Azdor GovformsindividualInnocent Spouse ReliefArizona Department of Revenue AZDOR 2022

What is the Arizona 200 form?

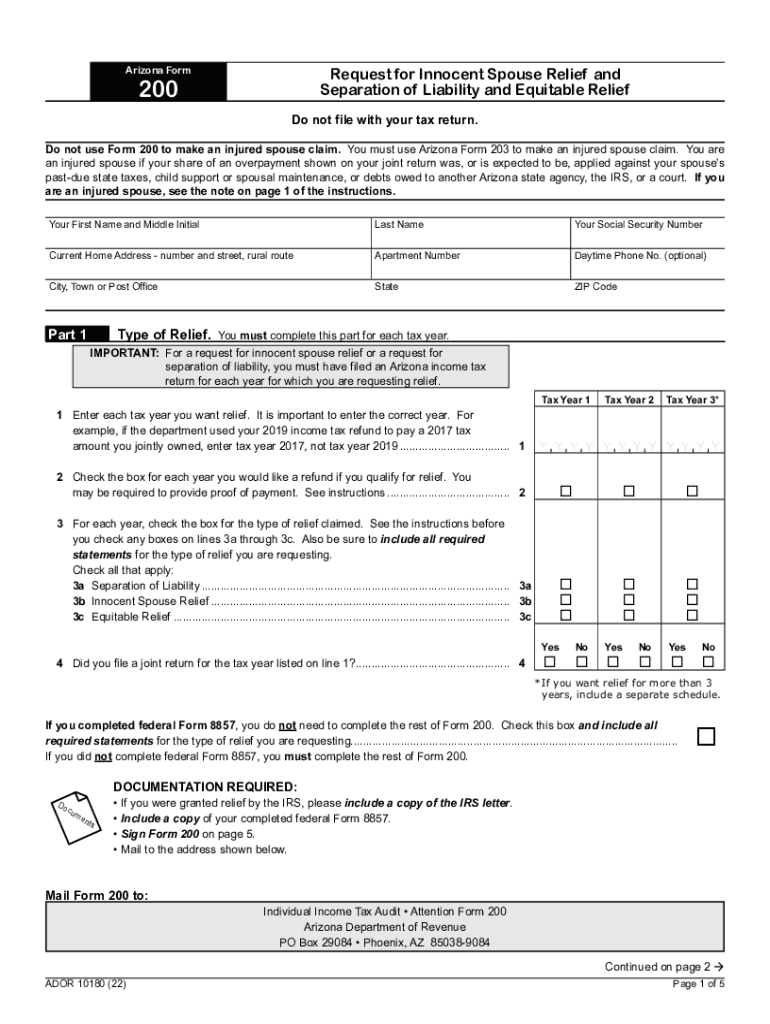

The Arizona 200 form, also known as the Arizona form for Innocent Spouse Relief, is a document used by individuals who seek relief from tax liabilities incurred by a spouse. This form is particularly relevant when one spouse believes they should not be held responsible for taxes owed due to the actions or omissions of the other spouse. The form is submitted to the Arizona Department of Revenue and is crucial for those who wish to separate their tax responsibilities from their spouse's financial actions.

Eligibility Criteria for the Arizona 200 form

To qualify for relief under the Arizona 200 form, certain eligibility criteria must be met. Individuals must demonstrate that they did not know, and had no reason to know, that their spouse was underreporting income or claiming improper deductions. Additionally, the individual must show that it would be unfair to hold them liable for the tax owed. Understanding these criteria is essential for anyone considering filing this form.

Steps to complete the Arizona 200 form

Completing the Arizona 200 form involves several key steps. First, gather all necessary documentation that supports your claim for relief. This may include tax returns, financial records, and any correspondence with the Arizona Department of Revenue. Next, accurately fill out the form, ensuring that all information is complete and truthful. After completing the form, review it for accuracy before submitting it to the appropriate department. Finally, keep a copy of the submitted form and any supporting documents for your records.

Required Documents for the Arizona 200 form

When filing the Arizona 200 form, specific documents are required to support your claim. These may include:

- Copies of joint tax returns filed during the years in question.

- Documentation of any income earned by both spouses.

- Proof of any deductions claimed that may be contested.

