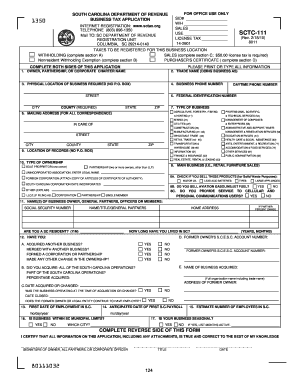

Sctc 111 Form 2020

What is the Sctc 111 Form

The Sctc 111 Form is a specific document used primarily for tax purposes in the United States. It serves as a declaration of certain tax-related information, which may be required by various governmental agencies. Understanding the purpose of this form is essential for individuals and businesses to ensure compliance with tax regulations.

How to use the Sctc 111 Form

Using the Sctc 111 Form involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant financial documents that pertain to the information required on the form. Next, fill out the form carefully, ensuring that all entries are correct and complete. Finally, submit the form according to the specified submission methods, which may include online filing, mailing, or in-person delivery.

Steps to complete the Sctc 111 Form

Completing the Sctc 111 Form requires attention to detail. Here are the steps to follow:

- Review the form instructions to understand the requirements.

- Collect necessary documentation, such as income statements and previous tax returns.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check for any errors or omissions before submission.

- Submit the completed form through the designated method.

Legal use of the Sctc 111 Form

The legal use of the Sctc 111 Form is crucial for ensuring that the information provided is recognized by tax authorities. To be legally binding, the form must be filled out correctly and submitted within the specified deadlines. Additionally, it is important to maintain copies of the submitted form for personal records and potential future audits.

Filing Deadlines / Important Dates

Filing deadlines for the Sctc 111 Form can vary based on individual circumstances, such as the taxpayer's status or the specific tax year. It is essential to be aware of these deadlines to avoid penalties. Typically, forms must be filed by April 15 for individual taxpayers, but extensions may apply in certain situations. Always check for the most current deadlines to ensure compliance.

Required Documents

To complete the Sctc 111 Form, certain documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Previous year’s tax returns for reference.

- Any relevant financial documents that support the information being reported.

Form Submission Methods (Online / Mail / In-Person)

The Sctc 111 Form can be submitted through various methods, making it convenient for users. The options typically include:

- Online submission via designated tax platforms.

- Mailing the completed form to the appropriate tax authority.

- In-person delivery at local tax offices, if applicable.

Quick guide on how to complete sctc 111 form 2010

Effortlessly Prepare Sctc 111 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the correct format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Sctc 111 Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign Sctc 111 Form with Ease

- Obtain Sctc 111 Form and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the specialized tools available from airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Sctc 111 Form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sctc 111 form 2010

Create this form in 5 minutes!

How to create an eSignature for the sctc 111 form 2010

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Sctc 111 Form?

The Sctc 111 Form is a crucial document used for various business processes, particularly in electronic signature environments. It streamlines the signing process, making it easier for businesses to handle their paperwork efficiently with airSlate SignNow.

-

How can I use the Sctc 111 Form with airSlate SignNow?

Using the Sctc 111 Form with airSlate SignNow is simple. Just upload your document, customize the workflow, and send it for signing. The platform allows for easy tracking and management of the Sctc 111 Form throughout the signing process.

-

What features does airSlate SignNow offer for managing the Sctc 111 Form?

airSlate SignNow provides essential features for managing the Sctc 111 Form, including secure eSignature capabilities, document storage, and templates for repetitive processes. These tools enhance productivity and ensure compliance.

-

Is there a cost to use the Sctc 111 Form on airSlate SignNow?

While airSlate SignNow offers a range of pricing plans, using the Sctc 111 Form can be seamlessly integrated into these plans. You can choose from various options depending on your needs, ensuring cost-effectiveness without compromising on features.

-

What are the benefits of using the Sctc 111 Form in airSlate SignNow?

The Sctc 111 Form, when used with airSlate SignNow, provides signNow benefits such as faster processing times, reduced paperwork, and enhanced security features. These advantages lead to improved business efficiency and compliance.

-

Can I integrate the Sctc 111 Form with other software using airSlate SignNow?

Yes, airSlate SignNow allows you to integrate the Sctc 111 Form with a variety of other software applications. This feature enhances your workflow by connecting the signing process with your existing systems for better data management.

-

How does airSlate SignNow ensure the security of the Sctc 111 Form?

airSlate SignNow employs advanced security measures to protect the Sctc 111 Form, including encryption, secure access controls, and compliance with industry standards. This ensures that your documents remain confidential and secure.

Get more for Sctc 111 Form

Find out other Sctc 111 Form

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free