AZ ADOR Form 200 10180 Fill Out Tax Template 2021

Understanding the Arizona ADOR Form 200

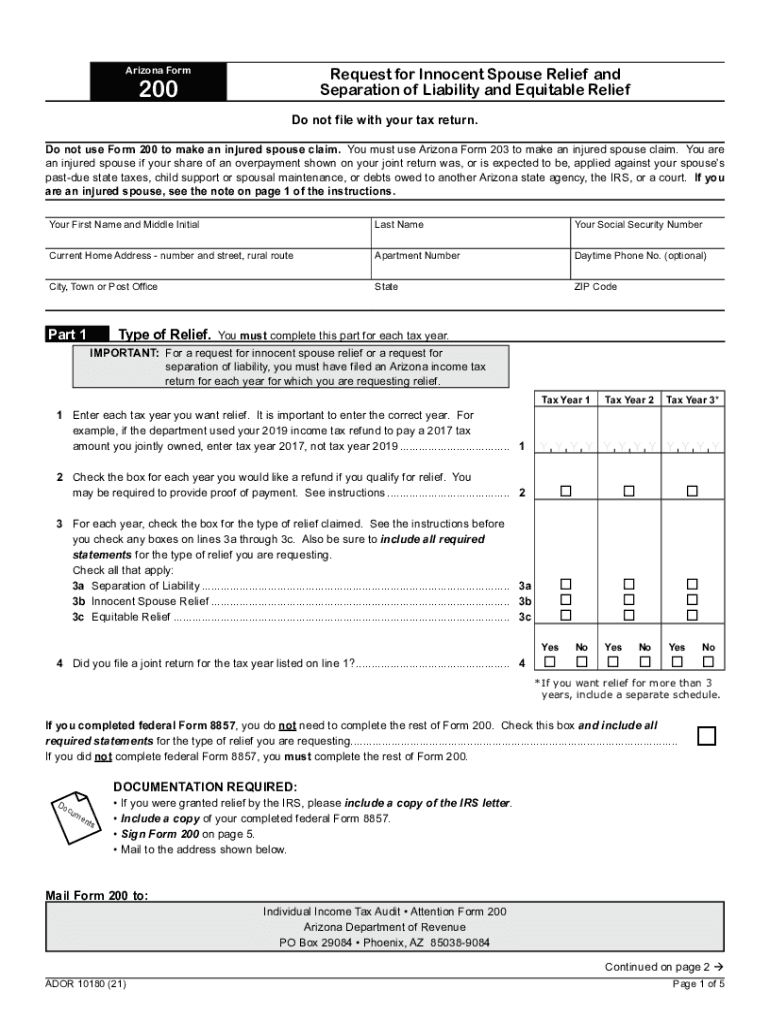

The Arizona ADOR Form 200 is a crucial document used for tax purposes in the state of Arizona. This form is primarily designed for individuals and businesses to report their income and calculate their tax liabilities. It is essential for ensuring compliance with state tax laws and regulations. The form helps taxpayers accurately report their earnings and claim any eligible deductions or credits, ultimately determining the amount owed or refunded by the state.

Steps to Complete the Arizona ADOR Form 200

Filling out the Arizona ADOR Form 200 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, previous tax returns, and any relevant deductions. Follow these steps:

- Provide personal information, including your name, address, and Social Security number.

- Report your total income, including wages, dividends, and any other earnings.

- Claim deductions and credits applicable to your situation, such as those for dependents or specific expenses.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Legal Use of the Arizona ADOR Form 200

The Arizona ADOR Form 200 is legally binding when completed and submitted according to state regulations. It must be filled out truthfully and accurately to avoid penalties. The form serves as an official record of your income and tax obligations, and any discrepancies may lead to audits or legal action. Compliance with all state tax laws is essential for maintaining good standing with the Arizona Department of Revenue.

Filing Deadlines for the Arizona ADOR Form 200

Timely submission of the Arizona ADOR Form 200 is critical to avoid penalties. The standard deadline for filing this form is April fifteenth of each year, aligning with the federal tax filing deadline. However, if you file for an extension, you may have additional time. It is important to stay informed about any changes to deadlines or requirements that may arise due to state legislation or special circumstances.

Required Documents for the Arizona ADOR Form 200

To successfully complete the Arizona ADOR Form 200, you will need several key documents. These may include:

- W-2 forms from employers detailing your annual earnings.

- 1099 forms for other income sources, such as freelance work or investments.

- Receipts for deductible expenses, including business-related costs.

- Documentation for any tax credits you plan to claim.

Having these documents ready will streamline the filing process and help ensure accuracy.

Form Submission Methods for the Arizona ADOR Form 200

The Arizona ADOR Form 200 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online using the Arizona Department of Revenue's e-filing system, which offers a secure and efficient way to submit your form. Alternatively, you can mail a printed version of the form to the appropriate address provided by the state. In-person submission at designated state offices is also an option for those who prefer face-to-face assistance.

Quick guide on how to complete az ador form 200 10180 2020 2022 fill out tax template

Easily Prepare AZ ADOR Form 200 10180 Fill Out Tax Template on Any Device

The management of online documents has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle AZ ADOR Form 200 10180 Fill Out Tax Template on any device with the airSlate SignNow applications for Android or iOS, and enhance any document-centered process today.

How to Edit and eSign AZ ADOR Form 200 10180 Fill Out Tax Template Effortlessly

- Obtain AZ ADOR Form 200 10180 Fill Out Tax Template and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to keep your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from your chosen device. Modify and eSign AZ ADOR Form 200 10180 Fill Out Tax Template and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct az ador form 200 10180 2020 2022 fill out tax template

Create this form in 5 minutes!

How to create an eSignature for the az ador form 200 10180 2020 2022 fill out tax template

How to generate an e-signature for a PDF document online

How to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The way to make an e-signature from your smart phone

The best way to create an e-signature for a PDF document on iOS

The way to make an e-signature for a PDF file on Android OS

People also ask

-

What is the Arizona 200 and how does it work?

The Arizona 200 is a feature-rich electronic signature solution offered by airSlate SignNow. It allows users to easily send, sign, and manage documents online in a secure environment. With its intuitive interface, even non-technical users can navigate the platform seamlessly.

-

How much does the Arizona 200 service cost?

The pricing for the Arizona 200 service varies based on the chosen plan and number of users. airSlate SignNow offers competitive rates designed to fit any budget, making eSigning accessible for small businesses and large enterprises alike.

-

What key features does Arizona 200 provide?

Arizona 200 includes features such as customizable templates, document tracking, and automated workflows. Additionally, users benefit from robust security measures that ensure the confidentiality and integrity of their documents.

-

What are the benefits of using Arizona 200?

By using Arizona 200, businesses can signNowly reduce turnaround times for document signing while improving overall efficiency. The paperless process not only saves time but also enhances customer experience with convenient, real-time access.

-

Can Arizona 200 integrate with other software?

Yes, Arizona 200 offers seamless integration with popular business tools and platforms, enhancing your workflow. Whether you use CRMs, project management tools, or cloud storage services, airSlate SignNow can be tailored to fit your existing technology stack.

-

Is the Arizona 200 solution secure?

Absolutely! Arizona 200 prioritizes security through advanced encryption technology and compliance with industry standards. This ensures that all your sensitive documents remain protected throughout the eSignature process.

-

Can I use Arizona 200 for international transactions?

Yes, Arizona 200 accommodates international transactions, making it easy to send and sign documents across borders. With global compliance and multilingual support, airSlate SignNow is a reliable choice for businesses operating internationally.

Get more for AZ ADOR Form 200 10180 Fill Out Tax Template

- Essential documents for the organized traveler package missouri form

- Essential documents for the organized traveler package with personal organizer missouri form

- Postnuptial agreements package missouri form

- Letters of recommendation package missouri form

- Missouri mechanics form

- Missouri construction or mechanics lien package corporation missouri form

- Storage business package missouri form

- Child care services package missouri form

Find out other AZ ADOR Form 200 10180 Fill Out Tax Template

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF