Ct 706 Form 2020

What is the Ct 706 Form

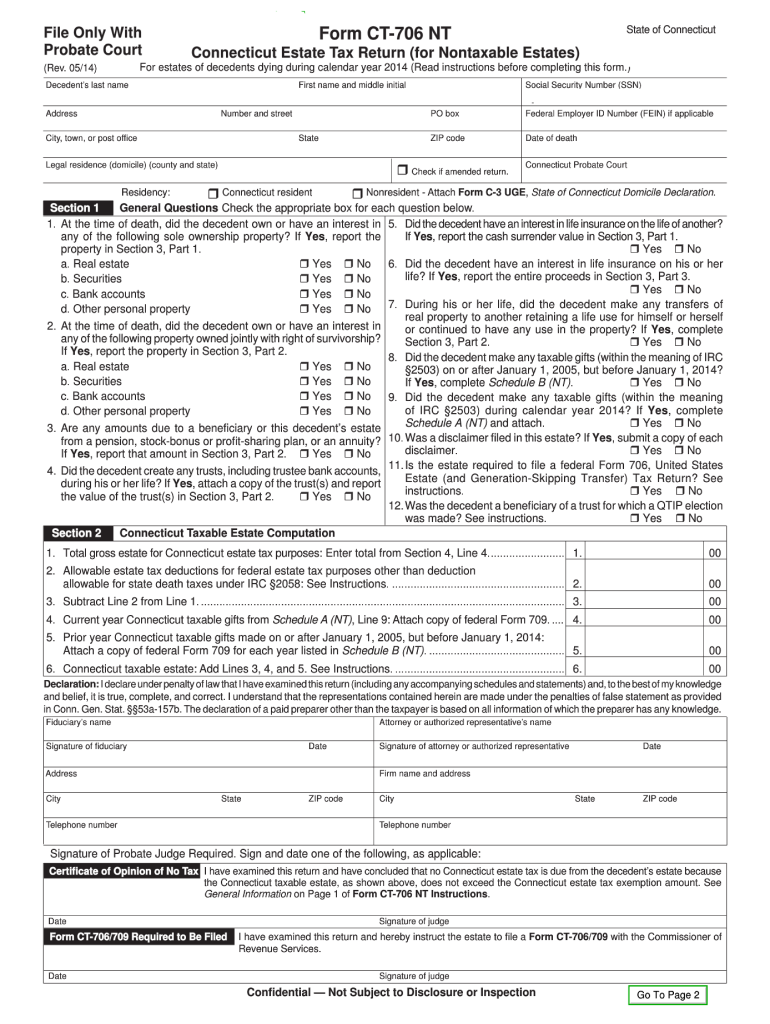

The Ct 706 Form, also known as the Connecticut Estate Tax Return, is a crucial document used for reporting the estate tax liability of a deceased individual in the state of Connecticut. This form is required when the gross estate exceeds a certain threshold, which is subject to change based on state regulations. The form helps the state assess the taxes owed on the estate before it can be distributed to heirs. Understanding the purpose and requirements of the Ct 706 Form is essential for executors and administrators managing an estate.

How to use the Ct 706 Form

Using the Ct 706 Form involves several steps to ensure accurate completion and compliance with state tax laws. First, gather all necessary documentation related to the deceased's assets, liabilities, and any previous tax filings. Next, complete the form by accurately reporting the value of the estate, including real estate, personal property, and financial accounts. It is important to follow the instructions provided with the form carefully, as any errors can lead to delays or penalties. Once completed, the form must be submitted to the Connecticut Department of Revenue Services along with any required payment for taxes owed.

Steps to complete the Ct 706 Form

Completing the Ct 706 Form involves a systematic approach to ensure all information is accurately reported. Here are the key steps:

- Gather necessary documents such as wills, trust documents, and financial statements.

- Determine the gross estate value by assessing all assets and liabilities.

- Fill out the form, ensuring that each section is completed according to the instructions.

- Calculate the estate tax due based on the applicable rates and exemptions.

- Review the completed form for accuracy and completeness before submission.

- Submit the form and payment to the Connecticut Department of Revenue Services by the specified deadline.

Legal use of the Ct 706 Form

The legal use of the Ct 706 Form is governed by Connecticut state law, which mandates its submission for estates exceeding the threshold value. Filing this form is a legal requirement that ensures compliance with state estate tax regulations. Failure to file the Ct 706 Form can result in penalties, interest on unpaid taxes, and potential legal complications for the estate's executor. It is crucial for individuals handling estates to understand the legal implications of this form to avoid non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 706 Form are critical to ensure compliance with state tax laws. Generally, the form must be filed within six months of the date of death of the decedent. Extensions may be available under certain circumstances, but they must be requested formally. It is important to keep track of these deadlines to avoid late fees and penalties. Executors should also be aware of any changes in deadlines that may occur due to state law updates.

Required Documents

To successfully complete the Ct 706 Form, several documents are required. These typically include:

- The deceased's will and any trust documents.

- Financial statements detailing assets such as bank accounts, investments, and real estate.

- Documentation of debts and liabilities owed by the estate.

- Previous tax returns, if applicable, to assist in determining the estate's tax obligations.

Having these documents readily available will facilitate a smoother completion process for the Ct 706 Form.

Examples of using the Ct 706 Form

Examples of scenarios where the Ct 706 Form is utilized include estates with significant real estate holdings, large financial portfolios, or those with complex family structures. For instance, if an individual passes away leaving behind a house valued at $500,000 and various investments totaling $300,000, the executor would need to file the Ct 706 Form to report the estate's total value and calculate any tax liability. Each estate is unique, and understanding how to apply the Ct 706 Form to specific situations is essential for proper estate management.

Quick guide on how to complete ct 706 2014 form

Complete Ct 706 Form effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documentation, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Ct 706 Form on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-focused workflow right now.

How to modify and electronically sign Ct 706 Form with ease

- Locate Ct 706 Form and click on Get Form to begin.

- Employ the tools provided to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Ct 706 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 706 2014 form

Create this form in 5 minutes!

How to create an eSignature for the ct 706 2014 form

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Ct 706 Form?

The Ct 706 Form is used in Connecticut to report and calculate the Connecticut estate tax. This form is essential for executors and administrators of estates to ensure compliance with state tax laws. Understanding the Ct 706 Form is crucial for proper estate management.

-

How can airSlate SignNow help with the Ct 706 Form?

airSlate SignNow allows users to easily eSign and send the Ct 706 Form securely. Our platform simplifies the process of managing estate documents, enabling you to gather necessary signatures quickly. With airSlate SignNow, completing tax forms like the Ct 706 becomes seamless.

-

What are the key features of airSlate SignNow for handling the Ct 706 Form?

Key features of airSlate SignNow include customizable templates, secure cloud storage, and the ability to track document status in real time. These features enhance the efficiency of handling the Ct 706 Form by reducing manual errors and ensuring timely submission. Our platform is designed for ease of use, making your filing process smoother.

-

Is there a cost associated with using airSlate SignNow for the Ct 706 Form?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. Users can choose from various subscription levels that provide access to all necessary features for managing documents like the Ct 706 Form. We also offer a free trial, allowing you to test our services before committing.

-

Can I integrate airSlate SignNow with other applications for the Ct 706 Form?

Absolutely! airSlate SignNow integrates with many popular applications, allowing for a streamlined workflow. Whether you're using accounting software or document management systems, you can easily incorporate the Ct 706 Form into your existing process. This integration enhances collaboration and efficiency.

-

What are the benefits of using airSlate SignNow for the Ct 706 Form?

Using airSlate SignNow for the Ct 706 Form increases efficiency and reduces the time spent on document management. Our intuitive platform enables quick eSigning and document sharing, ensuring that all parties can complete their roles without delay. This means less hassle and a smoother filing process.

-

Is my information secure when using airSlate SignNow for the Ct 706 Form?

Yes, security is a top priority at airSlate SignNow. We implement industry-leading encryption and safeguards to protect your information while handling the Ct 706 Form. You can be confident that your sensitive data is secure during the entire process.

Get more for Ct 706 Form

Find out other Ct 706 Form

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now