Www Taxformfinder Org Forms 2021State of Connecticut Form CT1040X Amended Connecticut 2021

Key elements of the Connecticut 1040X

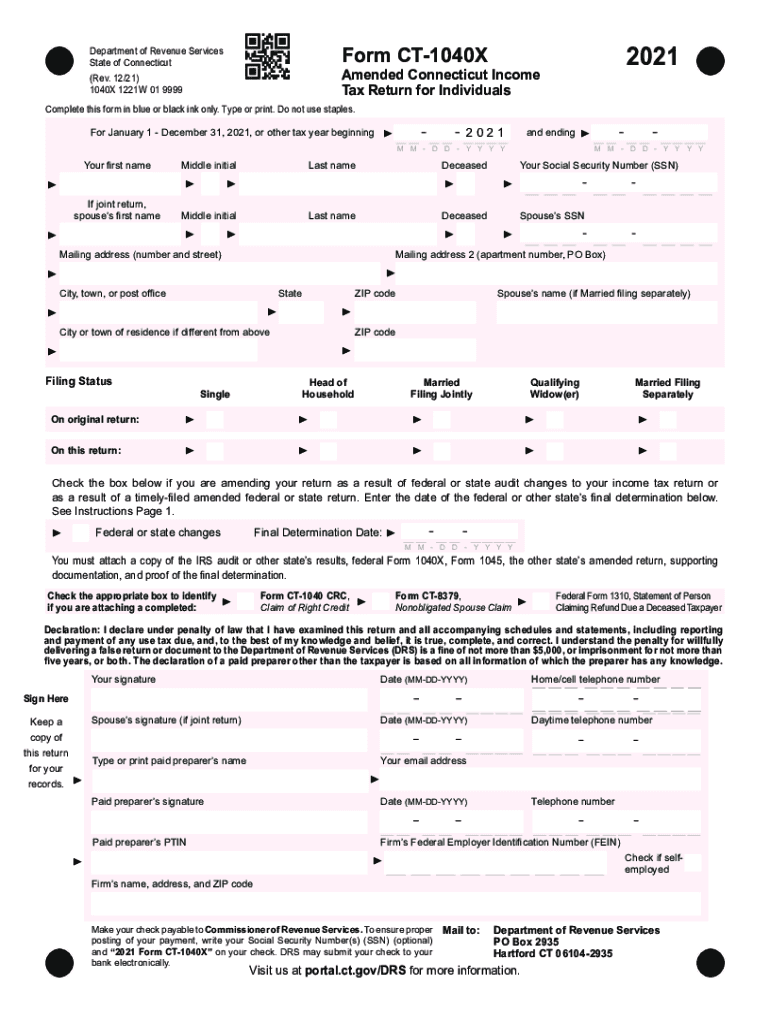

The Connecticut 1040X is the official form used to amend a previously filed Connecticut income tax return. It allows taxpayers to correct errors, update information, or claim additional deductions or credits. Key elements of the form include:

- Taxpayer Information: This section requires your name, address, and Social Security number.

- Original Return Details: You must provide information from your original return, including the tax year and filing status.

- Amended Information: Clearly indicate the changes being made, including adjustments to income, deductions, and credits.

- Reason for Amendment: A brief explanation of why you are amending your return is necessary.

Steps to complete the Connecticut 1040X

Filling out the Connecticut 1040X involves several steps to ensure accuracy and compliance. Follow these steps to complete the form effectively:

- Gather your original tax return and any supporting documents related to the changes.

- Fill in your personal information at the top of the form.

- Provide details from your original return, including the amounts reported.

- Make the necessary adjustments in the amended sections, clearly indicating increases or decreases.

- Explain the reason for your amendment in the designated area.

- Review the completed form for accuracy before submitting.

Filing Deadlines / Important Dates

Understanding the deadlines for filing the Connecticut 1040X is crucial to avoid penalties. The amended return must be filed within three years from the original due date of the return or within two years from the date you paid the tax, whichever is later. Keep these important dates in mind:

- Original return due date: April 15 of the tax year.

- Deadline for filing the 1040X: Three years from the original due date.

Form Submission Methods

You can submit the Connecticut 1040X through various methods to ensure it reaches the appropriate tax authority. The submission options include:

- By Mail: Send the completed form to the address specified in the instructions.

