Form 720 Vi

What is the Form 720 Vi

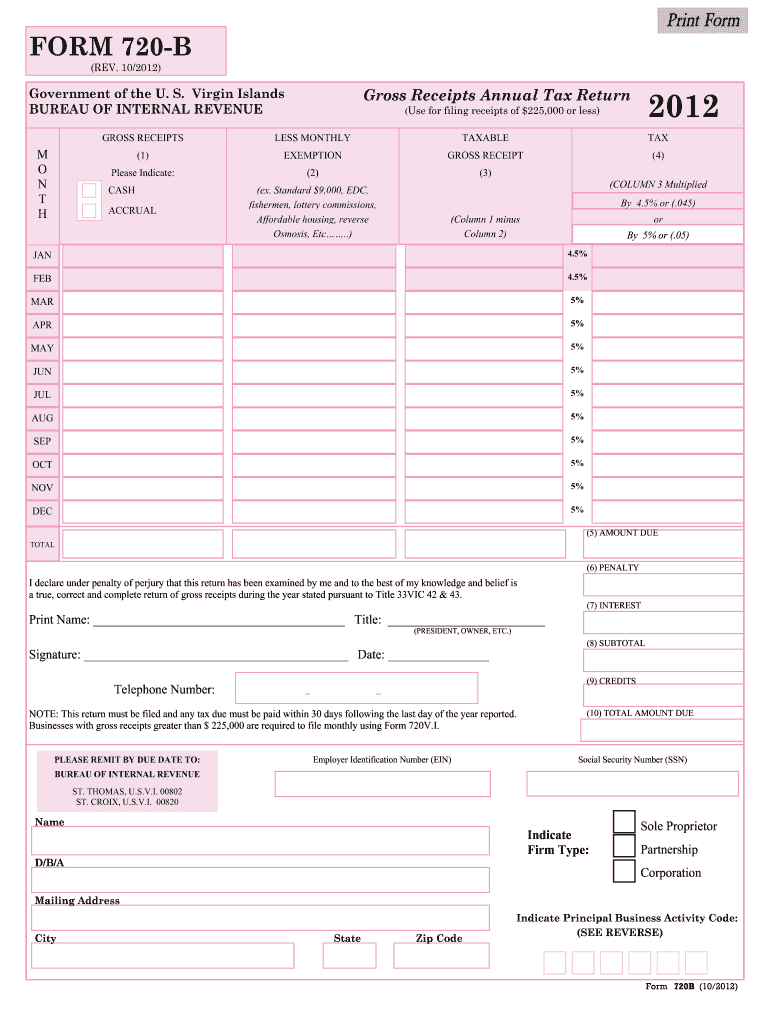

The Form 720 Vi is a tax document used specifically for reporting certain types of income and expenses related to businesses operating in the Virgin Islands. This form is essential for companies that need to comply with local tax regulations. It helps ensure that businesses accurately report their financial activities and pay the appropriate taxes to the Virgin Islands government. Understanding the purpose of this form is crucial for maintaining compliance and avoiding potential penalties.

How to use the Form 720 Vi

Using the Form 720 Vi involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form carefully, ensuring that all information is accurate and complete. It is important to follow the guidelines provided by the Virgin Islands Bureau of Internal Revenue to avoid errors. After completing the form, review it for any mistakes before submitting it either online or by mail, depending on your preference.

Steps to complete the Form 720 Vi

Completing the Form 720 Vi requires attention to detail. Here are the steps to follow:

- Gather necessary documents, such as income statements and receipts for expenses.

- Download the Form 720 Vi from the official Virgin Islands Bureau of Internal Revenue website.

- Fill in your business information, including name, address, and tax identification number.

- Report your income and expenses accurately in the designated sections.

- Double-check all entries for accuracy and completeness.

- Submit the completed form online or mail it to the appropriate tax office.

Legal use of the Form 720 Vi

The legal use of the Form 720 Vi is governed by the tax laws of the Virgin Islands. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated deadlines. Compliance with local tax regulations is crucial, as failure to do so may result in penalties or legal repercussions. Utilizing a reliable eSignature solution can enhance the legal standing of the completed form, ensuring that all signatures are verified and compliant with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720 Vi are critical for compliance. Typically, the form must be submitted by specific dates set by the Virgin Islands Bureau of Internal Revenue. It is essential to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important tax dates can help ensure timely submission. Regularly checking for updates from the Bureau can also provide information on any changes to filing requirements or deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Form 720 Vi can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses prefer to file electronically for convenience and speed.

- Mail Submission: The form can be printed and mailed to the appropriate tax office.

- In-Person Submission: Some businesses may choose to deliver the form directly to the tax office for immediate processing.

Each submission method has its own advantages, so businesses should choose the one that best fits their needs.

Quick guide on how to complete form 720 vi

Easily Prepare Form 720 Vi on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 720 Vi on any platform using airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

Effortlessly Edit and eSign Form 720 Vi

- Locate Form 720 Vi and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and hit the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Alter and eSign Form 720 Vi while ensuring seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 720 vi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 720 vi and how can airSlate SignNow help with it?

The form 720 vi is a tax form used for reporting certain taxes. airSlate SignNow simplifies the process of filling out the form 720 vi by allowing you to electronically sign and send it securely. This streamlines your tax filing process and ensures you meet deadlines efficiently.

-

How much does it cost to use airSlate SignNow for the form 720 vi?

airSlate SignNow offers various pricing plans that cater to different business needs. You can find affordable options that allow you to manage and sign documents like the form 720 vi efficiently. Check our pricing page for specific cost details and choose a plan that suits your requirements.

-

What features does airSlate SignNow provide for managing the form 720 vi?

airSlate SignNow includes features such as document templates, electronic signatures, and customizable workflows specifically for forms like the form 720 vi. These features help you streamline your document management process and ensure compliance with regulatory requirements.

-

Is it easy to integrate airSlate SignNow with other tools for handling the form 720 vi?

Yes, airSlate SignNow easily integrates with various applications and services, making it simple to manage the form 720 vi alongside your existing tools. Whether you use CRMs or document management systems, our integration options help you maintain efficiency and enhance productivity.

-

How does airSlate SignNow ensure the security of my form 720 vi?

airSlate SignNow prioritizes security by employing robust encryption protocols and secure storage for all documents, including the form 720 vi. This ensures that your sensitive information is protected against unauthorized access, giving you peace of mind while you handle important documents.

-

Can I track the status of my form 720 vi with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your documents, including the form 720 vi. You can easily see when your documents have been opened, signed, or completed, allowing you to manage your workflow effectively and stay updated.

-

What are the benefits of using airSlate SignNow for the form 720 vi?

Using airSlate SignNow for the form 720 vi offers numerous benefits, including increased efficiency, reduced paperwork, and improved collaboration. With eSigning capabilities and managed workflows, you can drastically cut down on processing time, making tax reporting much easier.

Get more for Form 720 Vi

- Form ct 247 application for exemption from corporation franchise taxes by a not for profit organization revised 1220

- Environmental compliance certificate form

- 200 piedmont avenue se suite 1712 atlanta ga 30334 9029 form

- 2220 underpayment of estimated tax by corporations form 990

- 2020 instructions for form 1120 s instructions for form 1120 s us income tax return for an s corporation

- Internal revenue service shareholders instructions for form

- 2017 alaska oil and gas facility tax credit form

- Pdf publication 5354 rev 9 2020 internal revenue service form

Find out other Form 720 Vi

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template