- Correspondence with the Arizona Department of Revenue regarding the tax liabilities.

Having these documents ready will streamline the application process and enhance the likelihood of a favorable outcome.

Form Submission Methods for the Arizona 200 form

The Arizona 200 form can be submitted in several ways. Individuals may choose to file the form online through the Arizona Department of Revenue's website. Alternatively, the form can be mailed directly to the department. For those who prefer in-person interactions, visiting a local Arizona Department of Revenue office is also an option. Each submission method has its own guidelines, so it is important to follow the instructions provided for the chosen method.

Legal use of the Arizona 200 form

The Arizona 200 form is legally recognized as a valid request for Innocent Spouse Relief under Arizona tax law. When completed and submitted correctly, it can provide individuals with a means to protect themselves from tax liabilities that they did not incur. It is essential to ensure compliance with all legal requirements when filing this form to avoid any potential complications or rejections from the Arizona Department of Revenue.

Quick guide on how to complete azdorgovformsindividualinnocent spouse reliefarizona department of revenue azdor

Effortlessly Prepare Azdor govformsindividualInnocent Spouse ReliefArizona Department Of Revenue AZDOR on Any Device

Digital document management has gained traction among enterprises and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without any hindrances. Manage Azdor govformsindividualInnocent Spouse ReliefArizona Department Of Revenue AZDOR on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and eSign Azdor govformsindividualInnocent Spouse ReliefArizona Department Of Revenue AZDOR Effortlessly

- Locate Azdor govformsindividualInnocent Spouse ReliefArizona Department Of Revenue AZDOR and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools specifically offered by airSlate SignNow for this task.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies your document management requirements in a few clicks from your device of choice. Edit and eSign Azdor govformsindividualInnocent Spouse ReliefArizona Department Of Revenue AZDOR to ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct azdorgovformsindividualinnocent spouse reliefarizona department of revenue azdor

Create this form in 5 minutes!

People also ask

-

What is Arizona 200 and how does it work?

Arizona 200 is a versatile solution offered by airSlate SignNow that allows businesses to send and eSign documents seamlessly. It streamlines your document workflows, making it easy to manage signatures from anywhere, enhancing your overall productivity.

-

What are the pricing plans available for Arizona 200?

airSlate SignNow offers competitive pricing plans for Arizona 200, catering to various business needs. You can select from monthly or annual subscription options, ensuring you find a plan that fits your budget while enjoying full access to its features.

-

What features are included in the Arizona 200 package?

The Arizona 200 package includes robust features such as customizable templates, advanced security options, and real-time tracking of your documents. These tools empower your business to streamline its eSignature processes efficiently.

-

Can Arizona 200 integrate with other software solutions?

Yes, Arizona 200 seamlessly integrates with various other software applications, including CRM platforms and productivity tools. This integration ensures that your eSignature processes fit smoothly into your existing workflows and improve overall efficiency.

-

What benefits does Arizona 200 offer to businesses?

Arizona 200 offers numerous benefits, including increased efficiency in document management and faster turnaround times on signatures. By utilizing airSlate SignNow's solution, businesses can reduce operational costs and enhance customer satisfaction.

-

Is prior training required to use Arizona 200?

No extensive training is required to use Arizona 200, as airSlate SignNow is designed to be user-friendly. Businesses can quickly familiarize themselves with the platform, allowing employees to start sending and signing documents right away.

-

What types of documents can I send using Arizona 200?

With Arizona 200, you can send a variety of documents, including contracts, invoices, and agreements. The versatility of airSlate SignNow's platform ensures that it can accommodate the signature needs for any type of business document.

Get more for Azdor govformsindividualInnocent Spouse ReliefArizona Department Of Revenue AZDOR

- Legal last will and testament form for divorced person not remarried with adult children montana

- Legal last will and testament form for divorced person not remarried with no children montana

- Legal last will and testament form for divorced person not remarried with minor children montana

- Declaration living will form

- Montana revocation 497316693 form

- Revocation of declaration of living will montana form

- Montana will 497316695 form

- Legal last will and testament form for divorced person not remarried with adult and minor children montana

Find out other Azdor govformsindividualInnocent Spouse ReliefArizona Department Of Revenue AZDOR

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free