before submission.

Legal use of the CT DRS CT EITC SEQ Fill Out Tax Template

The CT DRS CT EITC SEQ is legally recognized as a valid document for claiming the Earned Income Tax Credit in Connecticut. To ensure its legal standing, the form must be completed accurately and submitted within the designated filing period. Compliance with state tax laws is essential, as improper use or submission of false information can result in penalties.

Eligibility Criteria

To qualify for the CT DRS CT EITC, applicants must meet specific eligibility criteria. These include:

- Filing status as single, married filing jointly, or head of household.

- Meeting income limits based on the number of qualifying children.

- Having earned income from employment or self-employment.

- Being a resident of Connecticut for the tax year in question.

Required Documents

When filling out the CT DRS CT EITC SEQ, certain documents are necessary to support your application. These include:

- W-2 forms from employers, showing total income earned.

- 1099 forms if applicable, for self-employed income.

- Social Security cards for all family members included in the claim.

- Any additional documentation that verifies eligibility, such as child care expenses or other credits claimed.

Form Submission Methods

The CT DRS CT EITC SEQ can be submitted through various methods to accommodate different preferences. Options include:

- Online submission through the Connecticut Department of Revenue Services website.

- Mailing the completed form to the appropriate address provided by the DRS.

- In-person submission at designated DRS offices, if preferred.

Quick guide on how to complete ct drs ct eitc seq 2020 2021 fill out tax template

Complete CT DRS CT EITC SEQ Fill Out Tax Template seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents promptly without delays. Manage CT DRS CT EITC SEQ Fill Out Tax Template on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign CT DRS CT EITC SEQ Fill Out Tax Template effortlessly

- Locate CT DRS CT EITC SEQ Fill Out Tax Template and click on Get Form to commence.

- Make use of the tools we provide to complete your document.

- Highlight essential sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as an ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate problems with lost or misplaced files, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign CT DRS CT EITC SEQ Fill Out Tax Template and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct drs ct eitc seq 2020 2021 fill out tax template

Create this form in 5 minutes!

How to create an eSignature for the ct drs ct eitc seq 2020 2021 fill out tax template

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The way to create an e-signature straight from your smart phone

The best way to make an e-signature for a PDF on iOS devices

The way to create an e-signature for a PDF document on Android OS

People also ask

-

What is the CT EITC program and how does it work?

The CT EITC, or Connecticut Earned Income Tax Credit, is a program designed to provide financial assistance to low- to moderate-income working individuals and families. It helps reduce the amount of tax owed and can increase your tax refund, offering crucial support for eligible taxpayers in Connecticut.

-

How can airSlate SignNow assist with CT EITC document management?

airSlate SignNow simplifies the process of managing documents related to your CT EITC claims. You can easily send, sign, and store important paperwork digitally, ensuring that your documents are organized and easily accessible, which streamlines your tax return process.

-

What are the pricing plans for airSlate SignNow when applying for CT EITC?

airSlate SignNow offers competitive pricing plans that cater to various budgets, including a free option for basic usage. This flexibility ensures that you can manage your documents for CT EITC efficiently without overspending, making it a cost-effective choice for individuals and businesses alike.

-

How does airSlate SignNow enhance the signature process for CT EITC forms?

With airSlate SignNow, you can eSign CT EITC forms quickly and securely, reducing the need for physical paperwork. The platform’s user-friendly interface allows you to collect signatures from multiple parties seamlessly, expediting the submission of necessary documents to maximize your tax benefits.

-

Can airSlate SignNow integrate with accounting software for CT EITC preparations?

Yes, airSlate SignNow can integrate smoothly with various accounting software programs, enhancing your CT EITC preparation process. These integrations allow for real-time data sharing and easier management of financial documents, making for a more efficient workflow.

-

What are the benefits of using airSlate SignNow for CT EITC submissions?

By using airSlate SignNow for CT EITC submissions, you benefit from an efficient, secure, and legally-compliant way to handle your documents. The platform helps reduce delays caused by traditional mailing methods, ensuring your CT EITC claims are submitted on time and without missing information.

-

Is customer support available for users dealing with CT EITC through airSlate SignNow?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any inquiries about the CT EITC process. Whether you have questions about document management or signature collection, the support team is available to guide you through the process.

Get more for CT DRS CT EITC SEQ Fill Out Tax Template

Find out other CT DRS CT EITC SEQ Fill Out Tax Template

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors