Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges 2020

What is the Form 3840 California Like Kind Exchanges

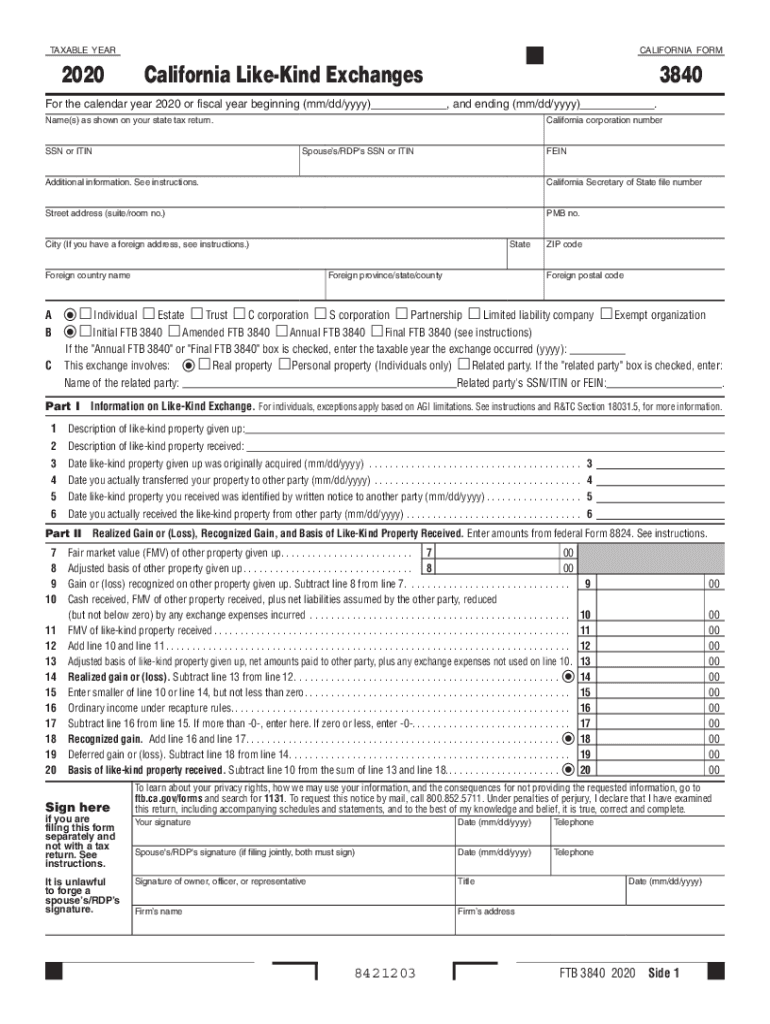

The Form 3840, also known as the California Like Kind Exchanges form, is a crucial document used by taxpayers in California to report like-kind exchanges of real property. This form allows individuals and businesses to defer capital gains taxes on properties exchanged for similar properties, provided that specific criteria are met. The primary purpose of the form is to ensure compliance with both state and federal tax regulations regarding these exchanges. By utilizing this form, taxpayers can manage their tax liabilities effectively while engaging in property transactions.

Steps to Complete the Form 3840 California Like Kind Exchanges

Completing the Form 3840 involves several key steps that ensure accurate reporting of the like-kind exchange. First, gather all necessary information regarding the properties involved in the exchange, including their fair market values and the dates of acquisition and transfer. Next, fill out the form by providing details about the relinquished and acquired properties. It is essential to accurately report the adjusted basis of the properties, as this information affects the calculation of potential gain or loss. After completing the form, review it carefully for any errors before submission.

Key Elements of the Form 3840 California Like Kind Exchanges

The Form 3840 includes several critical elements that taxpayers must understand. These elements consist of the identification of the properties involved, the fair market value at the time of exchange, and any liabilities assumed or transferred during the transaction. Additionally, the form requires taxpayers to disclose any prior exchanges they have conducted, as this can impact their current tax situation. Understanding these key components is vital for ensuring compliance and accurately reporting the exchange.

Eligibility Criteria for the Form 3840 California Like Kind Exchanges

To qualify for the benefits associated with the Form 3840, taxpayers must meet specific eligibility criteria. The properties exchanged must be held for investment or productive use in a trade or business. Both properties must also be of like kind, meaning they are similar in nature or character, even if they differ in grade or quality. Furthermore, the exchange must be completed within a designated timeframe, typically within 180 days of the transfer of the relinquished property. Meeting these criteria is essential for deferring capital gains taxes.

Legal Use of the Form 3840 California Like Kind Exchanges

The legal use of the Form 3840 is grounded in federal and state tax laws that govern like-kind exchanges. Under Section 1031 of the Internal Revenue Code, taxpayers can defer capital gains taxes on qualifying exchanges. The California Franchise Tax Board also recognizes this provision, allowing taxpayers to utilize the Form 3840 to report their exchanges accurately. It is important to understand the legal framework surrounding the form to ensure compliance and avoid potential penalties.

Form Submission Methods for the 3840

Taxpayers have several options for submitting the Form 3840. The form can be submitted electronically through the California Franchise Tax Board's online portal, which offers a convenient and efficient method for filing. Alternatively, taxpayers may choose to mail a printed version of the form to the appropriate tax office. In-person submissions are also an option, although they are less common. Regardless of the method chosen, it is crucial to ensure that the form is submitted by the applicable deadlines to avoid any penalties.

Quick guide on how to complete 2020 form 3840 california like kind exchanges 2020 form 3840 california like kind exchanges

Effortlessly Prepare Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges on Any Device

Digital document management has gained traction among organizations and individuals alike. It presents an ideal eco-friendly alternative to traditional printed and signed forms, enabling you to access the appropriate template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges on any device with airSlate SignNow apps for Android or iOS and enhance any document-related task today.

Simple Steps to Edit and eSign Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges with Ease

- Find Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about misplaced or lost documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 3840 california like kind exchanges 2020 form 3840 california like kind exchanges

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 3840 california like kind exchanges 2020 form 3840 california like kind exchanges

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to ca 3840?

airSlate SignNow is a powerful eSigning platform that enables businesses to manage their documents efficiently. With the ca 3840 tool, businesses can streamline their document workflows, ensuring a faster and more secure signing process. Its user-friendly interface makes it easy for anyone to adopt.

-

How does the pricing of airSlate SignNow compare to other eSigning solutions in the context of ca 3840?

airSlate SignNow offers competitive pricing when compared to other eSigning solutions that fit the ca 3840 budget. It provides flexible plans tailored to various organizational needs, making it a cost-effective choice for businesses of all sizes. This ensures that enterprises can harness the power of eSigning without overspending.

-

What are the key features of airSlate SignNow related to ca 3840?

Some key features of airSlate SignNow include customizable templates, automated reminders, and secure storage, all closely tied to the ca 3840 approach. These features help enhance document management and ensure compliance with regulations. Users also benefit from real-time tracking to monitor the signing process.

-

What are the benefits of using airSlate SignNow for businesses dealing with ca 3840-related documents?

Using airSlate SignNow streamlines the signing process for businesses handling ca 3840-related documents. It reduces turnaround times and enhances collaboration among teams. Additionally, the platform's security measures protect sensitive information while ensuring compliance with industry standards.

-

What integrations does airSlate SignNow offer that facilitate ca 3840 workflows?

airSlate SignNow integrates seamlessly with various tools and platforms, enhancing the efficiencies of ca 3840 workflows. Popular integrations include CRM systems like Salesforce, cloud storage services like Google Drive, and productivity tools like Microsoft Office. These integrations allow businesses to manage their documents from their preferred applications.

-

Is airSlate SignNow mobile-friendly for users associated with ca 3840?

Yes, airSlate SignNow is fully mobile-friendly, allowing users to manage their ca 3840 documents on-the-go. The platform's mobile application enables users to send, sign, and manage documents from any device. This flexibility caters to the needs of modern businesses that require mobility.

-

How does airSlate SignNow ensure compliance for ca 3840 document management?

airSlate SignNow ensures compliance for ca 3840 document management through its adherence to legal standards and regulations. The platform employs advanced encryption and secure authentication methods. This guarantees that all signed documents remain tamper-proof and legally binding, providing peace of mind to users.

Get more for Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges

- Nuclear decay worksheet form

- Sq3r worksheet pdf 208940832 form

- Unique id for the exam dmv form

- Lesson 2 1 translations practice and problem solving a b answers form

- Bill of sale for equipment form

- Validation master plan template word form

- Mortgage broker fee agreement for financial services form

- F fd 144 form

Find out other Form 3840 California Like Kind Exchanges Form 3840 California Like Kind Exchanges

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later