- Online Submission: If using e-filing software, ensure it supports the Connecticut 1040X.

- In-Person: Visit a local Department of Revenue Services office for assistance.

Legal use of the Connecticut 1040X

The Connecticut 1040X is legally recognized as a valid method for amending your tax return. To ensure its legal standing, follow these guidelines:

- Ensure all information is accurate and complete.

- Sign and date the form before submission.

- Retain copies of the amended return and any supporting documentation for your records.

Who Issues the Form

The Connecticut 1040X is issued by the Connecticut Department of Revenue Services (DRS). This agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. For any updates or changes to the form, refer to the DRS website or contact their office directly.

Quick guide on how to complete wwwtaxformfinderorg forms 2021state of connecticut form ct1040x 2021 amended connecticut

Complete Www taxformfinder org Forms 2021State Of Connecticut Form CT1040X Amended Connecticut seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Www taxformfinder org Forms 2021State Of Connecticut Form CT1040X Amended Connecticut on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Www taxformfinder org Forms 2021State Of Connecticut Form CT1040X Amended Connecticut effortlessly

- Obtain Www taxformfinder org Forms 2021State Of Connecticut Form CT1040X Amended Connecticut and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from the device of your choice. Edit and eSign Www taxformfinder org Forms 2021State Of Connecticut Form CT1040X Amended Connecticut and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxformfinderorg forms 2021state of connecticut form ct1040x 2021 amended connecticut

Create this form in 5 minutes!

People also ask

-

What is the Connecticut 1040X form and why do I need it?

The Connecticut 1040X form is used to amend your previously filed Connecticut income tax return. You might need it if you discover mistakes or omissions in your tax return, such as incorrect income, deductions, or credits. Filing a Connecticut 1040X allows you to correct these errors and ensure your tax obligations are met accurately.

-

How can airSlate SignNow help me with the Connecticut 1040X process?

airSlate SignNow streamlines the process of completing and submitting your Connecticut 1040X by allowing you to eSign documents securely. This ensures that your amended tax return is submitted promptly, reducing the risk of delays. Plus, with its user-friendly interface, you can easily manage your documents all in one place.

-

What are the key features of airSlate SignNow for handling tax forms like the Connecticut 1040X?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, and real-time document tracking. These functionalities are essential for efficiently preparing and managing your Connecticut 1040X and other tax documents. You can also collaborate with tax professionals within the platform to ensure accurate filing.

-

Is there a cost associated with using airSlate SignNow for my Connecticut 1040X?

Yes, airSlate SignNow operates on a subscription-based pricing model. However, the cost is often considered reasonable for the value it provides, especially when managing important documents like your Connecticut 1040X. There are different plans available depending on your needs, ensuring flexibility for users.

-

Can I integrate airSlate SignNow with other applications to manage my Connecticut 1040X?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, including accounting software and cloud storage services. This functionality allows you to easily connect your tools and manage your Connecticut 1040X as part of your overall document workflow.

-

What benefits does airSlate SignNow offer for electronically signing the Connecticut 1040X?

Using airSlate SignNow to eSign your Connecticut 1040X offers signNow benefits including speed, security, and convenience. Electronic signatures are legally recognized, ensuring that your amended tax return is valid. Additionally, you can eSign from anywhere, making the filing process quick and hassle-free.

-

Are there any security measures in place when using airSlate SignNow for sensitive documents like the Connecticut 1040X?

Yes, airSlate SignNow prioritizes the security of your documents. It employs advanced encryption and secure cloud storage to protect sensitive information, such as that contained in the Connecticut 1040X. You can trust that your data is safe while using our platform.

Get more for Www taxformfinder org Forms 2021State Of Connecticut Form CT1040X Amended Connecticut

- Objection name change form

- Petition for change of name north dakota form

- North dakota name change form

- Nd change 497317740 form

- Affidavit regarding publication and objection for name change north dakota form

- Order of name change north dakota form

- North dakota unsecured installment payment promissory note for fixed rate north dakota form

- North dakota installments fixed rate promissory note secured by residential real estate north dakota form

Find out other Www taxformfinder org Forms 2021State Of Connecticut Form CT1040X Amended Connecticut

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement