Rev 1117 Instructions for Form OS 114, Connecticut 2019

Eligibility Criteria for the Form CT EITC SEQ

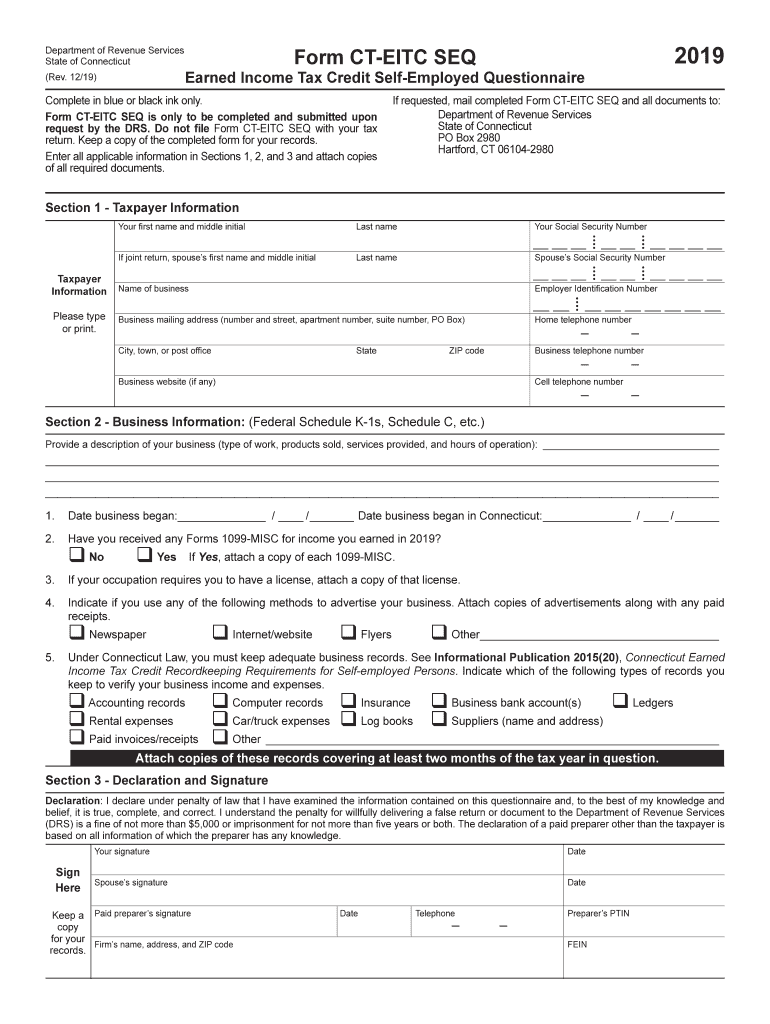

To qualify for the Connecticut Earned Income Tax Credit (EITC), applicants must meet specific eligibility criteria. These criteria include having earned income from employment or self-employment, filing a federal tax return, and having a valid Social Security number. Additionally, applicants must meet income limits based on their filing status and the number of qualifying children. For those who are self-employed, it is essential to report all income accurately and maintain proper documentation to support the claim.

Steps to Complete the Form CT EITC SEQ

Completing the Form CT EITC SEQ involves several key steps. First, gather all necessary documentation, including your federal tax return and proof of income. Next, accurately fill out the form, ensuring that all required fields are completed. Pay special attention to the sections that ask for your income details and any qualifying children. After completing the form, review it carefully for any errors before submission. Finally, submit the form electronically or via mail, depending on your preference.

Form Submission Methods

The Form CT EITC SEQ can be submitted through various methods to ensure convenience for taxpayers. You can file the form electronically using approved tax software or through the Connecticut Department of Revenue Services (DRS) website. Alternatively, you may choose to print the completed form and mail it to the appropriate address provided in the instructions. Ensure that you keep a copy of the submitted form for your records.

Key Elements of the Form CT EITC SEQ

The Form CT EITC SEQ includes several key elements that are crucial for determining eligibility and calculating the credit amount. These elements consist of personal information such as your name, address, and Social Security number. The form also requires details about your income, including wages, self-employment earnings, and any other sources of income. Additionally, you must provide information about qualifying children, if applicable, including their names and Social Security numbers.

Legal Use of the Form CT EITC SEQ

The Form CT EITC SEQ is legally binding and must be completed accurately to ensure compliance with state tax laws. By submitting this form, you declare that the information provided is true and accurate to the best of your knowledge. Misrepresentation or failure to provide accurate information can lead to penalties, including fines or denial of the tax credit. It is advisable to consult with a tax professional if you have questions about the legal implications of filing this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT EITC SEQ are aligned with the federal tax filing deadlines. Typically, the deadline for submitting your tax return, including the EITC claim, is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates to avoid late filing penalties.

Quick guide on how to complete rev 1117 instructions for form os 114 connecticut

Complete Rev 1117 Instructions For Form OS 114, Connecticut effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly without delays. Manage Rev 1117 Instructions For Form OS 114, Connecticut on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to modify and eSign Rev 1117 Instructions For Form OS 114, Connecticut effortlessly

- Find Rev 1117 Instructions For Form OS 114, Connecticut and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Rev 1117 Instructions For Form OS 114, Connecticut to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rev 1117 instructions for form os 114 connecticut

Create this form in 5 minutes!

How to create an eSignature for the rev 1117 instructions for form os 114 connecticut

How to create an eSignature for your Rev 1117 Instructions For Form Os 114 Connecticut online

How to generate an electronic signature for the Rev 1117 Instructions For Form Os 114 Connecticut in Chrome

How to make an eSignature for putting it on the Rev 1117 Instructions For Form Os 114 Connecticut in Gmail

How to create an eSignature for the Rev 1117 Instructions For Form Os 114 Connecticut straight from your smartphone

How to make an eSignature for the Rev 1117 Instructions For Form Os 114 Connecticut on iOS

How to make an eSignature for the Rev 1117 Instructions For Form Os 114 Connecticut on Android OS

People also ask

-

What is the form ct eitc seq and how is it used?

The form ct eitc seq is an essential document for claiming the Connecticut Earned Income Tax Credit (EITC). It helps individuals and families determine their eligibility and calculate the amount of the credit they may receive. Using airSlate SignNow, you can easily fill out and eSign this form, ensuring a smooth submission process for your tax filing.

-

How can airSlate SignNow help with filling out the form ct eitc seq?

With airSlate SignNow, users can streamline the process of completing the form ct eitc seq by accessing user-friendly templates and guided features. The platform simplifies data input, ensuring that all necessary information is accurately captured. Additionally, eSigning features allow for quick approvals and submissions directly from your devices.

-

Is airSlate SignNow a cost-effective solution for managing the form ct eitc seq?

Yes, airSlate SignNow offers a budget-friendly solution for managing the form ct eitc seq without compromising on quality. With competitive pricing plans, businesses can choose an option that best fits their needs while enjoying premium features like unlimited eSignatures and document storage. This cost-effectiveness makes it ideal for tax preparers and individuals alike.

-

What integrations does airSlate SignNow offer for enhancing the form ct eitc seq process?

airSlate SignNow integrates seamlessly with various applications, allowing you to enhance the process of managing the form ct eitc seq. These integrations include cloud storage platforms and customer relationship management (CRM) tools that can simplify document sharing and collaboration. This connectivity helps users handle their tax documentation more efficiently.

-

What features does airSlate SignNow provide for electronic signatures on the form ct eitc seq?

airSlate SignNow includes robust features for electronic signatures on the form ct eitc seq, ensuring a legally binding and secure signing process. Users can sign documents anywhere, anytime, using any device. The platform also provides authentication options to safeguard sensitive information, making it a secure choice for tax-related documents.

-

Can I access the form ct eitc seq on multiple devices with airSlate SignNow?

Absolutely! airSlate SignNow allows users to access the form ct eitc seq on multiple devices, including desktops, tablets, and smartphones. This flexibility ensures that you can complete, eSign, and share your tax documents whenever it suits you. The cloud-based interface means you can continue working seamlessly across devices.

-

How quickly can I prepare and send the form ct eitc seq using airSlate SignNow?

Preparing and sending the form ct eitc seq with airSlate SignNow can be done in just a few minutes. The intuitive platform guides users through the necessary steps, allowing for quick data entry and immediate eSigning. This speed helps individuals meet deadlines without the hassle of traditional paper processes.

Get more for Rev 1117 Instructions For Form OS 114, Connecticut

- Application for hoosier healthwise benefitscheckup form

- Adap colorado form

- Wet wild application form

- Declaration owner of a pleasre craft is unable to provide a copy of the bill of sale canada evidence act pdf form

- Parental permission single activity form girl scout council of the gscnc

- Import declaration form idf

- Amerigroup disclosure of ownership and control interest statement form

- Guidelines for completion of form w8 ben aj bell youinvest

Find out other Rev 1117 Instructions For Form OS 114, Connecticut

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement