Fillable Online Azdor Arizona Form Request for Innocent 2023

What is the Arizona Form 200 Request for Innocent Spouse Relief?

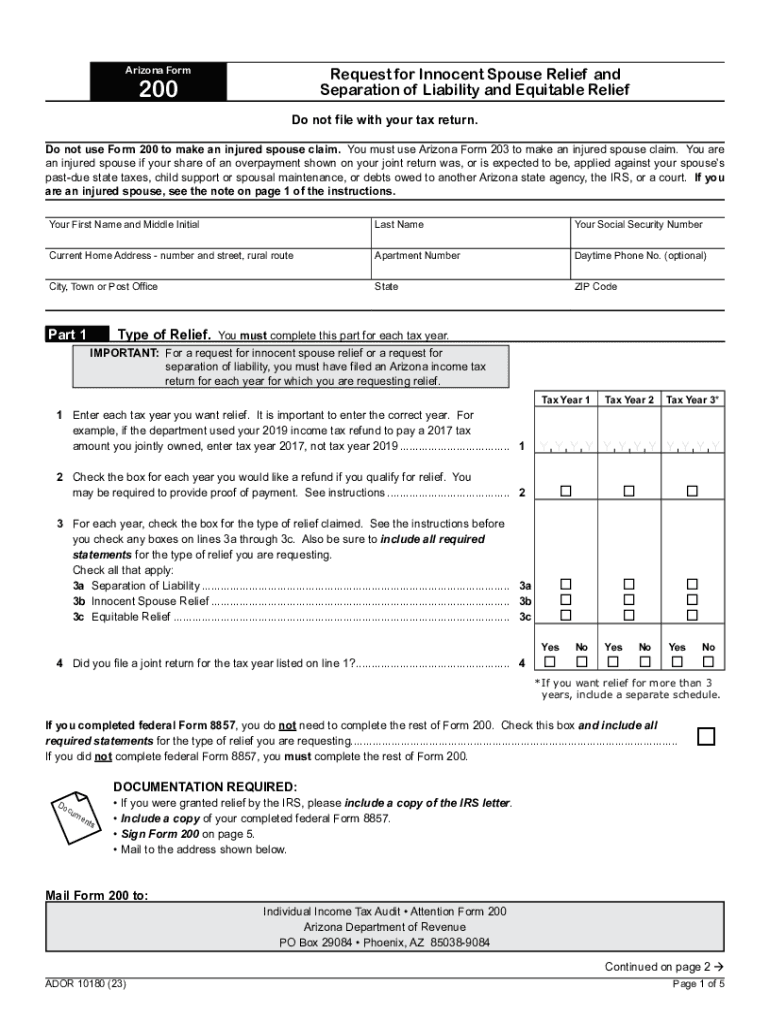

The Arizona Form 200 is a legal document that allows individuals to request equitable relief from tax liability due to the actions of a spouse or former spouse. This form is particularly relevant for those who believe they should not be held responsible for tax debts incurred during their marriage. The form is designed to help individuals who meet specific criteria to seek relief from joint tax liabilities that they did not incur themselves.

Key Elements of the Arizona Form 200

Understanding the key elements of the Arizona Form 200 is essential for successful completion. The form typically includes:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Spousal Information: Information about the spouse or former spouse, including their name and Social Security number.

- Reason for Request: A detailed explanation of why the taxpayer believes they qualify for innocent spouse relief.

- Signature: The form must be signed and dated by the taxpayer to validate the request.

Steps to Complete the Arizona Form 200

Completing the Arizona Form 200 involves several steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary personal and spousal information, as well as any documentation supporting the request.

- Fill Out the Form: Carefully complete each section of the form, providing clear and concise information.

- Review the Form: Double-check all entries for accuracy to avoid delays in processing.

- Submit the Form: Follow the designated submission method, whether online, by mail, or in-person.

Eligibility Criteria for Arizona Form 200

To qualify for relief under the Arizona Form 200, individuals must meet specific eligibility criteria. Generally, these criteria include:

- The individual must have filed a joint tax return with their spouse.

- The individual must not have benefited from the tax liability in question.

- The request must be made within the appropriate timeframe set by Arizona tax regulations.

Form Submission Methods for Arizona Form 200

Submitting the Arizona Form 200 can be done through various methods, allowing flexibility based on individual preferences:

- Online Submission: Many taxpayers choose to submit their forms electronically through the Arizona Department of Revenue's online portal.

- Mail: The completed form can be mailed to the appropriate tax office, ensuring to keep a copy for personal records.

- In-Person: Individuals may also opt to deliver the form directly to their local tax office for immediate processing.

Required Documents for Arizona Form 200

When filing the Arizona Form 200, certain documents may be required to support the request. These can include:

- Copies of tax returns filed during the marriage.

- Documentation proving the individual's lack of knowledge regarding the tax liability.

- Any correspondence from the Arizona Department of Revenue related to the tax issue.

Quick guide on how to complete fillable online azdor arizona form request for innocent

Effortlessly Prepare Fillable Online Azdor Arizona Form Request For Innocent on Any Device

Managing documents online has gained popularity among companies and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and store it securely on the web. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without interruption. Handle Fillable Online Azdor Arizona Form Request For Innocent on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and electronically sign Fillable Online Azdor Arizona Form Request For Innocent with ease

- Locate Fillable Online Azdor Arizona Form Request For Innocent and then click Get Form to begin.

- Use the features we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Generate your electronic signature utilizing the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow streamlines all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Fillable Online Azdor Arizona Form Request For Innocent and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online azdor arizona form request for innocent

Create this form in 5 minutes!

How to create an eSignature for the fillable online azdor arizona form request for innocent

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arizona 200 and how does it relate to airSlate SignNow?

Arizona 200 refers to a specific plan offered by airSlate SignNow, designed to streamline document signing processes for businesses. This plan includes features that enhance productivity and ensure secure signing experiences. By focusing on the needs of Arizona-based businesses, airSlate SignNow combines convenience and efficiency under the Arizona 200 package.

-

What features are included in the Arizona 200 plan?

The Arizona 200 plan includes essential features such as unlimited eSignatures, document templates, and real-time tracking of document status. Additionally, it offers customizable workflows to fit your business needs. With these capabilities, users can manage their document signing processes more effectively and efficiently.

-

How much does the Arizona 200 plan cost?

Pricing for the Arizona 200 plan is competitive and tailored to meet the needs of businesses in Arizona. We offer flexible payment options, allowing businesses to choose a plan that fits their budget. Contact our sales team for detailed pricing information and to discover any ongoing promotions.

-

What are the benefits of using airSlate SignNow's Arizona 200 plan?

The Arizona 200 plan offers numerous benefits, including increased efficiency in document management and enhanced compliance with legal standards. Users can signNowly reduce turnaround times for document approvals and improve collaboration within their teams. This plan empowers businesses to transition smoothly to a digital signing process.

-

Can I integrate Arizona 200 with other software?

Yes, airSlate SignNow's Arizona 200 plan supports various integrations with popular software such as Salesforce, Google Drive, and Microsoft Suite. These integrations allow for seamless workflows and data management across multiple platforms. By utilizing these connections, businesses can enhance their operational efficiency.

-

Is there a mobile app available for the Arizona 200 plan?

Absolutely! The Arizona 200 plan includes access to a mobile app that allows users to send and manage documents on the go. This ensures that users can sign documents anytime, anywhere, which is crucial for maintaining productivity in a fast-paced business environment. Download the app for a complete signing experience.

-

How secure is the Arizona 200 eSigning process?

The eSigning process under the Arizona 200 plan is highly secure, featuring industry-leading encryption methods and authentication protocols. airSlate SignNow complies with all necessary regulatory standards, ensuring that your documents are safe and protected from unauthorized access. Trust in our platform for secure transactions and peace of mind.

Get more for Fillable Online Azdor Arizona Form Request For Innocent

Find out other Fillable Online Azdor Arizona Form Request For Innocent

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF