Form 1040 X Filing Addresses for Taxpayers and Tax IRS 2022

Understanding the Form 1040 X

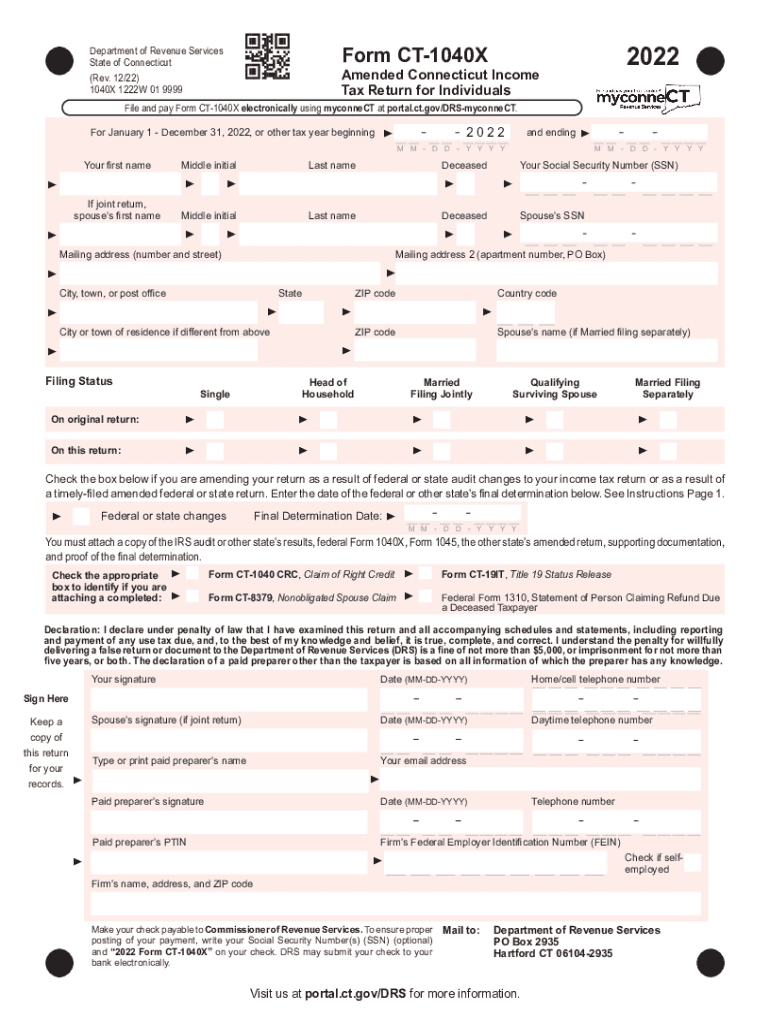

The Form 1040 X is an essential document for taxpayers who need to amend their previously filed tax returns. This form allows individuals to correct errors, claim overlooked deductions, or adjust their filing status. It is crucial to understand that the 1040 X cannot be used to file an original return; it is strictly for amendments. The form can address various tax years, including the ct 2022, ensuring that taxpayers can rectify their filings as needed.

Steps to Complete the Form 1040 X

Completing the Form 1040 X involves several key steps to ensure accuracy and compliance. First, gather all relevant documents, including your original tax return and any supporting documentation for the changes you are making. Next, fill out the form by providing your personal information and detailing the changes in the appropriate sections. It is important to clearly explain the reason for each amendment in the designated area. Finally, review the form for accuracy before submitting it to the IRS.

Filing Deadlines for the Form 1040 X

Timely submission of the Form 1040 X is critical to avoid penalties and ensure compliance with tax regulations. Generally, taxpayers have three years from the original filing deadline to submit an amended return. For the ct 2022, this means you should file by the deadline set for that tax year. Additionally, if you are expecting a refund from your amendment, it is advisable to file as soon as possible to expedite the process.

Legal Use of the Form 1040 X

The legal validity of the Form 1040 X is supported by federal tax laws, allowing taxpayers to amend their returns within the stipulated time frame. To ensure that your amended return is accepted, it is essential to follow all IRS guidelines and provide accurate information. The use of electronic filing methods can enhance the security and efficiency of your submission, making it easier to track your amendment status.

Key Elements of the Form 1040 X

Several key elements are essential when filling out the Form 1040 X. These include your personal information, the tax year being amended, and a clear explanation of the changes being made. Additionally, taxpayers must provide the amounts from the original return, the corrected amounts, and the difference between the two. This clarity helps the IRS process your amendment efficiently and accurately.

Form Submission Methods

Taxpayers have multiple options for submitting the Form 1040 X. You can file the form electronically through approved tax software, which can streamline the process and reduce errors. Alternatively, you can print the completed form and mail it to the appropriate IRS address based on your state of residence. In-person submission is also an option at certain IRS offices, though it is less common.

Quick guide on how to complete form 1040 x filing addresses for taxpayers and tax irs

Complete Form 1040 X Filing Addresses For Taxpayers And Tax IRS effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without holdups. Handle Form 1040 X Filing Addresses For Taxpayers And Tax IRS on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign Form 1040 X Filing Addresses For Taxpayers And Tax IRS with ease

- Find Form 1040 X Filing Addresses For Taxpayers And Tax IRS and click Get Form to commence.

- Utilize the tools provided to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Purge the worry of lost or mismanaged files, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Revise and eSign Form 1040 X Filing Addresses For Taxpayers And Tax IRS while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 x filing addresses for taxpayers and tax irs

Create this form in 5 minutes!

How to create an eSignature for the form 1040 x filing addresses for taxpayers and tax irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with ct 2022?

airSlate SignNow is an electronic signature solution that allows businesses to send and eSign documents seamlessly. With ct 2022, you can enhance your document workflow efficiency and ensure compliance with the latest regulations. This solution is both cost-effective and user-friendly, making it ideal for businesses looking to streamline their processes.

-

What pricing plans does airSlate SignNow offer for ct 2022?

airSlate SignNow provides various pricing plans suitable for different business needs in ct 2022. Whether you're a freelancer or part of a large enterprise, there are flexible options that can cater to your budget and document signing frequency. Each plan includes essential features that enhance your signing experience.

-

Are there any key features in airSlate SignNow related to ct 2022?

Yes, airSlate SignNow includes several key features tailored for ct 2022 users. These features consist of customizable templates, automated workflows, and real-time tracking of documents. This functionality ensures that your signing process is efficient and organized.

-

How does airSlate SignNow ensure security for documents in ct 2022?

AirSlate SignNow employs advanced security measures to protect your documents in ct 2022. This includes encryption, secure data storage, and compliance with industry standards such as GDPR and HIPAA. Thus, you can have peace of mind knowing your sensitive information is safe during the eSigning process.

-

What integrations are available with airSlate SignNow for ct 2022?

airSlate SignNow offers various integrations that enhance the ct 2022 experience. You can easily integrate with popular tools like Google Drive, Dropbox, and Salesforce. These integrations facilitate a smoother workflow, making it easy to manage your documents and eSignatures within your existing platforms.

-

Can airSlate SignNow assist with compliance in ct 2022?

Absolutely, airSlate SignNow is designed to assist businesses in maintaining compliance with ct 2022 regulations. The application keeps an audit trail of all document transactions and provides legally binding signatures. This level of compliance helps protect your business from legal challenges in the future.

-

Is airSlate SignNow user-friendly for beginners in ct 2022?

Yes, airSlate SignNow is exceptionally user-friendly, making it accessible for beginners in ct 2022. The intuitive interface allows users to quickly learn how to send, receive, and sign documents without extensive training. This ease of use is a major benefit for companies looking to adopt digital signing solutions.

Get more for Form 1040 X Filing Addresses For Taxpayers And Tax IRS

Find out other Form 1040 X Filing Addresses For Taxpayers And Tax IRS

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online