Arizona Form 200 2024-2026

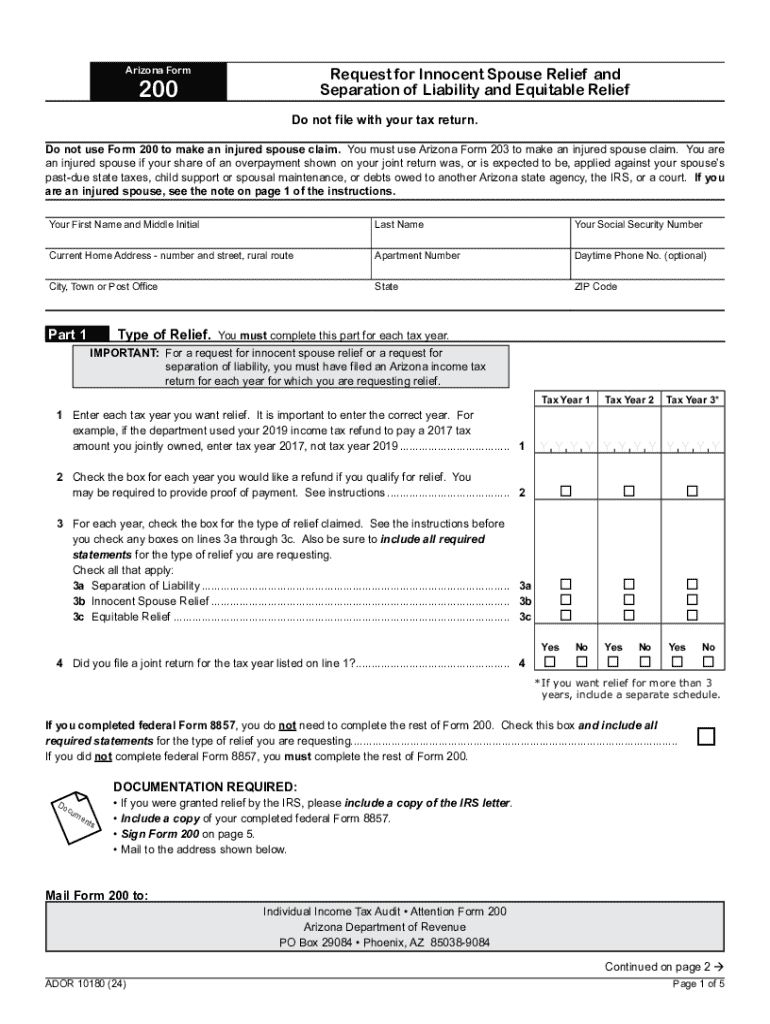

What is the Arizona Form 200

The Arizona Form 200 is a tax form used by individuals and businesses in the state of Arizona. This form is primarily designed for reporting income and calculating tax liabilities. It is essential for ensuring compliance with state tax laws and regulations. The form captures various types of income, deductions, and credits applicable to taxpayers, making it a crucial document for accurate tax reporting.

How to use the Arizona Form 200

Using the Arizona Form 200 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary financial documents, including W-2s, 1099s, and records of deductions. Afterward, they should carefully fill out the form, ensuring all income and deductions are reported correctly. Once completed, the form can be submitted either electronically or via mail, depending on the taxpayer's preference and eligibility.

Steps to complete the Arizona Form 200

Completing the Arizona Form 200 involves a systematic approach:

- Gather Documentation: Collect all relevant financial documents.

- Fill Out Personal Information: Include your name, address, and Social Security number.

- Report Income: Enter all sources of income accurately.

- Claim Deductions: List any eligible deductions to reduce taxable income.

- Calculate Tax: Use the provided tables or instructions to determine tax liability.

- Review the Form: Double-check all entries for accuracy.

- Submit the Form: Choose your submission method and send the form.

Legal use of the Arizona Form 200

The Arizona Form 200 is legally recognized for tax reporting purposes within the state. It is important for taxpayers to use this form correctly to avoid penalties and ensure compliance with Arizona tax laws. Filing this form accurately helps maintain good standing with the state’s tax authority and contributes to the proper functioning of state-funded services.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 200 are crucial for taxpayers to adhere to. Typically, the form must be filed by April fifteenth of each year for individual taxpayers. Extensions may be available, but it is essential to check specific deadlines to avoid late fees. Keeping track of these dates ensures timely compliance with state regulations.

Required Documents

To complete the Arizona Form 200, several documents are required:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductions such as mortgage interest and charitable contributions

- Any relevant tax documents from previous years

Having these documents ready facilitates a smoother filing process and reduces the risk of errors.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 200 can be submitted through various methods to accommodate different preferences:

- Online Submission: Many taxpayers opt for electronic filing through authorized software.

- Mail Submission: The completed form can be printed and mailed to the appropriate tax authority address.

- In-Person Submission: Taxpayers may also choose to submit the form in person at designated tax offices.

Each method has its benefits, and taxpayers should select the one that best suits their needs.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 200

Create this form in 5 minutes!

How to create an eSignature for the arizona form 200

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona 200 and how does it work?

The Arizona 200 is a powerful eSignature solution offered by airSlate SignNow that allows businesses to send and sign documents electronically. It streamlines the signing process, making it faster and more efficient. With its user-friendly interface, users can easily manage their documents and track their status in real-time.

-

How much does the Arizona 200 cost?

The pricing for the Arizona 200 varies based on the features and number of users. airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can visit our pricing page for detailed information and choose a plan that best fits your needs.

-

What features are included in the Arizona 200?

The Arizona 200 includes a range of features such as document templates, customizable workflows, and advanced security options. Additionally, it supports multiple file formats and allows for in-person signing. These features make it a comprehensive solution for managing electronic signatures.

-

What are the benefits of using the Arizona 200 for my business?

Using the Arizona 200 can signNowly reduce the time and costs associated with traditional document signing. It enhances productivity by allowing users to send and sign documents from anywhere, at any time. Moreover, it improves compliance and security, ensuring that your documents are protected.

-

Can the Arizona 200 integrate with other software?

Yes, the Arizona 200 seamlessly integrates with various software applications, including CRM systems, cloud storage services, and productivity tools. This integration capability allows businesses to streamline their workflows and enhance overall efficiency. Check our integrations page for a complete list of compatible applications.

-

Is the Arizona 200 suitable for small businesses?

Absolutely! The Arizona 200 is designed to cater to businesses of all sizes, including small businesses. Its cost-effective pricing and easy-to-use features make it an ideal choice for small teams looking to enhance their document management processes without breaking the bank.

-

How secure is the Arizona 200 for document signing?

The Arizona 200 prioritizes security with advanced encryption and authentication measures. It complies with industry standards to ensure that your documents are safe and secure during the signing process. You can trust that your sensitive information is protected with airSlate SignNow.

Get more for Arizona Form 200

- International exchange student application for admission form

- Master of social work bowling green state university form

- Ivy tech view unofficial transcript form

- 2020 master of social work msw admission application form

- Verrazano service verification form

- Fax419 372 2920 form

- Forms ampamp resources bowling green state university

- Dislocated worker form franciscan university of steubenville franciscan

Find out other Arizona Form 200

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure