3840 2018

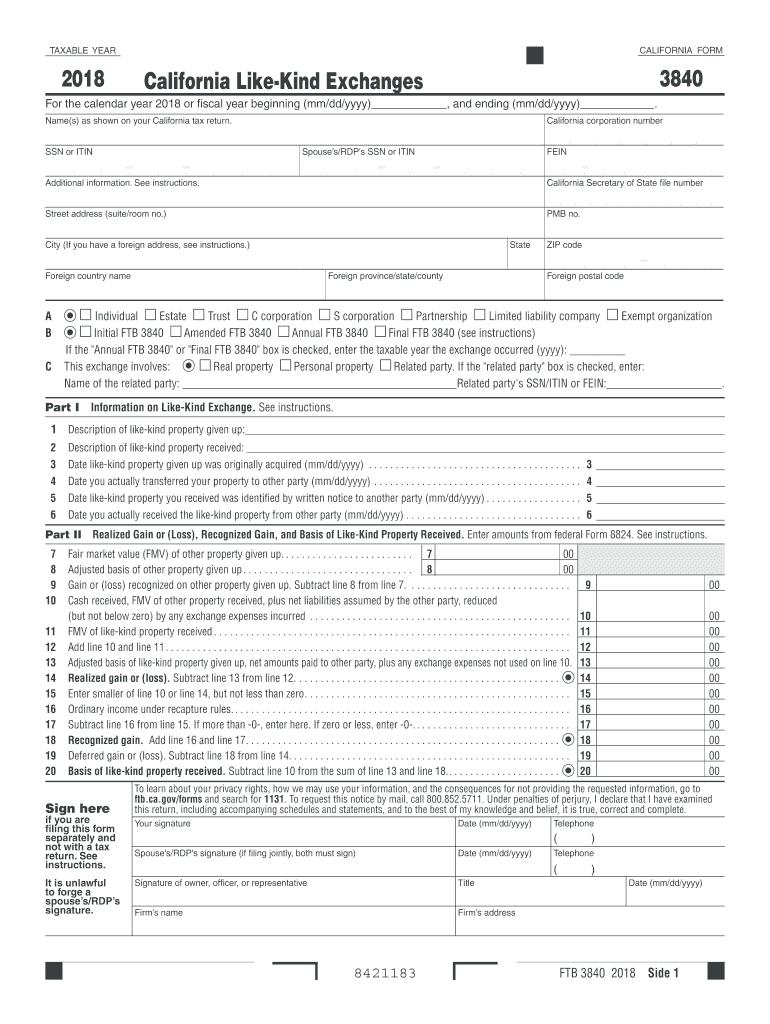

What is the CA 3840?

The CA 3840, also known as the California Like-Kind Exchange form, is used to report like-kind exchanges for California tax purposes. This form is essential for taxpayers who have exchanged property for other property of a similar nature, allowing them to defer capital gains taxes. The form provides the Franchise Tax Board (FTB) with necessary details about the transaction, ensuring compliance with California tax laws.

Steps to Complete the CA 3840

Completing the CA 3840 involves several key steps:

- Gather all relevant documentation regarding the properties involved in the exchange.

- Fill out the personal information section, including your name, address, and Social Security number.

- Detail the properties exchanged, including their descriptions, dates of acquisition, and fair market values.

- Indicate any liabilities assumed or relieved during the exchange.

- Review the completed form for accuracy before submission.

Legal Use of the CA 3840

The CA 3840 must be used in accordance with specific legal guidelines to ensure its validity. This includes adhering to the requirements set forth by the Internal Revenue Service (IRS) and the California Franchise Tax Board. Only qualified like-kind exchanges are eligible for tax deferral, and proper documentation must be maintained to substantiate the transaction. Failure to comply with these regulations may result in penalties or disallowed deductions.

Required Documents

To successfully complete the CA 3840, you will need to provide several documents:

- Purchase agreements for the properties involved in the exchange.

- Appraisals or fair market value assessments of the properties.

- Closing statements from the transactions.

- Any relevant correspondence with the FTB or IRS regarding the exchange.

Form Submission Methods

The CA 3840 can be submitted in various ways, ensuring convenience for taxpayers. Options include:

- Online submission through the California Franchise Tax Board website.

- Mailing a completed paper form to the appropriate FTB address.

- In-person submission at designated FTB offices.

Eligibility Criteria

To qualify for filing the CA 3840, taxpayers must meet specific eligibility criteria. These include:

- The properties exchanged must be held for productive use in a trade or business or for investment.

- Both properties must be of like-kind, meaning they are similar in nature or character.

- The exchange must be completed within a specific time frame as outlined by tax regulations.

Quick guide on how to complete 3840

Prepare 3840 effortlessly on any device

Online document management has gained traction among companies and individuals. It offers a wonderful eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle 3840 across any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign 3840 with ease

- Locate 3840 and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to store your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign 3840 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 3840

Create this form in 5 minutes!

How to create an eSignature for the 3840

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the ca 3840 document type and how can airSlate SignNow help with it?

The ca 3840 document type is a specific format used in various business contexts. With airSlate SignNow, you can easily manage, send, and eSign ca 3840 documents, ensuring a secure and efficient process without the hassle of paper.

-

What are the pricing plans for using airSlate SignNow for ca 3840 eSigning?

airSlate SignNow offers flexible pricing plans tailored to different business needs. You can choose a plan that fits your budget, enabling you to handle ca 3840 eSigning efficiently and cost-effectively, ultimately saving your business time and resources.

-

What key features does airSlate SignNow provide for ca 3840 documents?

AirSlate SignNow includes features such as customizable templates, secure cloud storage, and mobile accessibility, making it ideal for handling ca 3840 documents. These features streamline the signing process and enhance overall productivity for your business.

-

How can airSlate SignNow improve my workflow for managing ca 3840 documents?

By using airSlate SignNow, your workflow for managing ca 3840 documents can become signNowly more efficient. The platform automates document routing and notification features, allowing you to focus on your core tasks while speeding up the signing process.

-

What integrations does airSlate SignNow offer for managing ca 3840 documents?

AirSlate SignNow integrates seamlessly with many popular applications, including Google Drive and Salesforce, enhancing your ability to manage ca 3840 documents across different platforms. This integration capability ensures a smoother workflow for you and your team.

-

Is airSlate SignNow compliant with legal standards for ca 3840 eSigning?

Yes, airSlate SignNow complies with the ESIGN Act and UETA regulations, ensuring that your ca 3840 eSignatures are legally binding. This compliance provides peace of mind that your documents meet all required legal standards.

-

Can airSlate SignNow help with bulk sending of ca 3840 documents?

Absolutely! airSlate SignNow allows for bulk sending of ca 3840 documents, enabling you to streamline your document distribution process. This feature is particularly beneficial for businesses that need to send multiple documents to various recipients efficiently.

Get more for 3840

- Pet agreement 497426575 form

- Breeding contract 497426576 form

- Pro hac vice 497426577 form

- Contingency retainer form

- Attorney hourly rate form

- Injury intake form

- Checklist short of sequential activities to organize automobile action form

- Checklist long of sequential activities to organize automobile action form

Find out other 3840

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors