Eitc Forms from the Print Out 2018

What is the EITC Form?

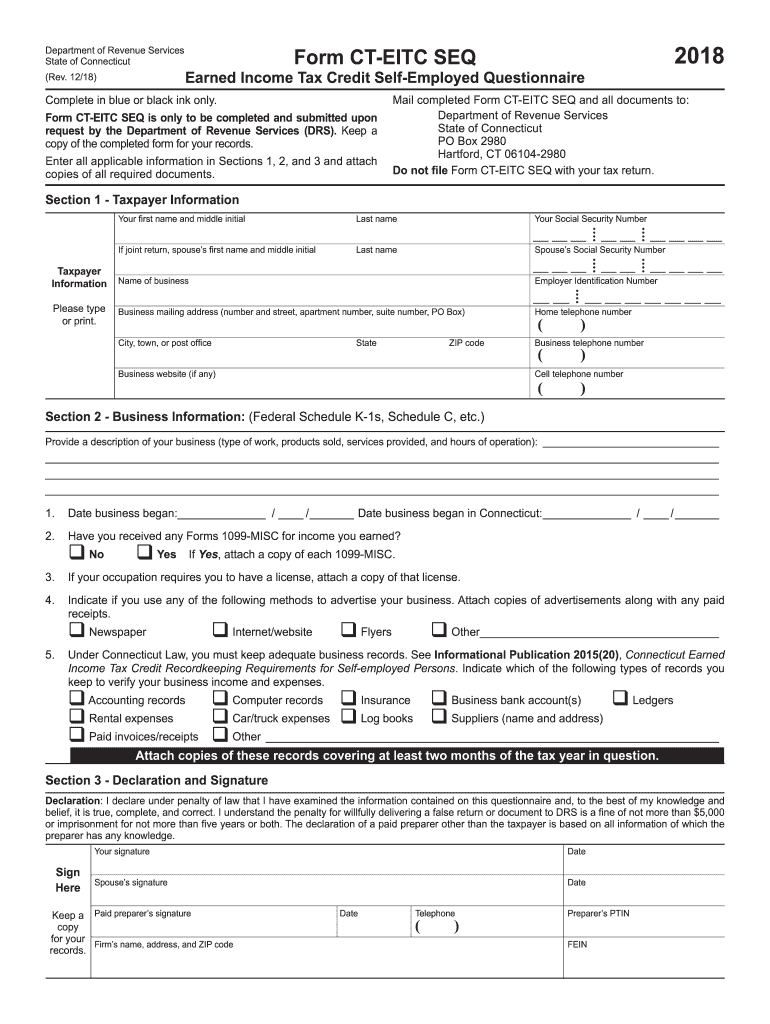

The Earned Income Tax Credit (EITC) form, specifically the ct eitc seq 2018, is a tax document used by eligible taxpayers in Connecticut to claim the EITC. This credit is designed to reduce the tax burden on low to moderate-income working individuals and families. By completing this form, taxpayers can receive a refund or reduce the amount of tax they owe. The ct department of revenue form ct eitc seq 2018 includes specific instructions and requirements that must be followed to ensure compliance with state regulations.

Steps to Complete the EITC Form

Completing the ct eitc seq 2018 involves several key steps:

- Gather necessary documents, including income statements and Social Security numbers for all qualifying children.

- Review the eligibility criteria to ensure you qualify for the EITC.

- Fill out the form accurately, providing all required information in the designated fields.

- Double-check the completed form for any errors or omissions.

- Sign the form digitally or manually, depending on your submission method.

- Submit the form by the deadline, either electronically or by mail.

Eligibility Criteria for the EITC

To qualify for the EITC, taxpayers must meet specific eligibility criteria, which include:

- Having earned income from employment or self-employment.

- Meeting income limits based on filing status and number of qualifying children.

- Being a U.S. citizen or resident alien for the entire tax year.

- Filing a tax return, even if no tax is owed.

Form Submission Methods

The ct eitc seq 2018 can be submitted through various methods, including:

- Online: Many taxpayers choose to file electronically using tax software that supports e-filing.

- By Mail: Completed forms can be printed and sent to the appropriate address provided in the form instructions.

- In-Person: Taxpayers may also visit local tax offices for assistance and submission.

IRS Guidelines for EITC

The Internal Revenue Service (IRS) provides guidelines for claiming the EITC, which include:

- Understanding the eligibility requirements and income limits.

- Maintaining accurate records of income and expenses.

- Filing the tax return by the due date to avoid penalties.

Key Elements of the EITC Form

Important elements of the ct eitc seq 2018 include:

- Personal Information: Taxpayer's name, address, and Social Security number.

- Income Information: Details regarding earned income and any other applicable income sources.

- Qualifying Children: Information about any children who meet the criteria for the credit.

- Signature: A declaration that the information provided is accurate and complete.

Quick guide on how to complete 2016 ct seq 2018 2019 form

Your assistance manual on how to prepare your Eitc Forms From The Print Out

If you're curious about how to establish and submit your Eitc Forms From The Print Out, here are some straightforward instructions to make tax filing signNowly simpler.

To start, you merely need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that permits you to modify, draft, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and revert to amend information as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Adhere to the steps below to complete your Eitc Forms From The Print Out in a matter of minutes:

- Create your account and start editing PDFs within moments.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Eitc Forms From The Print Out in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to add your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save edits, print your copy, submit it to your recipient, and download it to your device.

Make use of this manual to electronically file your taxes with airSlate SignNow. It is important to remember that submitting in paper can elevate return errors and postpone refunds. Naturally, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2016 ct seq 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the 2016 ct seq 2018 2019 form

How to generate an electronic signature for the 2016 Ct Seq 2018 2019 Form in the online mode

How to create an eSignature for your 2016 Ct Seq 2018 2019 Form in Google Chrome

How to generate an electronic signature for putting it on the 2016 Ct Seq 2018 2019 Form in Gmail

How to generate an eSignature for the 2016 Ct Seq 2018 2019 Form right from your mobile device

How to make an electronic signature for the 2016 Ct Seq 2018 2019 Form on iOS devices

How to generate an electronic signature for the 2016 Ct Seq 2018 2019 Form on Android OS

People also ask

-

What are Eitc Forms From The Print Out and how can they be used?

Eitc Forms From The Print Out are essential documents for claiming the Earned Income Tax Credit (EITC). These forms can be conveniently filled out and signed using airSlate SignNow, ensuring a hassle-free submission process. Our platform simplifies the handling of EITC forms, making it easier for individuals and businesses to manage their tax documents.

-

How does airSlate SignNow help with Eitc Forms From The Print Out?

airSlate SignNow streamlines the process of preparing and eSigning Eitc Forms From The Print Out. Our user-friendly interface allows you to quickly upload, edit, and send these forms for signature, helping you save time and avoid errors. With our solution, managing your EITC claims has never been easier.

-

Is there a cost associated with using airSlate SignNow for Eitc Forms From The Print Out?

Yes, airSlate SignNow offers various pricing plans to accommodate different user needs, starting from a free trial. For those who frequently handle Eitc Forms From The Print Out, our subscription plans provide excellent value with features designed to enhance productivity. Explore our pricing page to find the plan that best suits your requirements.

-

Can I integrate airSlate SignNow with other software for managing Eitc Forms From The Print Out?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and more, allowing you to manage Eitc Forms From The Print Out effortlessly. These integrations enhance your workflow, making it easier to access and store your documents in one place.

-

What features does airSlate SignNow offer for handling Eitc Forms From The Print Out?

airSlate SignNow provides a range of features specifically designed for Eitc Forms From The Print Out, including customizable templates, secure eSignature options, and real-time tracking. These tools help ensure your documents are completed accurately and efficiently, reducing the likelihood of delays in your EITC claim.

-

Are Eitc Forms From The Print Out secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We utilize industry-standard encryption and compliance with regulations to protect your Eitc Forms From The Print Out. You can trust that your sensitive information is safe while using our eSignature platform.

-

How can I track the status of my Eitc Forms From The Print Out sent for signing?

With airSlate SignNow, you can easily track the status of your Eitc Forms From The Print Out through our dashboard. You'll receive real-time notifications when the document is viewed, signed, or completed, allowing you to stay informed throughout the signing process.

Get more for Eitc Forms From The Print Out

- Fw 001 gc 79693123 form

- Admission form format 5440991

- Contractor safety agreement form

- Fast advisor agreement template form

- Featured artist agreement template form

- Featured or side artist agreement template form

- Fedramp interconnection security agreement template form

- Feasibility study agreement template form

Find out other Eitc Forms From The Print Out

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors