Amended Form 2019

What is the Amended Form?

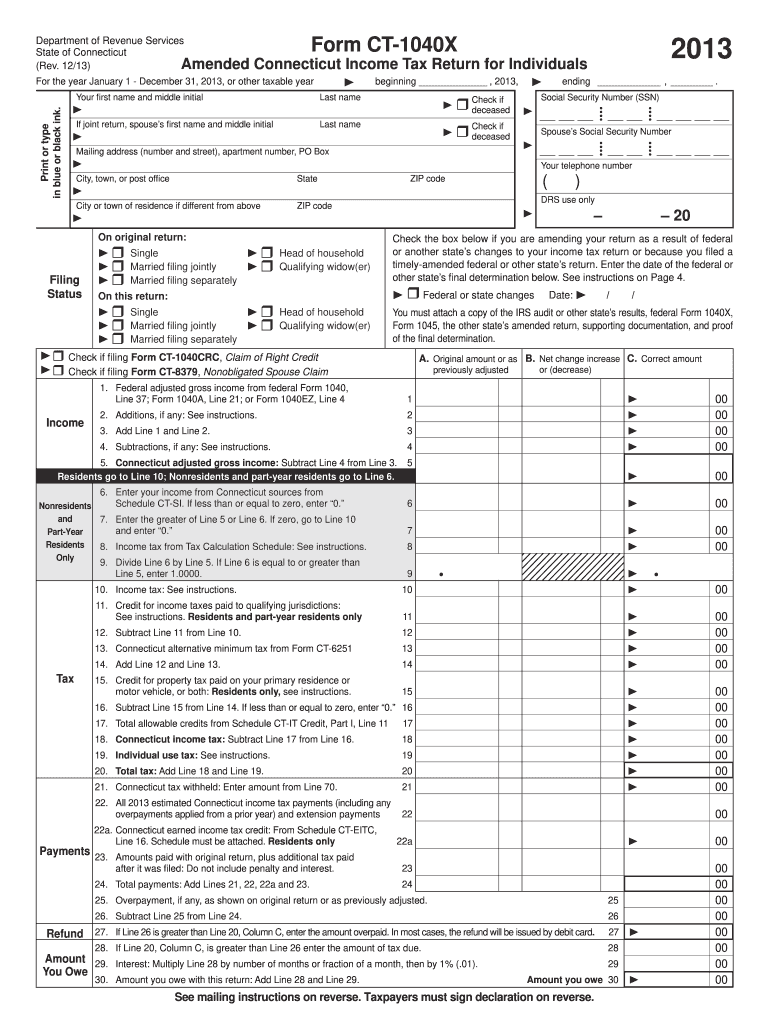

The 2013 Form 1040X is the official document used by taxpayers in the United States to amend their federal income tax returns. This form allows individuals to correct errors or make changes to their previously filed tax returns for the 2013 tax year. Common reasons for filing an amended return include correcting income, changing filing status, or claiming additional deductions or credits that were missed initially. Understanding the purpose of the Form 1040X is essential for ensuring accurate tax reporting and compliance with IRS regulations.

How to Use the Amended Form

Using the 2013 Form 1040X involves a few straightforward steps. First, obtain a copy of the form, which can be downloaded from the IRS website or filled out using digital tools. Next, complete the form by providing your personal information, including your name, address, and Social Security number. Indicate the tax year you are amending and explain the changes being made in the designated section. It is important to include any necessary supporting documents, such as W-2s or other forms that justify the amendments. Finally, submit the completed form to the IRS either by mail or electronically, depending on the options available for your situation.

Steps to Complete the Amended Form

Completing the 2013 Form 1040X requires careful attention to detail. Begin by filling in your personal information at the top of the form. Then, in Part I, check the box indicating the reason for your amendment. In Part II, provide the corrected amounts for your income, deductions, and credits. Ensure that you clearly explain the changes in Part III, as this helps the IRS understand your amendments. After reviewing your entries for accuracy, sign and date the form. If you are filing jointly, your spouse must also sign. Keep a copy of the completed form for your records.

IRS Guidelines

The IRS has specific guidelines regarding the use of the 2013 Form 1040X. It is crucial to file the amended return within three years from the original due date of the return, or within two years from the date you paid the tax, whichever is later. The IRS also recommends that taxpayers wait until they receive their original refund before filing an amendment, as this can streamline the process. Additionally, taxpayers should not file a Form 1040X to correct math errors, as the IRS automatically corrects these. Familiarizing yourself with these guidelines can help ensure a smooth amendment process.

Filing Deadlines / Important Dates

When filing the 2013 Form 1040X, it is important to be aware of key deadlines. Generally, the deadline for amending a tax return is three years from the original filing date, which means that for the 2013 tax year, the deadline would be April 15, 2017. However, if you are claiming a refund, the two-year rule from the date of payment applies. It is advisable to file as early as possible to avoid missing these deadlines and to ensure that any refunds are processed in a timely manner.

Form Submission Methods

The 2013 Form 1040X can be submitted to the IRS through various methods. Taxpayers have the option to file the form by mail or electronically, depending on their circumstances. If filing by mail, it is important to send the form to the correct IRS address, which varies based on your state of residence. For those using digital tools, e-filing options may be available, allowing for a quicker processing time. Regardless of the method chosen, ensure that you keep a copy of the submitted form and any supporting documents for your records.

Quick guide on how to complete 2013 amended form

Complete Amended Form effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Amended Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and electronically sign Amended Form without hassle

- Obtain Amended Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Amended Form and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 amended form

Create this form in 5 minutes!

How to create an eSignature for the 2013 amended form

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the 2013 form 1040x and why might I need it?

The 2013 form 1040x is used to amend your previously filed tax return for that year. You might need it if you discover errors or omissions in your original filing that could change your tax liability. This ensures your tax records are accurate and complete.

-

How can airSlate SignNow help me with the 2013 form 1040x?

airSlate SignNow simplifies the process of completing and eSigning the 2013 form 1040x. With our platform, you can easily upload, fill out, and send your amendment securely, ensuring that all signatures are captured electronically and efficiently.

-

Is there a cost associated with using airSlate SignNow for the 2013 form 1040x?

Yes, airSlate SignNow offers various pricing plans depending on your needs. Our services are cost-effective and designed to provide excellent value, especially for users needing to manage documents like the 2013 form 1040x efficiently.

-

What features should I look for when completing the 2013 form 1040x?

When completing the 2013 form 1040x, look for features that allow easy editing, eSigning, and real-time collaboration. airSlate SignNow offers these features, making it easier to amend your tax return with the necessary adjustments.

-

Does airSlate SignNow integrate with accounting software for the 2013 form 1040x?

Yes, airSlate SignNow seamlessly integrates with various accounting software platforms, enhancing your workflow when managing documents like the 2013 form 1040x. This integration helps streamline data transfer and reduces the chances of errors.

-

Can I store my completed 2013 form 1040x securely in airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for your completed documents, including the 2013 form 1040x. This ensures that your sensitive information is protected and easily accessible whenever you need it.

-

How can I track the status of my 2013 form 1040x after sending it for eSignature?

With airSlate SignNow, you can easily track the status of your sent 2013 form 1040x. Our platform provides real-time notifications and updates, so you know when your document has been viewed, signed, or completed.

Get more for Amended Form

Find out other Amended Form

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free