Past Due State Taxes, Child Support or Spousal Maintenance, or Debts Owed to Another Arizona State Agency, the IRS, or a Court 2020

Understanding Past Due State Taxes and Related Debts

Past due state taxes, child support, spousal maintenance, or debts owed to another Arizona state agency, the IRS, or a court can significantly impact an individual's financial standing. These obligations must be addressed promptly to avoid further penalties or legal repercussions. In Arizona, these debts can arise from various sources, including unpaid taxes, court-ordered support payments, or fines imposed by state agencies.

Steps to Address Past Due Obligations

To effectively manage past due state taxes and related debts, individuals should follow these steps:

- Identify the specific debts owed, including the amount and the entity to which they are owed.

- Gather all relevant documentation, such as tax returns, court orders, and payment records.

- Contact the appropriate agency or court to discuss payment options or potential resolutions.

- Consider setting up a payment plan if immediate payment is not feasible.

- Keep records of all communications and payments made regarding these debts.

Legal Implications of Unresolved Debts

Failing to address past due state taxes and related debts can lead to serious legal consequences. In Arizona, unresolved debts may result in wage garnishments, liens on property, or even legal action taken by the state or creditors. Understanding the legal framework surrounding these obligations is essential for individuals to protect their rights and financial interests.

Obtaining Information on Past Due Debts

Individuals can obtain information regarding past due state taxes and related debts through various methods:

- Visit the Arizona Department of Revenue website for tax-related inquiries.

- Contact local child support enforcement agencies for information on spousal maintenance or child support obligations.

- Request account statements or payment history from the relevant state agency or court.

Eligibility Criteria for Debt Relief Programs

Arizona offers several programs aimed at assisting individuals with past due state taxes and related debts. Eligibility for these programs often depends on factors such as income level, the nature of the debt, and the individual's financial situation. Individuals should assess their eligibility to determine if they can benefit from available relief options.

Filing Deadlines and Important Dates

Staying informed about filing deadlines and important dates is crucial for individuals managing past due obligations. In Arizona, specific deadlines may apply to tax filings, child support payments, and other legal requirements. Missing these deadlines can result in additional penalties or legal complications.

Required Documentation for Resolution

When addressing past due state taxes and related debts, individuals must prepare the necessary documentation. Commonly required documents include:

- Tax returns for the previous years.

- Court orders related to child support or spousal maintenance.

- Payment records and correspondence with agencies or courts.

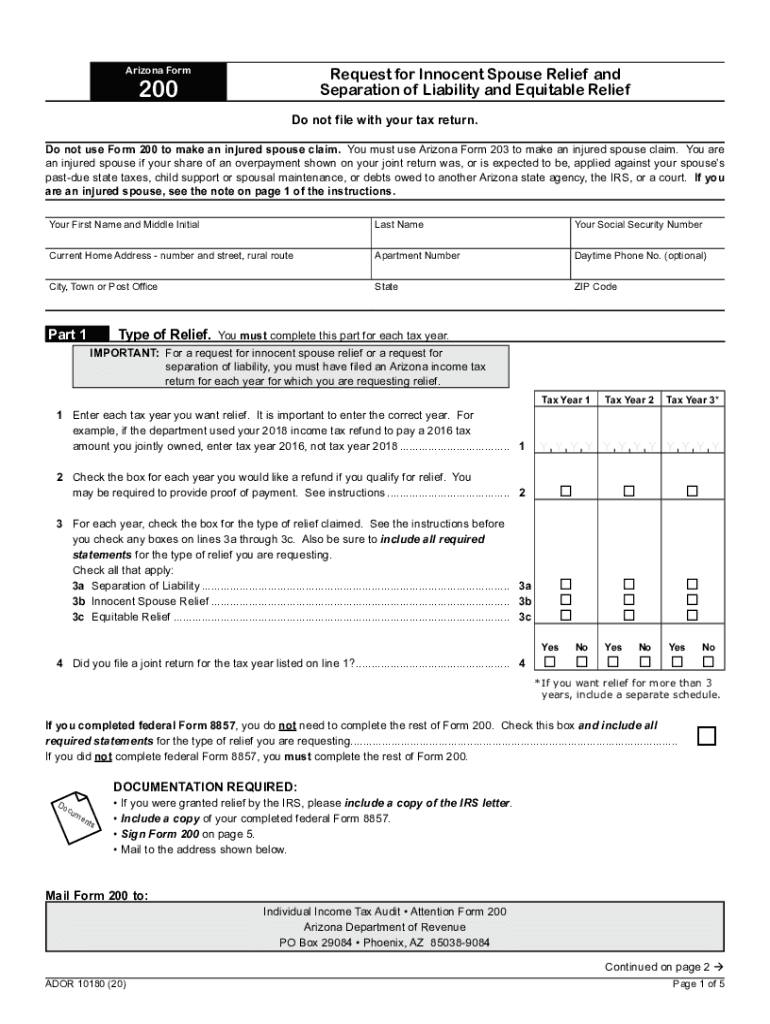

Quick guide on how to complete past due state taxes child support or spousal maintenance or debts owed to another arizona state agency the irs or a court

Complete Past due State Taxes, Child Support Or Spousal Maintenance, Or Debts Owed To Another Arizona State Agency, The IRS, Or A Court effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Past due State Taxes, Child Support Or Spousal Maintenance, Or Debts Owed To Another Arizona State Agency, The IRS, Or A Court on any platform via airSlate SignNow Android or iOS applications and ease any document-related workflow today.

How to modify and eSign Past due State Taxes, Child Support Or Spousal Maintenance, Or Debts Owed To Another Arizona State Agency, The IRS, Or A Court with ease

- Obtain Past due State Taxes, Child Support Or Spousal Maintenance, Or Debts Owed To Another Arizona State Agency, The IRS, Or A Court and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, cumbersome form searching, or mistakes that necessitate reprinting. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Past due State Taxes, Child Support Or Spousal Maintenance, Or Debts Owed To Another Arizona State Agency, The IRS, Or A Court and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct past due state taxes child support or spousal maintenance or debts owed to another arizona state agency the irs or a court

Create this form in 5 minutes!

How to create an eSignature for the past due state taxes child support or spousal maintenance or debts owed to another arizona state agency the irs or a court

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What are ador forms and how do they work?

Ador forms are digital documents that facilitate the collection and management of data online. With airSlate SignNow, you can easily create, customize, and distribute ador forms for any purpose. These forms streamline the process of obtaining information while ensuring security and efficiency.

-

How can ador forms benefit my business?

Ador forms offer several benefits, including increased efficiency and accuracy in data collection. By transitioning to digital forms through airSlate SignNow, businesses can reduce paper usage, minimize errors, and save time. Additionally, ador forms improve customer experience by allowing easy submission from any device.

-

Is there a cost associated with using ador forms on airSlate SignNow?

airSlate SignNow offers flexible pricing plans that include access to ador forms as part of its service. By choosing the right plan for your business needs, you can unlock various features, including unlimited access to ador forms at a competitive price. Explore our plans to find the best fit for your requirements.

-

Can I integrate ador forms with other applications?

Yes, airSlate SignNow allows integration of ador forms with various applications, enhancing your workflow. Popular integrations include CRMs and project management tools, making it easier to sync and manage data across platforms. This ensures that your ador forms work seamlessly within your existing systems.

-

What features are included with ador forms on airSlate SignNow?

Ador forms on airSlate SignNow come equipped with features like customizable templates, real-time collaboration, and electronic signatures. Additionally, you can track responses and gather analytics, ensuring thorough management of data collected through your ador forms. These features make it easier to create user-friendly forms.

-

Are ador forms secure for handling sensitive information?

Absolutely! airSlate SignNow prioritizes security, implementing strong encryption and compliance protocols for ador forms. You can confidently use ador forms to handle sensitive data, knowing that your information is protected. Our platform is designed to safeguard your business and client data at all times.

-

How easy is it to create ador forms in airSlate SignNow?

Creating ador forms in airSlate SignNow is incredibly user-friendly, even for those with minimal technical skills. The platform offers drag-and-drop functionality, allowing you to design forms quickly and efficiently. You can also customize fields and aesthetics to match your brand, making form creation straightforward.

Get more for Past due State Taxes, Child Support Or Spousal Maintenance, Or Debts Owed To Another Arizona State Agency, The IRS, Or A Court

- France individual dt form

- Little league pitch count sheet pdf form

- Empire state child credit instructions form

- Sme direct form new and maintenance mashreq

- Daily safety task instruction examples form

- Wett inspection checklist form

- By the waters of babylon questions pdf form

- Form i 942 instructions instructions for request for reduced fee

Find out other Past due State Taxes, Child Support Or Spousal Maintenance, Or Debts Owed To Another Arizona State Agency, The IRS, Or A Court

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation