Form CT?1040X 2019

What is the Form CT-1040X?

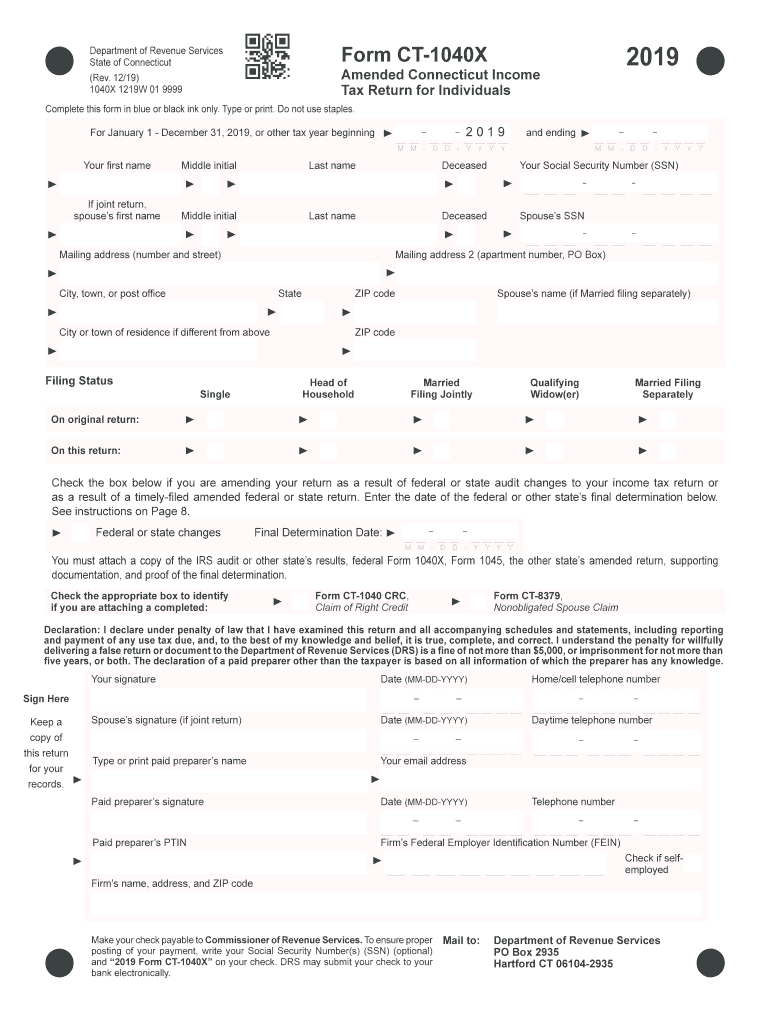

The Form CT-1040X is an amended individual income tax return used by residents of Connecticut to correct errors or make changes to their previously filed Connecticut income tax returns. This form allows taxpayers to adjust their income, deductions, credits, and any other relevant information that may affect their tax liability. It is essential for ensuring that the tax records are accurate and up to date, which can help avoid potential penalties or issues with the Department of Revenue Services.

How to use the Form CT-1040X

To use the Form CT-1040X, taxpayers must first gather their original tax return and any supporting documents that pertain to the changes being made. It is important to clearly indicate the specific items being amended and provide a detailed explanation for each change. The form requires taxpayers to fill out their corrected information and calculate any additional tax owed or refund due. Once completed, the form should be submitted according to the instructions provided by the Department of Revenue Services.

Steps to complete the Form CT-1040X

Completing the Form CT-1040X involves several key steps:

- Obtain a copy of your original CT-1040 tax return.

- Download the CT-1040X form from the Department of Revenue Services website.

- Fill out the form with the corrected information, ensuring to explain the reasons for the amendments.

- Calculate any changes in tax liability, including additional taxes owed or refunds due.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form either online or by mail as instructed.

Legal use of the Form CT-1040X

The legal use of the Form CT-1040X is governed by the regulations set forth by the Connecticut Department of Revenue Services. This form must be used in compliance with state tax laws, and it is important that all amendments are made in good faith and supported by appropriate documentation. Failure to comply with these regulations may result in penalties or legal consequences. It is advisable to consult with a tax professional if there are uncertainties regarding the amendments being made.

Filing Deadlines / Important Dates

When filing the Form CT-1040X, it is crucial to be aware of the deadlines associated with amended returns. Generally, taxpayers must file the form within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Keeping track of these deadlines ensures that any refunds or adjustments are processed in a timely manner, preventing complications with the Department of Revenue Services.

Form Submission Methods (Online / Mail / In-Person)

The Form CT-1040X can be submitted through various methods. Taxpayers may file the form electronically using the online services provided by the Department of Revenue Services, which offers a convenient option for many. Alternatively, the form can be printed and mailed to the appropriate address as specified in the filing instructions. In certain cases, taxpayers may also be able to submit the form in person at designated locations. It is essential to choose the method that best fits individual circumstances and to ensure that the form is submitted correctly.

Quick guide on how to complete form ct1040x

Complete Form CT?1040X effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without obstacles. Handle Form CT?1040X on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign Form CT?1040X without hassle

- Find Form CT?1040X and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form CT?1040X and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct1040x

Create this form in 5 minutes!

How to create an eSignature for the form ct1040x

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the department of revenue services Connecticut CT1040X?

The department of revenue services Connecticut CT1040X is a tax form used for filing an amended Connecticut income tax return. It allows taxpayers to correct any mistakes made on their original CT1040 tax return, ensuring accurate reporting of income and tax liability.

-

How can airSlate SignNow help with the department of revenue services Connecticut CT1040X?

airSlate SignNow streamlines the process of preparing and eSigning the department of revenue services Connecticut CT1040X. Our platform provides an easy-to-use interface for completing forms and securely sending them electronically, reducing paper usage and processing time.

-

Is there a cost associated with using airSlate SignNow for the CT1040X forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to various needs, including individual and business users. These plans provide access to features that simplify the completion and submission of department of revenue services Connecticut CT1040X forms.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow includes features like eSigning, document templates, and real-time collaboration. These tools are highly beneficial for users dealing with the department of revenue services Connecticut CT1040X, ensuring efficient document management and compliance.

-

Can I integrate airSlate SignNow with other accounting software for filing CT1040X?

Yes, airSlate SignNow can be integrated with various accounting and tax preparation software. This integration simplifies the preparation of the department of revenue services Connecticut CT1040X by allowing seamless data transfer between systems.

-

What benefits does airSlate SignNow provide for users filing the CT1040X?

Using airSlate SignNow for the department of revenue services Connecticut CT1040X offers benefits such as reduced turnaround times, improved accuracy, and enhanced security for sensitive tax documents. Users can conveniently eSign and send their amended returns without physical paperwork.

-

Is airSlate SignNow user-friendly for those unfamiliar with tax forms?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible even for those unfamiliar with tax forms like the department of revenue services Connecticut CT1040X. Our intuitive interface provides guidance throughout the document completion process.

Get more for Form CT?1040X

Find out other Form CT?1040X

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation